Thanksgiving sales make or break November in food retailing. According to the November IRI survey of primary shoppers, many Americans were back to celebrating like normal. "However, inflation did take a bite out of Thanksgiving spending, and for some categories, this was a substantial one. Fresh produce held its own with units and volume trending close to last year's levels," said Jonna Parker, team lead fresh, with IRI,

- The mid-November IRI consumer study found that one in five Americans were worried about being able to afford the type of Thanksgiving celebration they usually have because of inflation.

- Throughout the pandemic, the full week before the holiday week generated the biggest shopping volume. This year, the week of the holiday was once more the heaviest shopping week for Thanksgiving 2022.

- Some Americans needed a cooking break and sourced their Thanksgiving meal from restaurants.

- The IRI survey also noted how Thanksgiving meal traditions vary across the United States. The Northeast is more likely to serve cranberries and pumpkin pie. The Southeast likes apple pie and Brussels sprouts.

The price per unit across all foods and beverages in the IRI-measured multi-outlet stores, including supermarkets, clubs, mass, supercenter, drug, and military, increased 13.6 percent in November (the four weeks ending 11/27/2022). This increase was virtually unchanged from +13.7 percent in October.

The price per unit across all foods and beverages in the IRI-measured multi-outlet stores, including supermarkets, clubs, mass, supercenter, drug, and military, increased 13.6 percent in November (the four weeks ending 11/27/2022). This increase was virtually unchanged from +13.7 percent in October.

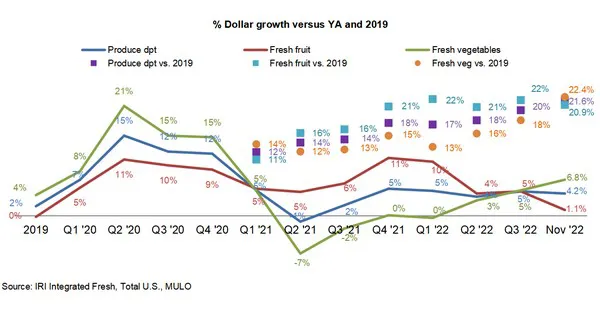

Fresh produce prices were also up from last year but at a relatively low +5.3 percent level on a per-unit basis and +5.6 percent on a per-pound basis. This is far below the total store average. The deceleration is driven by fruit, for which prices increased a low +3.2 percent. Additionally, vegetable inflation dropped into the single digits, at +7.7 percent year-on-year.

In November 2022, fresh produce sales reached $5.2 billion, surpassing the record set the prior year by +4.2 percent.

Thanksgiving week was one of the smaller selling November weeks, with produce sales peaking the week ending November 20th.

Thanksgiving week was one of the smaller selling November weeks, with produce sales peaking the week ending November 20th.

"Growth for fruit is slowing down due to moderating inflation levels," said Joe Watson, IFPA's VP of retail, food service, and wholesale.

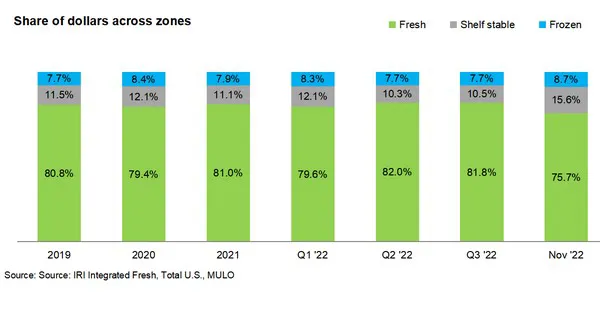

Thanksgiving buying patterns, such as canned green beans, cranberries, and corn, in combination with the below-average rate of inflation for fresh produce, meant a drop in the share of fresh fruit and vegetables (75.7 percent) versus the share of frozen (8.7 percent) and shelf-stable (15.6 percent).

"Apples, avocados, and citrus came on strong in November," Parker said. "Whereas berry sales are double that of other categories in the summer months, apples are up there now with monthly sales of $372 million."

"Potatoes and onions trended in the top three sellers, and celery was the November newcomer bumping broccoli out of the top 10," said Watson.

The next report, covering December, will be released in mid-January.

Click here for the full report.

For more information:

For more information:

Anne-Marie Roerink

210 Analytics LLC

Tel: +1 (210) 651-2719

[email protected]

www.210analytics.com