Capespan’s commercial executive Charl du Bois notes that early grapes from Namibia are looking good, while the Orange River has just started, not yet in full swing.

Capespan’s commercial executive Charl du Bois notes that early grapes from Namibia are looking good, while the Orange River has just started, not yet in full swing.

Limpopo has been packing for a few weeks, and the Olifants River region will start in the next two weeks.

The first Namibian grapes will arrive in the UK on 6 December, and in Rotterdam two days later, mostly Flame Seedless, Early Sweet and Prime. “Currently Namibia is packing the very first Sweet Globe and Arra 29, so the season is progressing well.”

Namibia is predicting a slightly bigger crop this year, with a crop estimate of 8.6 million 4.5 kg cartons.

From a supply side it is very difficult to see South Africa, Namibia and Peru flooding the market for the early part of the season. In fact, he remarks, it is important to take note that South Africa’s supply rhythm has changed dramatically over the past five years.

“The huge (one could say ‘oversupplied’) volume of Prime and Early Sweet that the Orange River traditionally packed in weeks 48/49 does not exist any more. It has been replaced by later white seedless varieties, consisting mainly of Sweet Globe, Autumn Crisp and Ivory. Similarly, the big volume of Flame, Starlight and Ralli has also been replaced by later, and newer, red seedless varieties such as Sweet Celebration.”

Unlikely that Orange River crop will equal previous season

In addition to this, northern production regions have prepared a smaller crop this year, and the Orange River has lost some fruit already due to untimely heat during set and some farms being affected by recent thunder showers, he explains, so it seems very unlikely that the crop from there will be comparable in size to last year.

“The early Southern African supply window is therefore much less congested this year.”

Photos supplied by Capespan

Photos supplied by Capespan

Peru has from the outset of their campaign focussed on their traditional markets of the USA and Canada, a decision largely driven by the US Dollar strength, strong North American market demand and lower shipping costs from Peru to North America than to Europe. As a result, it is expected that a smaller percentage of Peruvian grapes will go to Europe, the UK and Asia than in the last year, despite their bigger crop.

“Therefore, supply to Europe and the UK will remain constrained, and in equilibrium with what ‘normal’ demand can absorb at healthy prices for the first part of the season,” he says.

He also notes that demand will be driven by consumers’ appetite for relatively expensive, counter-seasonal table grapes in the Northern Hemisphere winter. He observes that where the price will really find a balance, it will therefore be purely driven by demand and supply.

Severe undersupply of Southern Hemisphere grapes He says that the early market in South Africa’s main markets is incredibly strong, due to a quick end to Northern Hemisphere supply and a severe undersupply of Southern Hemisphere grapes over the past weeks.

He says that the early market in South Africa’s main markets is incredibly strong, due to a quick end to Northern Hemisphere supply and a severe undersupply of Southern Hemisphere grapes over the past weeks.

"Logistics are better this year, as Cape Town port has returned to full operational effectiveness with three berths working simultaneously. Transnet has committed to keep it up this year. It looks like things are back to normal."

He adds: "The traditional South Easter wind will again probably lead to the usual shipping delays."

Improved logistics comes as a huge relief to them after last year's disastrous disruptions. "We hope for a good run with early fruit getting to a relatively empty market, and decent demand.”

This will, however, have to cover a substantial increase in break-even farmgate prices, driven by production cost.

The prices at which farmers are able to cover their production costs and see any kind of long-term return on investment, is, he says, “a great deal higher than in any previous year.”

Over the past year, Southern African table grape producers have seen significant increases in input costs: as an example, increases of approximately 80% on fertilisers, 21.5% on packaging material and 22% on local trucking costs have been imposed on growers and exporters.

Over the past year, Southern African table grape producers have seen significant increases in input costs: as an example, increases of approximately 80% on fertilisers, 21.5% on packaging material and 22% on local trucking costs have been imposed on growers and exporters.

Diesel which has come to play such an important role in mitigating the impact of power cuts is up by 25%. Wage and electricity costs have also increased with double digits.

“In order for growers to be able to survive, they will need to recoup this massive cost increase by increasing farm gate returns. It is critical that all growers, exporters, importers and retailers take note of the fact that growers will need these increases in sales prices, just to cover their additional input cost.”

Asian growth prospects look better than Europe’s

Low levels of economic growth in many of South Africa’s traditional table grape markets pose a potentially troubling scenario for Southern Hemisphere fruit in general, and table grapes in particular.

“Asian growth prospects do, however, look good and, with the exception of China where lockdowns continue, will receive a big focus from South Africa this year,” but, Charl points out, this is off a low base that accounts for only +/-15% of South Africa’s total grape sales in the past. “This can go only so far in addressing macroeconomic problems elsewhere in the world.”

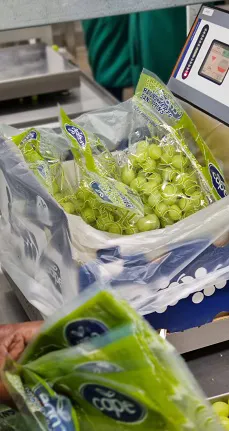

Sweet Globe in a Capespan Namibia vineyard

Sweet Globe in a Capespan Namibia vineyard

“Sales are caught between the scissor of higher costs that lead to higher retail prices, and stagnant economic prospects in our main markets. We will have to watch prices, demand and supply very closely this year to ensure there is no stock build-up that later needs big discounting.”

For more information:

For more information:

Charl du Bois

Capespan

Tel: +27 21 917 2600

Email: [email protected]

http://www.capespan.com/