EnWave Corporation has reported the Company’s consolidated interim financial results for the third quarter ended June 30, 2022.

- Royalty revenue YTD of $1.15 million, representing annual growth of 55% in the high-margin royalty portfolio.

- First 10kW GMP unit was commissioned for the dehydration of premium cannabis products in New Zealand, expanding the use of REV™ across the legalized global cannabis industry.

- REVworx™ facility obtained Safe Quality Food Certification (“SQF”) as part of the strategy to provide advanced toll processing capabilities to the food industry.

EnWave’s annual consolidated financial statements and MD&A are available on SEDAR at www.sedar.com and on the Company’s website www.enwave.net.

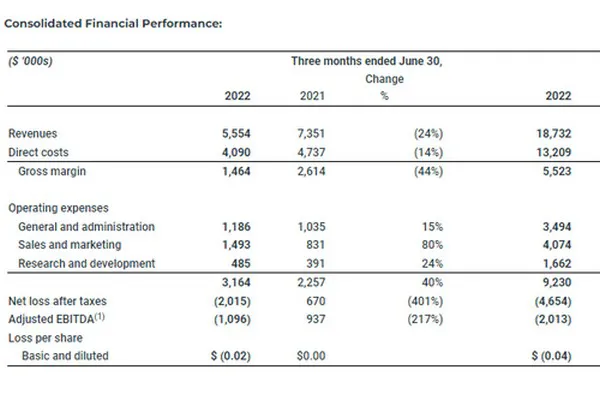

Key Financial Highlights for Q3 (expressed in ‘000s):

- The Company reported consolidated revenue for Q3 2022 of $5,554, compared to $7,351 in Q3 2021, a decrease of $1,797 or 24%.

- EnWave’s segment revenue was $2,663 compared to $3,560 in Q3 2021, a decrease of $897 or 25%. Royalty revenues for Q3 2022 were $301 compared to $191 for Q3 2021, an increase of $110 or 58%.

- NutraDried’s segment revenue was $2,891 compared to $3,791 for Q3 2021, a decrease of $900 or 24% due to lower sales volumes of bulk and ingredient products.

- Gross margin for Q3 2022 was 26%, compared to 35% for Q3 2021 and Q2 2022. Gross margins at NutraDried in the quarter were compressed due to higher input costs related to cheese and freight.

- Adjusted EBITDA(1) (refer to Non-IFRS Financial Measures section below) for Q3 2022 was a loss of $1,096 compared to a profit of $937 for Q3 2021, a decrease of $2,033.

- SG&A expenses (including R&D) were $3,164 in Q3 2022, compared to $2,257 in Q3 2021 an increase of $907. The Company continued to invest in developing its intellectual property during the quarter to support the expansion of its global licensing strategy. Marketing investments were made to generate awareness and enhance the business development pipelines at EnWave and NutraDried.

For more information:

Brent Charleton

EnWave Corporation

Tel.: +1 (778) 378-9616

bcharleton@enwave.net

Dan Henriques

Tel.: +1 (604) 835-5212

dhenriques@enwave.net