The U.S. GDP fell 1.4 percent in the first quarter of 2022, which has concerned economists and analysts alike. Ripples have been felt across the Trans-Pacific corridor as discussions of a freight recession and cooling ocean freight spot rates hit the headlines.

The U.S. saw an extremely high volume of imports in Q1 ‘22, increasing 4.77 percent from an already record-high Q4 ‘21 on the back of previous orders and consumer demand.

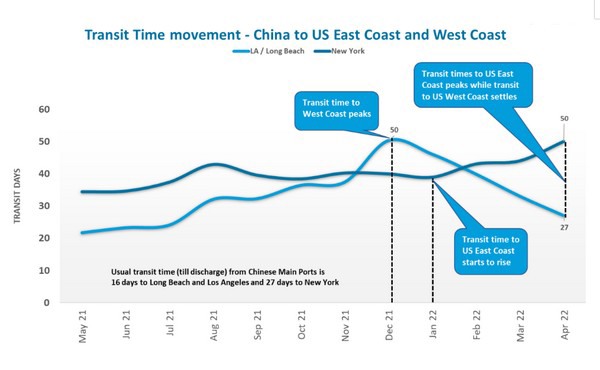

Meanwhile, the Chinese COVID-19 situation continues to worsen as movements within Shanghai remain restricted, shackling manufacturing output, trucking activity and port throughput. With Beijing teetering on the brink of a similar situation, the Chinese mainland might have problems returning to the previous smooth flow of cargo movement. The current drop in demand and the lockdowns in China helped the U.S. West Coast ports recover from the port congestion and resulted in a drop in total transit time to the West Coast ports in April 2022. The transit time from China to Los Angeles and Long Beach dropped by 85 percent from 50 days in Dec ‘21 to 27 days in Apr ‘22. Although it is a significant improvement, this is still above pre-pandemic levels.

The current drop in demand and the lockdowns in China helped the U.S. West Coast ports recover from the port congestion and resulted in a drop in total transit time to the West Coast ports in April 2022. The transit time from China to Los Angeles and Long Beach dropped by 85 percent from 50 days in Dec ‘21 to 27 days in Apr ‘22. Although it is a significant improvement, this is still above pre-pandemic levels.

At the peak of West Coast congestion, customers shifted deliveries of future orders to East Coast ports at the time when they were performing better. Transit to the port of New York went up from 40 days to 50 days representing a 20 percent increase for the same period and an 85 percent increase from pre-pandemic levels. “We however expect a relief in the East Coast congestion in the near future as the impact of blank sailings created by the decrease in demand and China lockdowns will be felt in New York, albeit later than West Coast ports due to the naturally longer transit time,” said Shabsie Levy, founder and CEO of Shifl. There is however the unknown outcome of the labor negotiations talks between the International Longshore and Warehouse Union (ILWU) and marine terminal operators due to begin on the 12th of May 2022.

There is however the unknown outcome of the labor negotiations talks between the International Longshore and Warehouse Union (ILWU) and marine terminal operators due to begin on the 12th of May 2022.

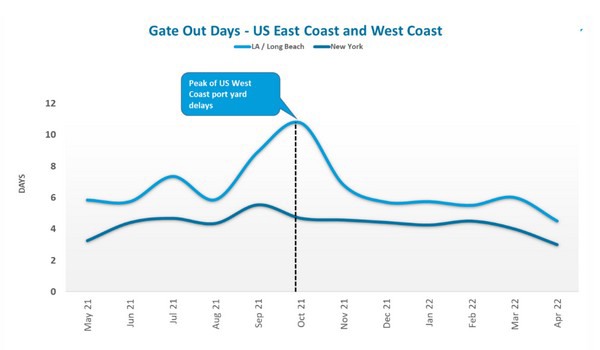

While congestion outside the ports has shifted to the East Coast, the container gate-out times have improved on both coasts. Los Angeles/Long Beach gate-out times improved by 28 percent dropping from 5.74 days in Jan ‘22 to 4.5 days in Apr ‘22 while New York had a 47 percent drop in container gate from 4.25 days in Jan ‘22 to 3 days in Apr ‘22.

The restrictions on truck movement and workers lowered China’s industrial activity with exporters having a hard time delivering export containers to Shanghai port. This resulted in lower volumes flowing in the China-to-U.S. trade lanes.

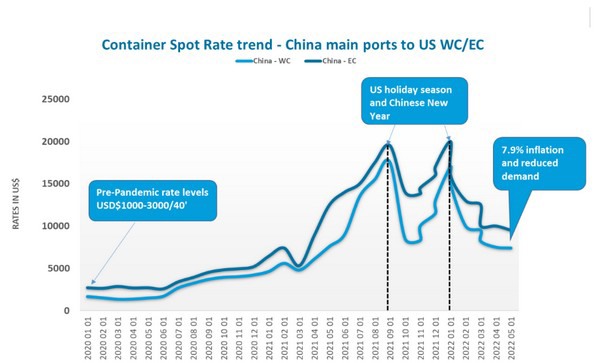

Container spot rates fell sharply on the back of the combined impact of reduced demand in the U.S. and Chinese exports affected by pandemic-induced shutdowns in Shanghai.

For more information:

For more information:

Charlie Pesti

Shifl

charlie@pesti.io

https://shifl.com