Whilst the harvesting season for the Northern Provinces, Orange River and Olifants River have come to an end, the Berg River and Hex River regions, which are both having above average seasons, should still be packing for at least the next two weeks.

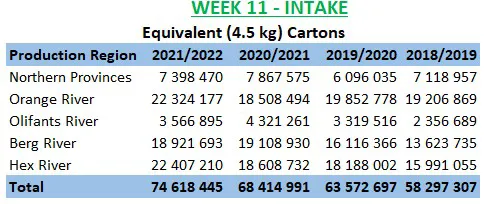

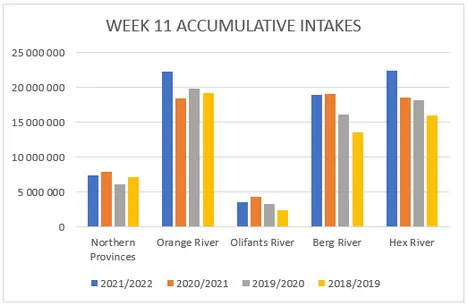

The national intake volume until week 11 came to 74, 618, 445 cartons (4,5 kg equivalent), which is 9,1% more than 2021 and 17,4% more than 2020.

Berg River

Although handling lower volumes, several farms were still busy packing during the previous week, while the season for a few farms has come to an end.

Amongst the cultivars currently being harvested are Sugranineteen (Scarlotta Seedless), Sugrathirtyfour (Adora Seedless), Sugrathirtyfive (Autumncrisp), White Crimson Seedless, Red Globe and Autumn Royal. Due to favourable weather conditions the quality of the grapes is acceptable.

Within the next week or two, all the farms within this region will have completed their packing season. Based on current tendencies, the Berg River region should reach, or maybe even exceed its high estimate of 19,7 million cartons.

Hex River

The Hex River region is enjoying a good season, and it produced above average volumes of grapes of during its pre- and mid-season. Whilst the early part of the Crimson Seedless harvest was excellent, the volumes seemed to decrease towards the latter part of the season.

Nevertheless, weather permitting, the indications are there that the Hex River region will have a satisfactory season, and that it should reach or even surpass its high estimate of 24,3 million cartons..

Impact of the Russia-Ukraine conflict on the South African fruit industry

The Minister of Agriculture, Land Reform and Rural Development, Thoko Didiza reached out to the South African fruit industry when she convened a meeting with important role players in the industry to discuss this critical issue.

The minister provided the opportunity for the industry to make recommendations on how government could assist by speeding up certain processes that would benefit South Africa’s fruit exports.

The meeting resulted in a document being drawn up by fruit industry role players tabling recommendations regarding logistics, improving productivity in the harbours, and reviewing tariffs to unlock and further develop certain markets.

The industry is grateful to the Minister for providing this opportunity to discuss this critical issue and for her understanding and preparedness to accelerate processes to the benefit of the South African fruit industry and its producers.

2021/22 Definitely not business as usual for Table Grapes

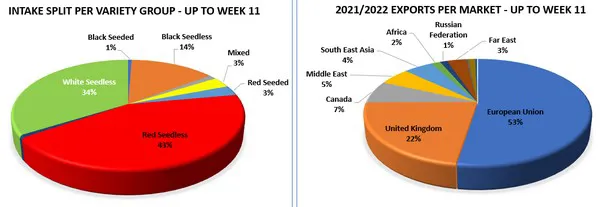

This season will definitely go down as one of the most challenging seasons for our industry due to numerous external factors such as logistical challenges (local and international), cost inflation in regard to various inputs and the Russia and Ukraine situation.

Given recent media coverage concerning the industry SATI would like to share our view on the matter and communicate that all possible avenues are being explored to address the situation. Furthermore, we’d like to highlight continued progress and efforts in regard to supporting our producers and the industry.

As a representative of the table grape industry, we (like other industry stakeholders) have engaged with Transnet regarding harbour operations over the last several months – and remain in constant contact with Transnet stakeholders in this regard.

In the interest of not only the table grape industry, but also the South African fruit industry and other role players, we continue to explore all possible avenues to address the situation in order to improve our harbour’s productivity and ensure that fruit reaches export markets in the best possible condition.

We are encouraged by the leadership at Transnet and believe that productive engagement with this key industry role player is the most effective mechanism to achieve the industry-desired results.

We note the President’s remarks during the latest State of the Nation Address and take comfort in the fact that, along with other key infrastructure projects, our harbours will remain a priority and a very important link in the agribusiness value chain.

This year will probably be our largest export season to date – and we acknowledge the industry for their hard work to achieve this. We are acutely aware of the profitability challenges our producers are facing given numerous external factors including weather conditions, inflation, rising input costs and the Russia-Ukraine situation.

Producers and their well-being remain our primary focus and, together with industry stakeholders, we will relentlessly keep exploring all avenues to facilitate the necessary change required at all levels to support our industry.

For more information:

For more information:

AJ Griesel

South African Table Grape Industry

Tel: +27 21 863 0366

www.satgi.co.za