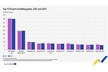

The earnings from container shipping are expected to remain strong well into 2022, showing another year of rising profits for shipping lines. In fact, the spot rate for a 40-foot container for the Asia-USWC route exceeded $20.000 last year, including surcharges and premiums, up from less than $2.000 a few years ago.

Maritime industry analyst Lars Jensen has specified that average freight rates in the fourth quarter of 2021 increased by 80%, which is also below several rate indexes. As detailed the SCFI spot index has risen 170%, Drewry's WCI spot index has risen 179%.

Meanwhile, the CCFI index of long-term contracts has done so by 192% and the CTS index (global that includes long-term contracts) by 136% (October-November). Low container availability and port congestion mean that long-term rates set in contracts between shipping lines and exporters are 200% higher than a year ago, indicating that prices will be high in the near future.

Source: blueberriesconsulting.com