Price gains in 2021/22 should be modest due to a gradual production recovery in São Paulo and a return to the long-term demand trends of gradual decline after the short-term retail sales gains seen during the pandemic.

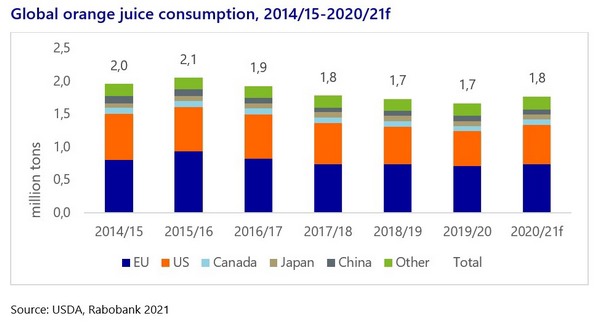

The orange juice category has faced a long decline in global consumption since the mid-2000s. Intensified competition from other beverages, negative press regarding its sugar content combined with higher prices, and adverse demographic trends in key markets (the EU, US, Japan) played an important role in the category’s underperformance. However, in 2020, the arrival of the global Covid-19 pandemic lifted orange juice retail sales in large consumer markets like the US and Europe. Fear of the virus increased demand for orange juice as a source for vitamin C, and more at-home consumption under lockdowns increased the amount of breakfasts at home.

“We believe that the long-term trend of decline in orange juice consumption in mature markets will gradually resume once the pandemic is controlled later on in 2021,” according to Andrés Padilla, Senior Analyst – Beverages at Rabobank. What underpins this is the fact that the category continues to be dependent on developed markets, which will continue to live through adverse demographic trends and strong competition from other beverages. With no sign of significant growth in Asia or other large emerging markets – other than Brazil – global orange juice consumption will continue to face challenging times, unless growth can be revived in other emerging markets.

Meanwhile, supply could see a moderate rebound in 2021/22, with more production in São Paulo after a very small crop in 2020/21. Global inventories remain at relatively high levels, and the rebound in supply forecasted for 2021/22 suggests that will not change in the short term. Price gains in 2021/22 should be modest due to a gradual production recovery in São Paulo and the return to the global demand decline trend.

Source: Rabobank