Greenyard has released its financial results for the first half of the 2020/2021 financial year. Greenyard's turnover increased by 10.3% in the first half of the 2020/2021 financial year to 2.17 billion euros. Organic sales growth is 11.1%. Sales were 0.2% depressed by divestments and exchange rates had a negative impact of 0.6%.

Key financials – continuing progress

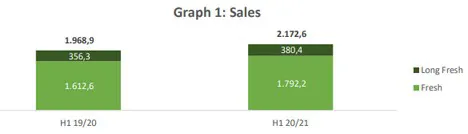

Sales: Greenyard continues to achieve positive sales growth. Group sales increased year-on-year by €203,7m, up from €1.968,9m to €2.172,6 m (10,3%). Of the 10,3% increase, 11,1% is organic growth, slightly negatively impacted by 0,6% FX headwinds, and 0,2% representing divestments in the last financial year.

• Fresh. An 11,1% increase in sales amounting to €179,6m, up from €1.612,6m to €1.792,2m, resulted mainly from better vegetable sales, combined with continued strengthening and growth in integrated customer relationships. To a lesser extent, it was also driven by higher volumes arising from the COVID-19 quarantine measures starting in mid-March 2020, which caused a shift from out-of-home to at-home consumption in the first quarter of the financial year.

• Long Fresh. Sales have increased by €24,1 m (6,8%) in the first half of the financial year, up from €356,3m to €380,4m. Despite the temporary drop in sales to food service customers, when out-of-home consumption ground to a halt in the second quarter of the calendar year, particularly affecting the Frozen division. The Long Fresh segment continues its steady growth. The sales dip in the food service segment has been offset by increased sales to retail customers.

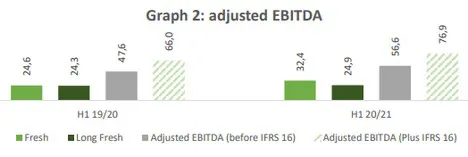

Adjusted EBITDA: As a result of transformation initiatives and growth in sales, particularly arising from integrated customer relationships, the adjusted EBITDA (before application of IFRS 16) increases significantly by 18,9%, up from €47,6m to €56,6m. Consequently, the adjusted EBITDA margin increased from 2,4% in the same period last year to 2,6% for the first six months of the financial year.

Adding the impact of IFRS 16 to the adjusted EBITDA, this would amount to €76,9 m, up 16,5% from the €66,0m for the first six months of the previous financial year.

• Fresh. The adjusted EBITDA for the Fresh segment increased by €7,8 m over the same period last year, from €24,6m to €32,4m, representing a considerable increase of +31,5%, resulting in a margin improvement of 28bps. Focusing on stable margin improvement and efficiency through Greenyard’s transformation initiatives has had positive results. In this way, margins have not been materially impacted by the additional costs associated with the COVID-19 pandemic. Since around two-thirds of sales in the Fresh segment are already earned through stable and long-term integrated customer relationships, the adjusted EBITDA margin is becoming increasingly robust and volatility is being eliminated.

• Long Fresh. The adjusted EBITDA for the Long Fresh segment increased by 2,5%, up from €24,3 m to €24,9 m, mainly driven by a better product/price mix. Nevertheless, the margin declined slightly by 27bps due to costs associated with COVID-19 and lower than expected agricultural yields over the summer, though yields gradually recovered from September onwards.

Hein Deprez, co-CEO: “Greenyard is demonstrating that its strategy of long term, sustainable and stable relationships in the value chain of both segments, works. This strategy ensures balance and certainty across the entire value chain. It reinforces the trust placed in growing together with the customer, even in uncertain times. For growers too, we will accelerate our investment, with the same level of intensity and integration, in professional, innovative and integrative collaborations,

ultimately leading to a further shortening of the supply chain. At group level, we are therefore taking the next steps in group sourcing.”

Marc Zwaaneveld, co-CEO: “Our objective to deepen our close collaboration in the value chain with customers and growers demonstrates our clear determination to add value to improve the entire supply chain in terms of availability, quality and cost. It forces us to adapt our organisation every day, making it better, more efficient and more sustainable, growing with every step. It is already leading to a significant shift towards more stable and higher volumes and margins, partly through more added value services, but also through structural process transformation, for example in sourcing and transport. Above all, we are accelerating our sustainability ambitions, with four concrete commitments. By striving for sustainable and continuous improvements in an integrated value chain, we lay the foundation for strong and stable growth over the coming years.”

To read the full financial results of Greenyard, please click here.

For more information:

Dennis Duinslaeger

Greenyard

Tel: +32 15 32 42 49

Email: Dennis.duinslaeger@greenyard.group

www.greenyard.group