AgroFresh Solutions, Inc. announced its financial results for the third quarter ended September 30, 2020.

AgroFresh Solutions, Inc. announced its financial results for the third quarter ended September 30, 2020.

Jordi Ferre, Chief Executive Officer, commented, "Our northern hemisphere apple season saw a return to a normal seasonal pattern in Europe causing revenues in that region to increase 26.4% in the third quarter versus the prior year period. We faced some challenges in the U.S. that caused revenues to come in below our expectations, including COVID-19 related uncertainty that lowered the propensity for customers to utilize quality enhancing solutions such as Harvista, which was compounded by better than expected labor availability in North America. Having said that, Harvista still generated growth of 7.9% for the quarter and through our strengthened operations and cost optimization strategy, we were able to deliver 21.0% adjusted EBITDA growth for the third quarter."

Mr. Ferre concluded, "As the original innovator and global leader in the near- and post-harvest industry, our platform is solutions-based and service-oriented. Not unexpectedly, competitors have targeted AgroFresh given our leadership position in the market, but as we've seen time and again, their low-price low-touch approach is not sustainable with customers that expect the quality and service that AgroFresh has provided to the marketplace for decades. Our organization is driving towards a technologically-enabled future for our industry and participating as an AgTech innovator utilizing our FreshCloud capabilities as the foundation. We aim to deliver novel and highly customized, confidence-inspiring solutions tailored to unique customer needs that are based on our unmatched depth of agricultural experience, product expertise and data-driven insights."

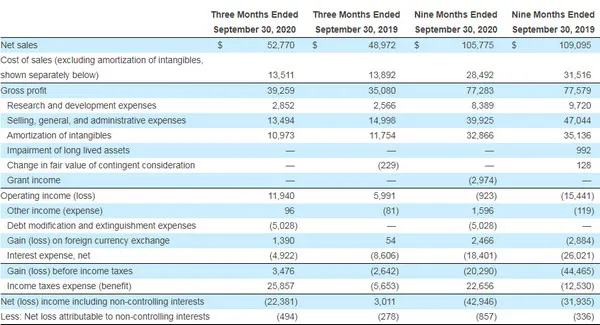

Financial Highlights for the Third Quarter of 2020

Net sales for the third quarter of 2020 increased 7.8%, to $52.8 million, compared to $49.0 million in the third quarter of 2019. Excluding foreign currency translation impacts, which increased revenue by $1.1 million as compared to the third quarter of 2019, revenue increased 5.6%. The net sales increase was primarily the result of SmartFresh growth in Europe due in part to the normalization of harvest seasonality versus the prior year period, increased traction with Harvista in European markets, and positive contributions from Tecnidex.

Gross profit for the third quarter was $39.3 million, compared to $35.1 million in the prior year period. Gross profit margin increased 280 basis points to 74.4% versus 71.6% in the prior year period. The higher gross margin was primarily the result of the Company's supply chain efficiencies and further supported by price discipline.

Research and development costs were $2.9 million in the third quarter of 2020, compared to $2.6 million in the prior year period. This increase was driven primarily by the timing of projects.

Selling, general and administrative expenses decreased 10.0%, to $13.5 million, in the third quarter of 2020 as compared to $15.0 million in the prior year period. Included in selling, general and administrative expenses were $0.4 million in the current quarter and $1.6 million in the prior year quarter of costs associated with non-recurring items that included litigation, M&A and severance. Excluding these items, selling, general and administrative expenses decreased approximately 1.6% in the third quarter versus the prior year period, which reflects the Company's ongoing cost optimization initiatives.

Third quarter 2020 net loss was $22.4 million, compared to net income of $3.0 million in the prior year period. Tax expense increased by $31.5 million compared to the prior year period primarily due to the Company recording a $24.7 million valuation allowance against carryforwards of cumulative net operating losses related to the change of control for federal income tax purposes associated with the recent PSP investment.

Adjusted EBITDA1 improved by $4.3 million, or 21.0%, to $25.0 million in the third quarter of 2020, compared to $20.6 million in the prior year period.

As of September 30, 2020, cash and cash equivalents were $25.1 million.

Financial Highlights for the First Nine Months of 2020

Net sales for the first nine months of 2020 were $105.8 million, a decrease of 3.0% versus the prior year period. The impacts of foreign currency translation reduced revenue by $2.7 million for the first nine months of 2020; excluding this impact, revenue decreased approximately 0.5%. Our core SmartFresh business on a constant currency basis grew 1.3%. The slight decrease in net sales on a constant currency basis was primarily the result of geographic mix, where the relative strength of the Company's business in the EMEA and APAC regions were more than offset by relative weakness in the North America and Latin America regions.

Gross profit margin was 73.1% for the year-to-date period, which compares to 71.1% in the year-ago period, an improvement of 200 basis points. The year over year improvement was a result of the supply chain cost optimizations that were implemented at the end of 2019 and are expected to carry through the balance of 2020.

Research and development expenses decreased $1.3 million, to $8.4 million, in the first nine months of 2020 compared to the prior year period, driven primarily by the timing of projects.

Selling, general and administrative expenses decreased 15.1%, to $39.9 million, for the nine months ended September 30, 2020 compared to the prior year period. There were non-recurring costs associated with M&A, litigation, refinancing and severance in the amount of $2.8 million in the current year period and $6.9 million in the prior year period. Excluding these items, selling general and administrative expenses decreased approximately 7.6% versus the same period last year driven by ongoing cost optimization initiatives, and to a lesser extent reflect the temporary decrease in travel and other miscellaneous expenses as a result of the COVID pandemic.

Net loss was $42.9 million in the first nine months of 2020, compared to net loss of $31.9 million in the prior year period. Tax expense increased by $35.2 million compared to the prior year period primarily due to the Company recording a $24.7 million valuation allowance against carryforwards of cumulative net operating losses related to the change of control for federal income tax purposes associated with the recent PSP investment.

Adjusted EBITDA improved by $4.7 million, or 14.8%, to $36.4 million in the first nine months of 2020 as compared to the prior year period. Adjusted EBITDA margin improved 530 basis points to 34.4% versus the prior year. The increase was driven by lower operating expenses, after adjusting for non-recurring items.

For the full financial report, please click here.