The rainy season is upon the Netherlands, and autumn is here again. When the weather turns, the mushroom season begins anew. In the summer, it was doom and gloom for the sector, with several companies filing for bankruptcy. The industry has also had to deal with rock-bottom prices for its products. How do traders and exporters currently see the market?

The market

There is not much demand for mushrooms in the summer, so the market is mostly quiet then too. Things were, however, a little different this year. “We usually have to deal with surpluses at the end of August,” says Paul Verhoeckx of Verhoeckx mushrooms in Kerkdriel, the Netherlands. “Now, there are shortages on the market. Some growers have fewer mushrooms per square meter.” These low yields have to do with last year’s lesser quality compost. The straw, in particular, was too dry, thanks to 2018’s dry summer.

Different kinds of mushrooms and packaging.

Different kinds of mushrooms and packaging.

Besides the issue with the quality of the compost, the sector also had to contend with a large mushroom grower going belly-up at the start of the summer. “For the first time in six or seven years, we are seeing mushroom prices rising again,” says Forest Flavour’s Suresgopi (Gopi) Selvanayagam. Forest Flavour is a mushroom cultivation and trading company based in Boekel in the Dutch province of North Brabant. “Competition means prices have been adjusted upward, which benefits the whole sector. Last year, we were selling entire crates for €3, now our mushrooms are going for €2/kg."

Despite the shortages, the market was still fluctuating wildly at the end of August/beginning of September. “Sometimes we made double the number of sales in one week compared to the previous week,” says Gopi. “This was mostly due to the weather. When it is warm, the demand for mushrooms from both the hospitality as well as the consumer sector drops. When it gets colder, this demand increases.”

The hot weather also affected cultivation. “A week of 40°C + temperatures still affects a company, even six weeks later,” says Noud Spetgens of Nesco, another mushroom company in Boekel. “The problems found in regular cultivation are also relevant to our organic cultivation. For example, we also had issues with inferior quality compost. Conventional growers had fewer third mushroom run rejections because of infections than organic farmers did. All-in-all, we had about 15% lower yields than last year. And although this brings a better price on the market, it does not really benefit the grower. I think 15% per kg has to be added to mushrooms’ purchasing price across the board, for both organic and conventional products, if growers want to make a little money. Since we work on fixed prices, the shortages on the market have little influence on the price of organic mushrooms.”

Although prices are on the rise in the Netherlands, Paul Verhoeckx does not expect the Dutch retail sector will go looking for overseas products. “They prefer having Dutch mushrooms on their shelves than those from a country such as Poland, for example. Other production countries have had to deal with dry, hot weather and inferior quality compost too.”

There are more kinds of edible mushrooms than you would think

There are more kinds of edible mushrooms than you would think

Import and export

The fear of a mushroom shortage may be unfounded when one takes Dutch export figures into account - 75% of the mushrooms in the Netherlands are earmarked for the export market. One of the most important of these export markets in the United Kingdom. It is uncertain what effect the looming Brexit, planned for October, will have on this trade. “We are keeping various scenarios in mind at the moment,” says Westland Mushrooms’ Harold Schuurmans. This company is based in the Dutch town of De Lier.

Arie Verburg of Fresh Mushrooms Europe has seen the demand for mushrooms growing. “At the same time, we are waiting in anticipation for what Brexit could eventually bring.”

Although the UK is an important sales market for most mushroom traders, Paul Verhoeckx focuses on mushroom exports to Norway. “I recently received a certificate from our Norwegian client, Bama Oslo, for being their best supplier. We have been supplying this client, non-stop, for 28 years. There is always a bit of paperwork, but things are going well. Regarding the problems Brexit will cause for other traders, all I can envision is long queues at the border. The Brits will still want to have Dutch and Polish mushrooms on their shelves; otherwise, there will be shortages.”

More destinations keep cropping up for Dutch mushrooms. Gopi exports early mushrooms to far-off places such as Singapore and the Middle east. “We still do that, but we now use a middleman,” says Gopi. “The risk is reasonably high, and then, there is also the paperwork. That is why we now mostly supply clients who handle the exports themselves. Sales to these countries are going well. You must just not want to export any shiitakes or oyster mushrooms to Taiwan. They have these varieties themselves.” Closer to home, Gopi sees the sale of his Dutch cultivation rising too. “For example, we have a client in Belgium, who wants Dutch purple mushrooms, not Polish ones.”

Champost Fond as part of the Zero-Waste concept.

Champost Fond as part of the Zero-Waste concept.

Mushrooms

“The European market is on the move,” says Arie of FME. “The dietary trends of today’s consumers, such as deliberately no longer eating meat, cannot be halted. The retail sector pays much attention to the mushroom category, an important one in the fruit and vegetable sector. This creates opportunities for us, but we must correctly approach these. Mushrooms must be brought onto the market in the right way, and that requires know-how and investment. There are opportunities for the entire category too - from white mushrooms to chestnut mushrooms, shiitake, oyster mushrooms, chanterelles, porcini mushrooms, truffles, and so on.”

People became familiar with white mushrooms in the supermarket a long time ago already. “Chestnut and oyster mushrooms, as well as mixes of different mushrooms, are becoming increasingly popular,” says Paul Verhoeckx. “White mushrooms are remaining at the same level; where we do see an increase, is in the sales of this product. This increase is because mushrooms are becoming an increasingly popular meat substitute and as being processed into a salt-replacement powder. I think this bodes well for the mushroom sector’s future.”

“Chestnut mushrooms, in particular, are becoming more popular. These mushrooms have a nice color, are tastier, and have a better shelf life than white mushrooms.” The fact that these mushrooms taste better is mainly thanks to the product’s moisture/dry matter balance. “White mushrooms have a balance of 90% water and 10% dry matter. With chestnut mushrooms, this is 80/20. Chestnut mushrooms used to be good for ten percent of the market. That share has now grown to 15-20%.”

Organic mushroom cultivation.

Organic mushrooms

There is a different ratio between chestnut and white mushrooms in the organic segment. “In organic mushrooms, about 60-65% are chestnut mushrooms, and 30-35% are white mushrooms,” Noud Spetgens. “That is the opposite of regular cultivation. Organic mushrooms’ share of the mushroom sector is small - about six percent of the entire sector is comprised of organic products. This share is, however on the rise. We supply the whole of Europe, in particular, Germany, Belgium, Switzerland, and Scandinavia. There is sometimes fierce competition, especially in Germany and Belgium.”

For Nesco, being 100% organic was not an absolute must. “It is just a fun side business we kept over from the Nesco/Bio-Europe merger,” says Noud. “We see that this has an added value in the market in which more people are deliberately choosing organic products. Besides white and chestnut mushrooms, we also grow portabella mushrooms. We get supplied with shiitake, eryngii, and oyster mushrooms from growers we collaborate with, too. It is essential for organic cultivation that you coordinate the sale of these products well with the market demand.”

Other kinds of mushrooms

“Unusual mushrooms, especially, are gaining popularity,” says Gopi. “That is why we decided to keep up the mushroom trade in our company. We, therefore, also offer chestnut, portabella, chanterelle, shiitake, and oyster mushrooms in our range. We always ensure we have every kind of mushroom in stock so that we can deliver to our clients. We offer different mushrooms mixes, too. Cut and uncut for use in, for example, soups. With processed mushrooms, we can offer them cut into different sizes. In the summer, we offer a barbecue mushroom mix, and we can deliver to our clients using our own Forest Flavour truck.”

These unusual mushrooms are not only becoming more popular, but the assortment of mushrooms is also increasing, thanks to this growing trend. “We are continually discovering new products that we try to introduce to the market,” says Harold Schuurmans. “The Cordyceps and Desert Rose varieties are relatively new products for us. They offer a whole new flavor profile. We try to bring these new products to our clients’ attention by sending samples and information about how they can use these products. For example, we put recipes in our newsletter.”

“If a mushroom variety catches on - ultimately it is the client that determines this - we see if we can grow it in the Netherlands. This begins a long journey for growers. They have to use the correct substrate and create the right conditions in which to cultivate these mushrooms. We import some of our mushrooms from, for instance, Japan, where they have many years of knowledge of growing certain kinds of mushrooms.” Harold sees these developments helping the market recover, compared to a few years ago. “Our company’s client base keeps growing, and this is, especially because mushrooms are becoming more popular among our clients again. The low buy-in prices for mushrooms at supermarkets are also on the decline. This is thanks to, among other factors, Fair Produce.”

FME is set on making mushrooms better known to the consumer. They do this using various concepts under the Bolettus label. “For example, we have the Bolettus Combo,” says Arie. “Here, we offer clients a mix of mushrooms for certain dishes. There is a recipe on the label of these packs, which makes it easier for people. We have Bolettus World too, where we bring flavors of the world together. There are not only mushrooms in these dishes but also complementary vegetables, and a sauce for a complete meal. Think, for example, of a Thai or Italian pack.”

Newsletters, sites, etc. - all to convey knowledge about mushrooms.

Newsletters, sites, etc. - all to convey knowledge about mushrooms.

Wild mushrooms

There are now enough niche markets in the mushroom sector for companies to focus on. Besides truffles, shiitake, and standard mushrooms, there are, after all, many other kinds of mushrooms. Funghi Funghi was founded in 2017 in the Belgian town of Meer. This company has cornered such a niche market and has the goal of becoming an authority in this specific area. “When I ask a chef about how many kinds of mushrooms he uses in the kitchen, the answer is usually around five to seven different kinds,” says Leon van Basten, Funghi Funghi’s spokesperson. “That, while we have close to 70 different kinds of mushrooms in our range. This range includes wild as well as cultivated mushrooms. That just goes to show, once again - unknown means unloved. We want to change this.”

Wild mushroom season starts in September. The end of August was still the calm before the storm. “The first wild mushrooms then came in from Southern Sweden. These include grey Funnel Chanterelle and Penny Bun mushrooms. In September, more products follow from different Eastern European countries such as the Baltics, Belarus, Russia, and Poland. We then move to the Balkans. This summer, we had summer truffles from Northern Iran in our assortment too.”

Funghi Funghi’s founder, Corné Verboom, makes a round of calls every day from the company’s nerve center in Meer. “He phones the pickers who collect these mushrooms and asks them, daily, how things are going. It was a less favorable year in 2018 - mushrooms do not like hot, dry weather and, most of all, require moist air. We had issues with quality in Europe as well as Northern America. Things look better in the 2019 season. We regularly have yet another rain shower. Mushrooms love that.”

The company does not only have wild mushrooms in its assortment, but they also have cultivated mushrooms. “This year, we added two new varieties - the Cordyceps and Royal Chestnut. Blue stalk mushrooms are an unusual variety that is cultivated for us in the marl caves of Kanne in Belgium. We also began growing chestnut mushrooms in the caves there. We add marlstone to the compost. The mushrooms do, however, take much longer to grow this way.”

A wide assortment of mushrooms.

Funghi Funghi wants to become an authority in the area of fresh mushrooms. “We receive the mushrooms at our premises in Meer, where we check, repackage, and eventually clean them. The mushrooms then go to our clients, spread across 23 different countries. We have buyers from as far afield as the United States, the United Arab Emirates, and the United Kingdom. The mushrooms are transported via air freight to these distant destinations. The trade to the UK is sent via the Channel tunnel. Our clients in New York get their mushrooms on their plates sooner than those in London. However, the UK remains our most important market. We are, therefore, waiting to see what effect Brexit will have on our business.”

Although this company’s clients are mostly made up of wholesalers, Funghi Funghi does organize demos and information meetings for its end-client, the hotel, restaurant, and catering sector. “We work in a niche market that does not have its own umbrella organization. We show chefs how the products can be incorporated into a dish, and we publish a weekly newsletter. We can give demonstrations in our own Funghi kitchen too.”

Cordyceps, a new top seller in the mushroom world.

Cordyceps, a new top seller in the mushroom world.

Regional products

The growing range of mushrooms seems to be contradicting the ever-increasing trend of using regional products, especially in the hospitality industry. “Yes and no,” answers Harold Schuurmans. “Yes, there is more demand for regional products. However, on the other hand, we have various ongoing projects to see if we can cultivate mushrooms in the Netherlands that are, originally, exotic. An example of this is the Shiitake. This mushroom variety was imported from the Far East 20-odd years ago. However, nowadays, it is being grown by Dutch mushroom farmers. Simply put, mushrooms thrive in many different places, and it is a product that can contribute to feeding the global population. Mushrooms’ exclusivity may diminish somewhat, but when it comes to prices, this will benefit the consumer.”

This rising trend toward regional products applies to organic products too. “We have, however, noticed that this is causing more problems for us in Europe,” says Noud. “If Germans want local products, then the local region is first in line, followed by products from the rest of the country, and then, only, Dutch mushrooms. While, if you consider quality, it is, in fact, Dutch mushrooms that take top honors. This is because we have been doing battle on the market for 15 years and more. This longevity is only possible if you have a product of superior quality.”

Their wild mushrooms are already entirely regional. “Chanterelles do grow in the Netherlands, but you are prohibited from picking these mushrooms. If restaurants want to work with these wild mushrooms, they have to come from Eastern Europe, where there are still vast forests. Many wild mushrooms cannot be, or are not yet, being cultivated. We are reliant on the season when it comes to wild mushrooms, but our end-users sometimes want to use a mushroom in their menu that is out-of-season. Porcini mushrooms at Christmas is a particularly good example of this. I, personally, find this ridiculous. However, we have decided to serve our clients. We have to import porcini mushrooms from Namibia, Zambia, and South Africa to achieve this. They are in season in those countries at that time of year. This is sometimes a dilemma for us because we have so many other mushroom varieties on offer.”

Ready to go.

Cultivation

Growing mushrooms is a labor-intensive process when it comes to harvesting. Mushrooms are also cultivated indoors, and cooling costs climb quickly in the summer. The prices paid in supermarkets do not cover these production costs. “Mushrooms farmers do not have it easy,” says Arie from FME. “It involves personnel costs, staff benefits, power, maintenance, and so on, and making a profit from a nursery is no mean feat.”

“Fewer mushroom farms are being passed onto the next generation,” says Paul Verhoeckx. “The smaller growers fall by the wayside, and the larger farms keep growing. There are fewer and fewer successors to be found; choices are limited. Expansion in the market has its benefits, but it is more a question of necessity. The smaller growers are also suffering because they simply have to follow the same rules as the big companies, and the big boys put pressure on market prices.”

Production costs often used to be much higher than the price growers received for their goods. To halt this downward spiral, Fair Produce was created to monitor labor conditions in the sector. “Fair Produce has ensured stability and fewer corners are being cut in the sector,” says Paul Verhoeckx. “It, however, affects prices. It is a pity that only the mushroom sector does this, and not, for instance, the strawberry sector as well. There is, after all, misconduct in every sector. There are now fewer growers ruining things for others in the market.”

Although Gopi of Forest Flavour saw prices rise in the mushroom sector this summer for the first time, cost prices are also on the rise. “Personnel and compost costs are continually rising. Last year, we lost roughly 20 to 40% of our revenue because of supermarkets' low buy-in prices.”

Sustainability

Mushrooms are a good example of a circular economy. The mushrooms grow in compost made up of straw and manure and require little to no pesticides. Mushroom waste can be used as champost, which then aerates the soil. Nowadays, mushroom stems are also increasingly being processed into, for example, mushroom powder, a salt substitute that is on the market.

Portabella

Portabella

During packing, mushrooms are still often packed in plastic boxes. “Switching to cardboard is not that easy yet when it comes to mushrooms,” says Paul Verhoeckx. “The mushrooms go into cold storage, and growers work a lot with water. Moisture and paper simply do not go well together. Six months ago, we did introduce r-PET in our company. We had to invest in our packing line for this. The sealing heads we use to seal the lids were too weak to handle the slightly thicker r-PET. We have replaced these heads with more powerful ones.”

In spite of the sector’s advantages, cooling facility costs are rising because of the hot summers. “The costs rise as the temperatures do,” explains Paul. “Various growers have already installed solar panels on their roofs, and I suspect that number will probably increase even more.”

At Westland Mushrooms, they also try to use environmentally-friendly packaging. “For example, we use recycled plastic and cardboard, and we try to keep our CO2 footprint in mind. It uses a considerable amount of energy to cultivate mushrooms, but we have noticed growers looking for alternatives such as geothermal and solar power to compensate for this.” Higher purchasing prices, compared to higher production costs, however, offer no remedy. “Rising demand and shrinking supply mean profit margins will improve throughout the entire chain,” says Harold. “This allows us to continue to keep supplying sustainable products in the longer term, too. Our initiatives regarding sustainability are part of the ISO 26000 program.”

At Forest Flavour, they have replaced conventional packaging with, among other alternatives, r-Pet. “It was an investment, but it will be worth it,” says Gopi. “We also focus mainly on vegetarian products - this is, after all, a trend - and we think veggie burgers made of mushrooms or half-half will be an added value product. We have, however, not yet discussed this idea with manufacturers yet. We aim to inform end-users, which are mostly our clients’ clients, too, by giving them ideas, such as recipe and ways to use the product.”

Easier for the client - ready-to-use.

Easier for the client - ready-to-use.

“Making the sector more sustainable is one of our goals, and, this year, we are right in the middle of this,” says Leon. “We are doing this on two fronts. We are striving for zero-plastic and zero-waste. With zero-plastic, we want to work with a cardboard packaging and a biodegradable top seal. The first packs and packaging line for these have been ordered. We hope to begin with this toward the end of the year. We are uncertain about the use of biodegradable plastic since there are lots of issues with this, such as composting knowledge. Several countries also do not have the means to process alternative plastics.”

Their other goal is zero-waste. “We are already well on the way with this. We now work with a company that makes broths for the hospitality sector. We have used this as a test to see if we can process non-saleable mushrooms into broths like these. We want to offer this end-product to our clients to use in the kitchen. We also have a drying and freezing line at our disposal. In the UK, we supply mushrooms to top restaurants, who want only the best quality mushrooms. If a mushroom can no longer be sold as an A-class, we always still have people who will take a Class II product. But, if that does not succeed either, we can either dry or freeze the mushrooms, and they can then still be used for processing. In this way, we throw nothing away. In the future, we might even supply other sectors, such as retailers, with mushrooms, but that is something for the future.”

Organic does not equal sustainable. However, Nesco is spending the necessary money on this. “We always get our organic compost from the same dealer. When we have completed the harvest, our old compost, the champost, goes back to the plot where the straw that is used in compost comes from, and we spread it over the fields. In this way, we work in a completely circular manner. We get our power from solar panels and are also busy making our packaging more sustainable for the supermarket. For example, we would prefer to start working with cardboard instead of plastic.”

The future

The shortages on the market, as outlined here, can lead to higher prices in the supermarket. Although countries like Poland bring their mushrooms to market at much lower prices, most supermarkets still prefer Dutch mushrooms. Most traders and growers see a future in the sector, although it is essential for companies to move forward. They must, for example, focus on niche markets. Forest Flavour has, for instance, come a long way doing this. “We followed a little behind the market for many years,” says Gopi. “It was more of a hobby for us for four years, but last year we decided to make a go of it. We did so gradually, and have grown considerably as a small business.”

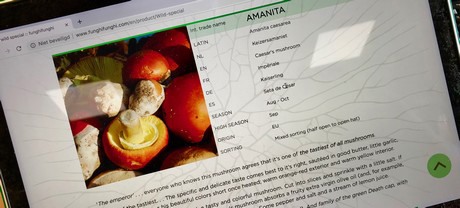

The Caesar’s mushroom is the tastiest, according to those in the know

The Caesar’s mushroom is the tastiest, according to those in the know

“The Caesar’s mushroom is my favorite,” says Leon van Basten. “Anyone who knows this wild mushroom agrees it is the tastiest of all the edible mushrooms. In contrast to the Fly agaric, which is also an amanita - the well-known red mushroom with white spots - the Caesar’s mushroom can be eaten raw too.” Harold Schuurmans is more a fan of the Pied de Mouton, or Sheepsfoot. “It tastes simply fantastic.”

Meat substitute

“We have noticed that there is more demand for mushrooms from the hospitality sector, says Harold Schuurmans of Westland Mushrooms. “Mushrooms are, after all, an excellent alternative for meat, and that drives demand on the market. To respond to this demand, we supply, for example, the mushroom stalks to the industry. They extract these and make blended burgers from them. When burgers are blended, meat is mixed with mushrooms. We also make our own products such as Mushroom burgers and balls, which are 100% vegetarian. These are being bought in increasing numbers by the foodservice as well as the food retail sectors.”

Not all mushrooms are used as meat substitutes, but Harold does see the sector experimenting more and more with different varieties. “At the moment, we make our circular products from mushrooms and oyster mushrooms that come from our growers. Since this is such a trend, we have noticed the sector experimenting with new taste profiles from other kinds of mushrooms.”

paul@verhoeckxenzn.nl

gopi@forestflavour.nl

leon@funghifunghi.com

h.schuurmans@westland-mushrooms.nl

noud@nescomushrooms.nl

matthijs.verburg@fme-nv.com