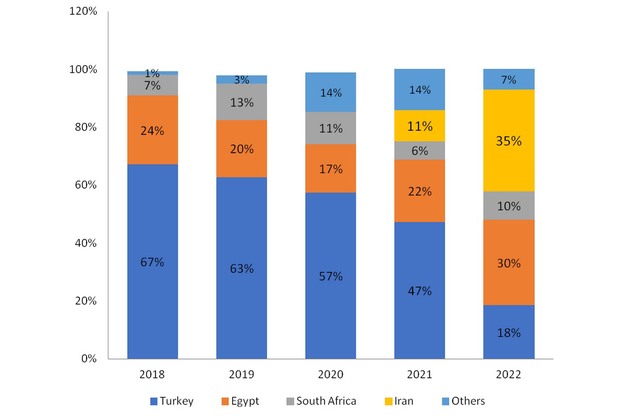

Iran is emerging as a dominant force in the Uzbekistani orange market, as it has been steadily boosting its exports of this product to Uzbekistan since 2021. Last year, Iran shipped more than four times as many oranges to Uzbekistan as it did in 2021, and increased its market share by more than threefold. This year, Iran further consolidated its position in the Uzbek orange market, edging out Turkey and other competitors, as reported by EastFruit analysts.

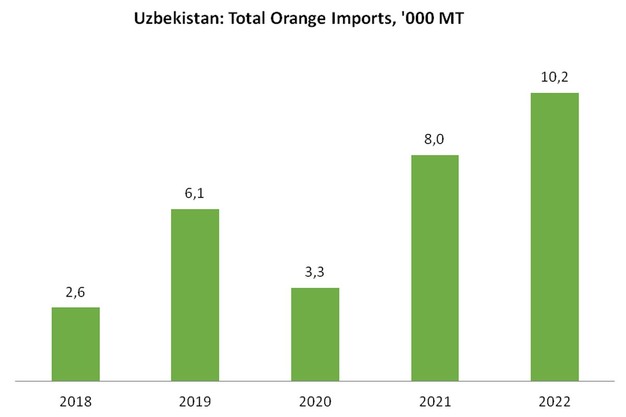

The Uzbekistani demand for oranges bounced back after a sharp drop in the year of the coronavirus pandemic, and resumed the upward trend that started in 2019.

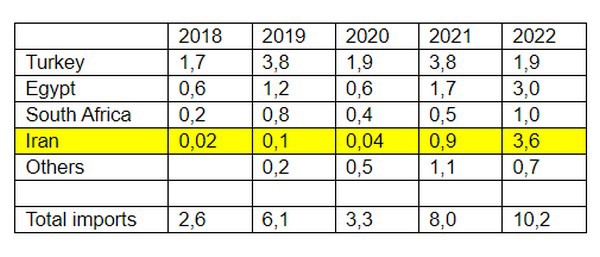

Along with the recovery, the Uzbekistani orange market also underwent significant changes in the composition of its suppliers. Turkey, which used to be the main source of oranges for Uzbekistan, saw its share in this market gradually shrink since 2019, but the most dramatic decline happened in 2021-2022. Even though the total volume of orange imports in Uzbekistan grew almost fourfold from 2018 to 2022, the volume of Turkish orange exports to this market barely changed – from 1.7 thousand to 1.9 thousand tons. As a result, Turkey’s share in the Uzbekistani market plummeted by 3.7 times – from 67% in 2018 to 18% in 2022.

Meanwhile, Iran ramped up its orange exports to the Uzbek market starting from 2021. Before that year, Iran only supplied up to 130 tons of oranges per year to Uzbekistan, which made up no more than 2% of the total orange imports to this country. But in 2021, Iran sold 855 tons of oranges to this market – raising its market share to 11%, and in 2022 – 3.6 thousand tons, increasing its share in this market to 35%!

The share of other countries in 2022 dropped compared to the previous year, due to a more than twofold decrease in orange imports to Uzbekistan from Kazakhstan – from986 to 448 tons. Kazakhstan acts as a re-exporter of this product.

EastFruit analysts predict that by the end of this year, the volume of orange imports to Uzbekistan will keep growing, at a rate of 15-25% compared to 2022. At the same time, the annual volume of Iranian orange exports is expected to double compared to last year, which may account for around half or even more of the total orange imports to Uzbekistan.

For more information: east-fruit.com