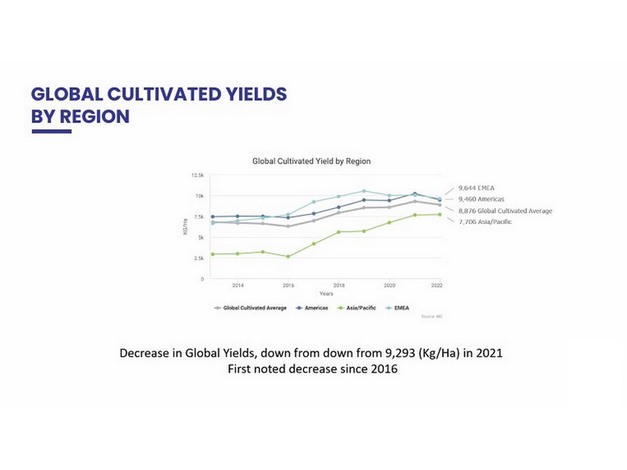

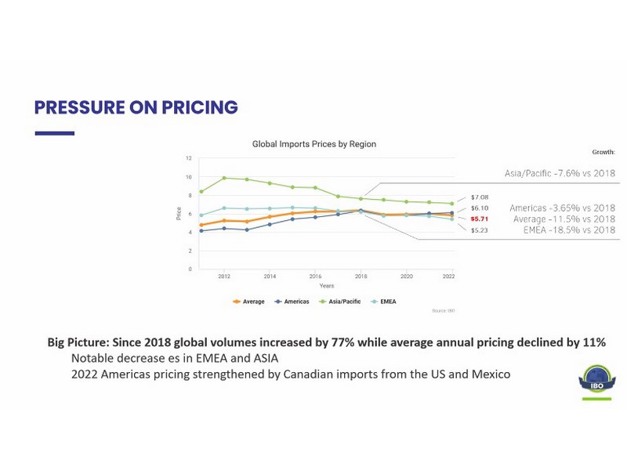

The global blueberry industry, which has become accustomed to stellar growth in nearly all key measures over the years, was somewhat surprised as the average global yield fell for the first time since 2016. The industry also faces "a significantly disrupted year with markets under pressure due to increased costs and inflation." This was revealed at yesterday’s (15 August, 2023) International Blueberry Organisation (IBO) 2023 Global State of the Blueberry Industry report launch. Cort Brazelton, Chief Editor and co-author of the report, said: “The decrease in yields took 96.3 MT out of production, with average growth this year coming from new hectares, which come into full production. Since 2018 global volumes increased by 77% while the annual price declined by 11%. The pricing is not seeing the high peaks and values as in the past. It remains consistent on average, depending on region and market. There’s notable pricing decreases in Europe, Middle East, Asia and Africa. The 2022 pricing is strengthened by Canadian imports from the US and Mexico.”

Cort Brazelton, Chief Editor and co-author of the report, said: “The decrease in yields took 96.3 MT out of production, with average growth this year coming from new hectares, which come into full production. Since 2018 global volumes increased by 77% while the annual price declined by 11%. The pricing is not seeing the high peaks and values as in the past. It remains consistent on average, depending on region and market. There’s notable pricing decreases in Europe, Middle East, Asia and Africa. The 2022 pricing is strengthened by Canadian imports from the US and Mexico.”

Despite the world leaders Peru’s leadership in the industry the IBO marks for the first time the Americas production share fell below 50%. A lot of production growth is coming from Asia Pacific at 165% since 2018 and EMEA with 108% since 2018.

“The market in the US is likely to be short due to the substantial drop from Peru who turned the flags late to indicate that their production is impacted due to El Nino. If you have fall fruit coming in, because Peru has a strong position in the September to December window. It could lead to a false flag for Mexico due to the late signal from Peru. It’s going to be an interesting year in the market. The Middle East and India are increasing imports and domestic supply. The consumption base will become increasingly global. Production has been increased in the Western states of US and Canada. There was a lot of replanting in Michigan and Georgia, to provide more consistent and sustained volumes. I see production in the US shifting to areas with more water availability,” stated Brazelton.

Colin Fain, CEO Agronometrics who’s team prepares the report for the IBO, says Peru remains the top fresh producing and exporting country. The US is the main fresh cultivated importing country, followed by the Netherlands due to their re-exports to the EU with Germany taking over from the UK in third place. Blueberry industry challenges

Blueberry industry challenges

The most significant challenges for producers are the soaring input costs of 20-30% while non-harvest costs doubled in the last year. There is also margin pressure with high inflation and pressure on returns in nominal and real economic terms.

“Poland is an example where their exports and imports are on par due to aggressive domestic market promotion. Producers need to focus on field efficiency and higher yield to offset costs. The general trend is to make use of economies of scale. The regions with low cost such as Mexico, Peru and Morocco are a major source of growth for the industry,” says Brazelton.

Other factors to be considered and that drive change in the industry in the last few years are berries with improved firmness, flavour and texture. “There’s a preference for these new varieties. There’s also a shifting focus to the summer season to high chill varieties. Organics is increasingly not resolving their pricing issues. Organic alone does not resolve the growing demand for quality. Improving quality appears to be key to grow demand,” notes Brazelton.

Fain says the total global production surpassed 2 million MT with the fresh share of production up to 65% from 50% in 2016. “The ramp up in production comes from especially Peru and Mexico with Morocco and China too. Fresh continues to fetch better prices in the market. We see it in the reduction mix on a global scale. Expanding the base of consumers is key for the industry. We are capturing new consumers. There’s a massive increase in consumers based in Europe, Asia, China, Western and Central Europe.”

Fain and Brazelton highlighted some other key industry trends from the report: "Machine harvesting is not mainstream yet. ESG, climate change and regenerative agriculture is becoming more prominent. We have to tell our success stories more. Like showing it uses less water than other crops. Our industry supports large labour forces and contributes to society. Our health research and benefits of blueberry consumption too.”

For more information:

For more information:

Jodean Robbins Duarte

International Blueberry Organization

Email: [email protected]

www.internationalblueberry.org