Following their strong growth trajectory, Hong Kong-based Global Produce Holding will open the doors of Global Produce Saudi Arabia Joint Venture in Riyadh on the first of April 2023.Last year Global Produce vertically integrated its supply chain by entering into a joint venture in Ho Chi Minh City, Vietnam (right). Besides their JVs, Global Produce has strong local market representation in Eastern Europe as well as in the People’s Republic of China.

The next two key markets into which Global Produce will grow steadily are Indonesia and India, either via the local market or with a similar JV format.

“We experienced a good growth in the citrus category and brought competitive prices back to the farms we represented during the 2022 season,” maintains Rutger van Wulfen, founder of Global Produce; the company had a 270% growth in citrus from South Africa during 2022 season.

A large part of this increase was represented by processing grade (PP) Star Ruby programme to China and to Iraq. “The PP Star Ruby was highly successfully, sold by our local team in China Mainland, where fruit and tea retail chains represented close to 60% and the balance to juice factories across China,” he says.

“Our strategy is to work with a select number of farming cooperatives, fight for them and avoid working with unnecessary middlemen.”

Global Produce’s head office is based in Cape Town, South Africa from where the planning and logistics services are centralized. This office is merely a service centre to help link farmers with overseas markets.

Focus on second tier cities in mainland China

A decade ago, Rutger says, Global was a frontrunner in distributing South African fresh grapes and citrus to the more remote cities in China Mainland, markets like Beijing but also Shenyang, Kunming and Zhengzhou.

Grapes from South Africa (symbolised by the elephant) in the Global Produce Geo brand

“By doing this we bypassed the main traditional first tier markets like Shanghai and Guangzhou. We do have very good partners (sales teams) that we cooperate with directly since certain fruit simply does not move as fast in second tier markets. This structure has created the benefit of sending a lower-class orange including class 2 South African apples to China Mainland instead of only the premium clean “spec” product.”

He explains that for a farmer, this makes a huge difference in the packhouse as he now can pack more for China than ever before and get a better price for the same count fruit than in the traditional markets such as Europe, Russia or the Middle East.

“The other advantage of opening a container ‘deeper’ into China is that it is not unnecessarily passing through middlemen before it reaches the end destination. We have been delivering vast volumes of South African fresh fruit to the end customers at their doorstep. We are happy we set a trend because this is great for the South African citrus industry overall.”

He adds they’re seeing their growth in China predominantly with B2B and B2C partners, remarking: “Our general manager in China used to head HEMA, Alibaba Fresh, and is like an octopus - well connected!”

New market development in UK, North America Besides China (“Global Produce’s comfort zone”, Rutger calls it), the company is focusing on new market development.

Besides China (“Global Produce’s comfort zone”, Rutger calls it), the company is focusing on new market development.

In January 2023 they welcomed Hannah Langford (right), previously a buyer for Lidl, procuring several categories of produce, including stone fruit, exotic fruit, tomatoes, onions and cut flowers. She has moved to South Africa to look after their retail clients around the world as well as developing their South African fresh fruit basket into Canada and North America.

“The United Kingdom is also becoming more and more of interest to Global Produce. The issue of citrus blackspot in the European Union makes it a difficult export market while the UK is not affected. The UK preference for bigger size lemons is also attractive.”

To support their endeavours to the West, Global Produce appointed Gerik Rautenbach, formerly a citrus farm manager in Patensie who is, Rutger says, a real citrus expert.

Gerik will handle their business in the south of the country, where they have traditionally not been as strong as in the north. Gerik will assist in sourcing from Southern Africa (including Zimbabwe and Eswatini) for the UK.

Right: South African oranges

“We just started loading lemons for Hong Kong, Malaysia and Kuwait and Saudi Arabia. There’s a very good crop hanging and we were very lucky this year that we hit the sweet spot: normally we hit the market together with Egyptian lemons. We are seeing this now in the Middle East - there are quite a bit of Cypriot lemons, Turkish lemons and still Egyptian lemons but volumes are low and quality-wise, the early South African Eureka lemons are very juicy.”

What’s more, he adds, their early lemons will be just in time to be enjoyed during Ramadan. The juice content from South African lemons is much better than the competitors, he says.

Limited supply of large apples due to hail

Global Produce visited their apple suppliers in the Ceres and Grabouw areas last week where they ascertained for themselves the effect of the hail events on Ceres orchards, which, Rutger says, normally has bigger apples than Grabouw.

“There could be fewer big fruit available for places like Vietnam and I expect that prices for bigger-sized fruit will be better this year because of supply and demand.”

Exports of their first Royal Galas will start soon. “A lot of the fruit goes to Hong Kong, Philippines, Malaysia, Singapore, Sri Lanka, Maldives, Bangladesh, India and a small volume to Indonesia.” "South Africa was allowed to send its very first pears to China last year but we didn’t," Rutger says, although he trades in Belgian PiqaBoo pears in the Far East and he was the first to sell Conference pears to Hong Kong, when it was an unknown variety 15 years ago.

"South Africa was allowed to send its very first pears to China last year but we didn’t," Rutger says, although he trades in Belgian PiqaBoo pears in the Far East and he was the first to sell Conference pears to Hong Kong, when it was an unknown variety 15 years ago.

Right: the Flamingo pear harvest is about to start in South Africa

“What people need to understand is that a red blush pear Forelle will do well, especially in northern China where they have a strong appetite for pears in general. Other blush varieties like Rosemarie and Cheeky could also do well, but we’ll first have to see, it's new and China normally approaches new changes with reservation.”

He continues: “A lot of farmers hope to send Packhams to China but I have my doubts. It would need to be supported by an investment into market promotion, in the same way that the Belgian Conference pear, which is an unattractive pear, was heavily supported and promoted in China during the first seasons.”

Global Produce is exporting a big volume of small sized apples like Fuji and Cripps Red to Vietnam, mostly for retail sales. Rutger notes that Vietnamese wholesalers are dominated by premium big sized, red apples to compete against the USA and New Zealand’s apple segment dominance.

Promising red seedless market in Far East

The grape season is nearing its end with the Hex River vineyards being harvested.

“There are beautiful quality grapes from the Hex and it’s very unfortunate for farmers that they lost volumes because of the heavy rain. The quality I’m seeing is of a very high standard, much better than previous years.”

The first seafreight grapes from Namibia are arriving in excellent condition and Trawal area shipments are arriving now too. After a sharp increase in early season air freight, they started loading grapes for shipping when the Crimson crop started in Vanrhynsdorp and Trawal. In the Far East the market looks promising for red seedless from South Africa.

"The main reason why we have a window of opportunity is because Chinese New Year was early and the local Chinese Crimson was being held back for Chinese NY sales, therefore, as we are hitting the market first week February, the markets are empty."

Global Produce saw a big increase in airfreight to Cambodia, the Maldives, Malaysia and Vietnam. They didn’t do much from the Orange River this year, which was unfortunate, he says.

“Chinese New Year was quite early, and it was actually a fantastic timing for air freight. We did very well, two or three consignments per week, 400% more than usual. Some could be flown out from Cape Town, but closer to New Year we had to go through Johannesburg from where there are more flight options and availability.”

Photos supplied by Global Produce

Rutger continues: “Our main focus has always been mainland China. Normally 40% of what we procure from South Africa goes to China but we see that the window is getting smaller. In the past we’ve had a lot of competition from Peru. There’s less competition from Peru this year but still, they can land a lot of grapes, big sizes as well.”

“Crops are a little bit lighter and markets are stable in the UK and Europe, so I don’t expect too much fruit to enter China. Bigger volumes normally start from Piketberg and Hex, that’s when we don’t load too much fruit for China anymore, you’re coming together with Chilean Crimson at a lower price point. Then we’d rather send to retailers in South East Asia and Middle East for fixed price levels.” Global Produce also procures airfreight grapes from Australia for Vietnam and Cambodia around this time.

Global Produce also procures airfreight grapes from Australia for Vietnam and Cambodia around this time.

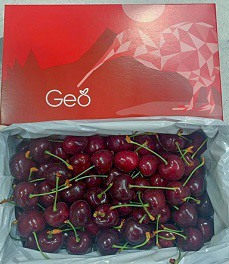

Right: Global Produce's portfolio includes New Zealand cherries

“The grapes get to the market quicker and in Asia they’re willing to pay extra for quality. Certain customers have a preference for Australia.”

Very good run on litchis

During Ramadan the consumption of fruit is very high, he remarks, and they are flying fresh Namibian dates to various countries in the Far East and Indian Ocean islands.

“Not only Medjool but also fresh dates are gaining popularity among farmers in Namibia and the North Cape. It’s a nice little add-on to what we do. We like to do things our customers ask for.”Oranges from Egypt, denoted by the camel, packed in the Geo brand

Mangoes and litchis are two other products they’ve not done before.

“We had a very good run on litchis to the Far East and to the Middle East. We sent a number of mango varieties like Tommy Atkins, Kent, Keitt and Shelly mangoes to the Middle East and the Indian Ocean islands like Maldives. Not a lot, a couple of pallets a week, all by air.”

They will increasingly focus on avocados, starting the season with Kenyan avocados. Kenya as well as Zimbabwe opened up their protocol with China and they are, he notes, closely monitoring this opportunity.

“We have a great balanced group of professional industry experts operating globally and in April our new CFO will start at our head office in Cape Town. We will keep fighting for the best programmes for our group of loyal farmers, especially in South Africa. Many are under great pressure due to rising input costs and if this industry will hold onto the old model of farmer-exporter-importer, many farmers – especially the smaller ones – won’t make it,” he says.

“We take our responsibility as an actor in the chain seriously. Vertical integration and market presence are key for the next five years to come.”

For more information: Rutger van Wulfen

Rutger van Wulfen

Global Produce

Tel: +27 82 300 5313

Email: [email protected]

https://globalproduce.co/