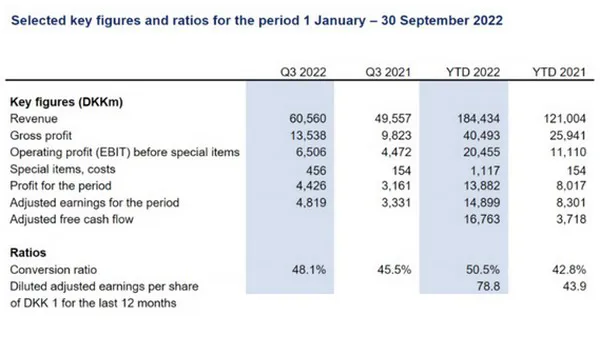

DSV reports strong results in Q3 2022, driven by good performance across divisions, with growth in earnings and market share gains across most business areas. In the first nine months of the year, gross profit grew by 50%, while EBIT before special items grew 75% and adjusted free cash flow more than quadrupled compared to the same period last year.

Today's highlights

DSV is releasing strong results in Q3 2022, driven by good performance across divisions, with growth in earnings and market share gains across most business areas. In the first nine months of the year, gross profit grew by 50%, while EBIT before special items grew 75% and adjusted free cash flow more than quadrupled compared to the same period last year.- Air & Sea achieved an 81% increase in EBIT before special items, Solutions achieved a 104% EBIT increase and Road achieved a 18% EBIT increase, for the first nine months of 2022.

- The integration of Agility GIL is now successfully completed. The Q3 results are the first interim financial results to overlap with the integration, which commenced on 16 August 2021.

- The global economic uncertainty has increased, but DSV's flexible business model enables the company to quickly adapt to changes.

- DSV has upgraded the full-year outlook range for 2022. EBIT before special items is expected to be in the range of DKK 24,500-25,500 million (previously DKK 23,000-25,000 million).

Jens Bjørn Andersen, Group CEO: "We are very pleased to report a strong set of results for Q3 2022 and for the first nine months of the year. All three divisions continued the good performance with growth in earnings and market share gains across most of our business areas. The global economic uncertainty has increased, but we have great trust in our flexible business model, which enables us to quickly adapt to changes."

Outlook for 2022

Based on DSV's strong performance in the first nine months of 2022 and our expectations for Q4, we upgrade the full-year outlook range for 2022 as follows:

EBIT before special items is expected to be in the range of DKK 24,500-25,500 million (previously DKK 23,000-25,000 million).

Share buyback

By separate company announcement on 25 October 2022, DSV will launch a new share buyback programme of up to DKK 3 billion. The share buyback programme will be concluded no later than on 14 November 2022.

An extraordinary general meeting of DSV A/S will be convened shortly to take place on 22 November 2022 with a view to proposing a reduction of the share capital (treasury shares) and a renewal of the authorisation to acquire treasury shares.

Read the Q3 company announcement here.

Click here for the full Interim Financial Report Q3 2022.

For more information:

Christian Krogslund

DSV

Tel. +45 43 20 41 28

christian.krogslund@dsv.com