Dr Mmatlou Kalaba’s International Fresh Produce Association Cape Town conference presentation on the as yet little-understood Africa-wide free trade system drew much interest, coming as it did in the same week that Botswana’s closure of its borders to South African vegetables (a practice also followed by fellow Southern African Customs Union member Namibia to protect its domestic industry) made national headlines.

Dr Mmatlou Kalaba explaining the impact of the African Continental Free Trade Agreement on fresh produce at the recent IFPA conference (photo: Brent Abrahams)

Dr Mmatlou Kalaba explaining the impact of the African Continental Free Trade Agreement on fresh produce at the recent IFPA conference (photo: Brent Abrahams)

The mostly South African delegates know the intra-African trading environment well, as one conference-goer and apple exporter shared during Dr Kalaba’s presentation. Apples will be amongst the top fresh produce from SA to benefit early or upon entry into force, Dr Kalaba says, because South Africa already has a presence in most markets on the continent, including those maintaining high tariffs.

In Kenya (which has very high tariffs on South African apples), noted the apple exporter, Pink Lady apples sell for US$41 a carton, higher than probably anywhere in the world – but they just cannot trade more into that market because of currency shortages.

“Our exports into Africa could have doubled but instead we’re decreasing our exposure in Africa due to currency: we cannot get access to enough Euros and US Dollars from central banks,” the exporter maintained. Dr Kalaba agrees on the difficulties of the different monetary systems on the continent, a matter on the mind of the AfCFTA Secretariat too, he notes.

Almost 90% of AfCFTA tariff lines completed

The African Continental Free Trade Agreement is far progressed, Dr Kalaba, director at the Bureau for Agricultural Policy, told conference-goers, with 87.7% of the tariff lines and rules of origin negotiated, and the usual outstanding sticklers of vehicles, clothing and sugar to be finalized by next month. The details of the agreement are still confidential, but economists have an idea what it looks like.

For trade items in the general category (which includes fresh produce), non-Least Developed Countries have 5 years to eliminate tariffs on 90% of products, whereas Least Developed Countries have a decade. (Trade in what is considered sensitive products will be liberalized more slowly).

“The aim at unifying the continent goes back many decades,” Dr Kalaba says, and since the signing of the agreement in 2018, 44 African countries have indicated they have permission from their respective parliaments to proceed with the agreement to integrate the African market through giving better access to African products in African markets.

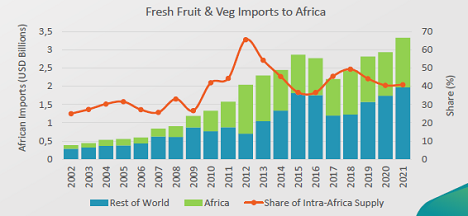

Globally, Africa has fastest growth in fresh imports

He points out that African goods often have more market access elsewhere than in Africa and Africa has been a net fresh produce exporter over the past five years. Simultaneously, African imports of fresh produce have grown fastest in world.

“Demand for fresh produce is high on the continent,” he said. “This is an opportunity for African suppliers to meet the demand of neighbouring countries who are importing more than they are exporting. We need to use this market where we’re seeing growth relative to the world.”

Over the past decade fresh imports into Africa rose by 16%, higher than the global average of 10% (graph courtesy of Dr Kalaba/BFAP)

Over the past decade fresh imports into Africa rose by 16%, higher than the global average of 10% (graph courtesy of Dr Kalaba/BFAP)

Africa’s current tariff rates higher than global average

There are some very high tariffs in place in Africa, compared to the global environment, he notes: South African apples, for instance, are subject to tariffs of between 20% and 30% across the continent which will have to fall away under the new AfCFTA-led trading environment.

South African apple exporters have pointed out that while zero tariffs will be welcomed, and will probably draw more South African exporters to Africa where a premium is paid for apples, the fundamental problem of a shortage of forex among central banks will remain a major impediment.

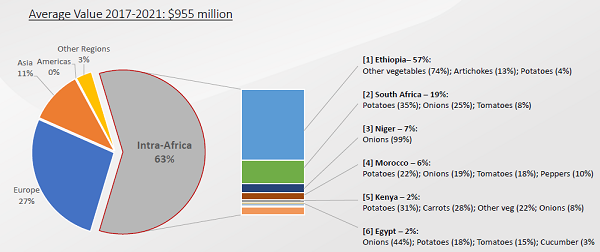

Within Africa, top veg-trading countries led by Ethiopia

Intra-African fresh produce trade is dominated by vegetables, unlike the global trade pattern where fruit is most traded, with flowers in far third place.

Almost two-thirds of the African vegetable trade is intra-African (graph courtesy of Dr Kalaba/BFAP)

Almost two-thirds of the African vegetable trade is intra-African (graph courtesy of Dr Kalaba/BFAP)

Fresh produce accounts for roughly a third of all intra-African trade (mining and vehicles constituting the other large trade items), and countries from certain regions clearly dominate in the continental fresh produce trade while others regions are noticeably absent.

“The facilitation of fresh produce trade will need to be encouraged by those who are already in the market. Senegal and West Africa and Central Africa have relatively low participation rates and this is a concern. It could be indicative of one of two things: most LDCs are concentrated in Central Africa and data is not very accessible but there’s also a lot of cross-border trade which is difficult to account for.”

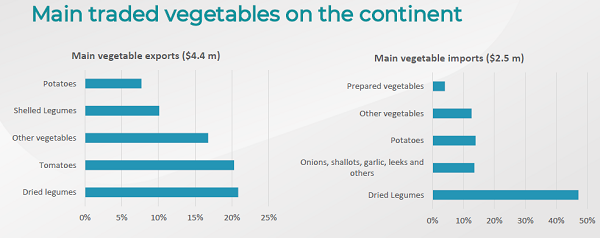

Over a fifth of intra-African vegetable exports are, in fact, dried legumes, followed by tomatoes, potatoes, shelled legumes and other vegetables.

Ethiopia accounts for 57% of intra-African vegetable trade with mostly “other vegetables” and, interestingly, artichokes making up a further 13% of the vegetables with which the country trades within Africa.

In second place is South Africa whose market share is 19%, consisting mostly of potatoes and onions, with Niger in third place with almost only onions.

Graph courtesy of Dr Kalaba/BFAP

Graph courtesy of Dr Kalaba/BFAP

Surprisingly, Morocco, Egypt, Tanzania and Kenya (countries that, together with Ethiopia, account for about 80% of African vegetable exports) each accounts for only 2% of the intra-African vegetable trade; naturally primarily onions in the case of Egypt and potatoes and carrots in Kenya’s.

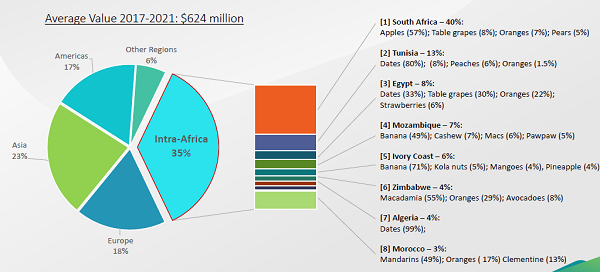

Top fruit-trading countries led by South Africa

Apples constitute 57% of South Africa’s African fresh produce trade, as well as 40% of overall intra-African fruit trade. Far lower volumes of South African table grapes and citrus are traded on the continent.

In second place (13% of total fruit trade) is Tunisia, 80% of whose trade within Africa is in dates. In third place is Egypt also with dates (33%), a strong component table grapes (30%) and strawberries at 6%.

Fourth is Mozambique, trading much bananas (49% of their fruit exports) and cashews (in which the country used to be the world leader) at 7% of their exports. (Mozambique’s early avocados could be sold in an empty South African market, but earns more if exported to Europe.)

Africa's fruit supply (graph courtesy of Dr Kalaba/BFAP)

Africa's fruit supply (graph courtesy of Dr Kalaba/BFAP)

Bananas make up an even larger proportion of the Ivory Coast’s fruit trade – 71% - putting the West African country ahead of Zimbabwe (mostly macadamias, some citrus and avocados).

Algerian exports consist of almost totally dates and in 8th place is Morocco whose African trade is exclusively in citrus (mandarins, oranges).

Fresh produce imports from outside Africa

The USA and Canada together supply 11% of Africa’s fresh produce, the Netherlands a further 7%, Spain and Turkey each 4%; China, Ecuador and Australia at 3%, with an array of other countries bringing up the rear.

Interestingly, Somalia accounts for easily the most fresh produce imports, followed by Morocco, South Africa, Djibouti and Kenya. The only West African country on the list is Nigeria, in eighth place, despite its large population and economic growth.

Vegetable imports from outside of Africa is again dominated by dried legumes, followed by processed vegetables, potatoes and onions. Africa is a net exporter of vegetables to mainly the European Union.

Benchmarked against EU’s economic partnership agreements

General produce falls into the general category of trade items which will be liberalized, and here Dr Kalaba maintains that the economic partnership agreements that the European Union has with almost every African country will need to be the benchmark for liberalized fresh produce trade within Africa.

“It has to look like the EPA, except that in fresh produce we can see some trade items excluded from EPA market access for protection of the EU market, but this would have to change to serve the principal objective of increasing market access to African countries. The EPA has set a benchmark for what the trade should look like otherwise there are parts of the continent where the EU has better and larger market access than other African countries themselves."

Dr Kalaba observes that the completion and implementation of AfCFTA is not the only solution to the continent’s challenges, or even on trade-related aspects. "Governments in respective countries still must facilitate and enable these opportunities to reach farmers, companies and consumers. Chief amongst the key steps are investment in infrastructure, adjustment of domestic policies to align with the agreements, addressing non-tariff measures and other hidden restrictions, as well as empowering citizens with skills and information about AfCFTA opportunities."

For more information:

Dr Mmatlou Kalaba

Bureau for Food and Agricultural Policy

Tel: +27 083 276 1384

Email: mmatlou@bfap.co.za

https://www.bfap.co.za/