Developing a deeper understanding of fresh avocado shoppers purchase trends and behavior helps marketers and retailers create strategies that grow sales of fresh Hass avocados.

A recent avocado channel segmentation study by the Hass Avocado Board (HAB) provides a greater understanding of avocado shopper segmentation by outlining key purchase metrics of buyer groups within each retail outlet where avocados are purchased. As a companion piece to a study released earlier this year, Rethinking Retail: Avocado Shopper Segmentation, this study helps the industry further understand key shopper segments.

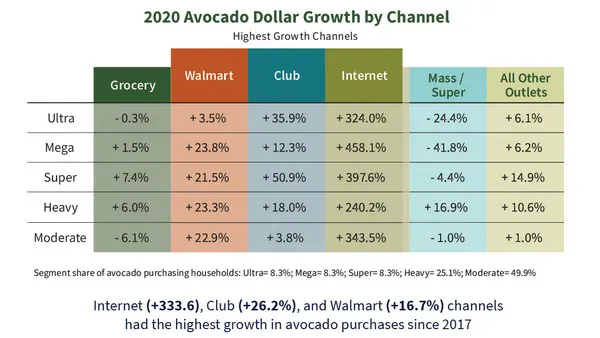

- Grocery claimed the majority of avocado purchases across segments in 2020. However, grocery lost dollar share to the Internet and large format channels since 2017. The Internet, Walmart and club channels contributed a combined +$123.2 million in incremental avocado purchases, accounting for the majority of total net category growth from 2017-2020.

- The Internet channel has emerged as the fastest growing channel for avocado shoppers over the past four years. The channel has shown growth for avocado purchases of nearly +334 percent since 2017. This growth added +$30.5M in purchases to the category over the three-year period. Since 2017, the Internet channel has more than doubled its share of avocado purchases.

- Club stores have the second highest share of avocado purchases at 14 percent, and posted the second highest growth rate at +26 percent since 2017. Club store purchases accounted for an additional +$55.6M for the category, making club the largest contributor of incremental purchases over the three-year period.

One finding in the companion study stated that the Ultra Shopper segment represents eight percent of shoppers, yet accounted for 35 percent of avocado purchase dollars in 2020. The channel study determined that Ultra shoppers are more likely to purchase avocados across multiple retail outlets. The Ultra segment made up a smaller portion of avocado shoppers across all retail channels in 2020, yet these shoppers hold the largest share of avocado purchases in every channel. They are also more likely to make repeat purchases, make more purchase trips per year and have the highest avocado spend per trip of any other segment across all channels.

As marketers and retailers work to understand the changing retail marketplace better, the findings in the channel segmentation study highlight opportunities to engage with shopper segments in various retail channels. The industry can leverage key shoppers in the internet channel, capitalize on opportunities to generate engagement in high-growth channels with Ultra shoppers and create marketing/ promotional opportunities that bring in shoppers and increase purchase frequency. Download a copy of the full study and action guide for more information about these shopper channels and segments, including key insights, shopper trends and profiles.

The study is based on household purchase data from the IRI Consumer Network™. To learn more about the various channels and shopper segmentation, click here.

For more information:

For more information:

Lecia Rdzak

Hass Avocado Board

Tel: +1 (818) 718.8084

lrdzak@gowithfusion.com

https://hassavocadoboard.com/