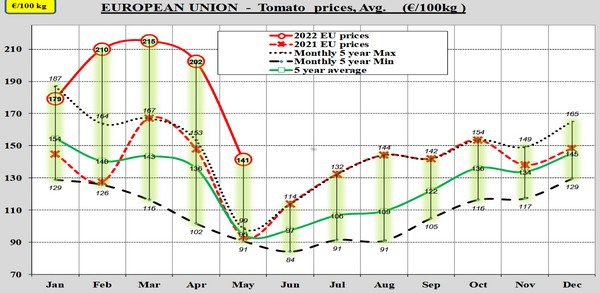

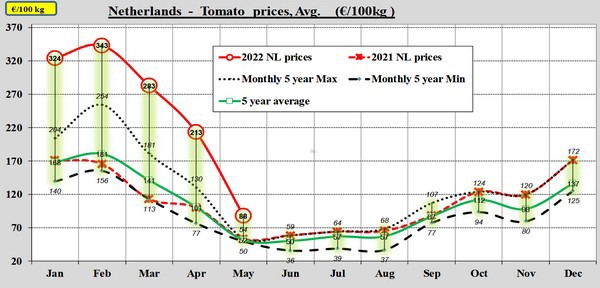

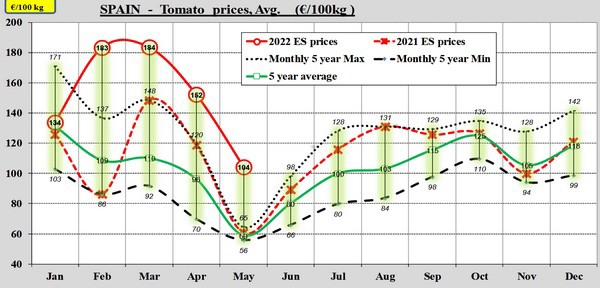

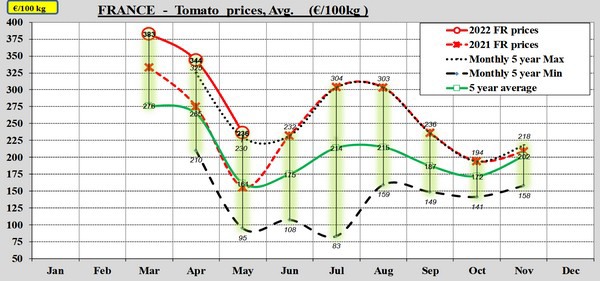

As expected, tomato prices continued to drop in May. Nevertheless, the prices are still above average. In the Netherlands, the prices decreased more than average. In Spain, however, prices fell slightly less. A new update of the European Commission's tomato dashboard shows that in both countries, a kilogram of tomatoes yielded less than the European average.

In a previous update of the dashboard, the question was still what would happen to tomato prices once the production of delayed crops would start to accumulate. Judging by the dashboard, there is still a nearly fifty percent higher kilo price.

This has not yet happened in mid-June. Looking at the prices at the Belgian auctions is always an important reference. After a heavy fall in the price on the clock at the Belgian auctions in week 17, the price recovered. Since then, the price is still well above the five-price average of around 50 Eurocents per kilo.

Figures VBT, from the page with agricultural figures of the Flemish Department of Agriculture and Fisheries.

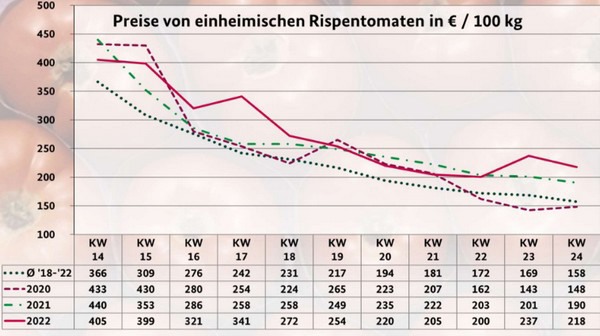

Also, on the German wholesale markets, the price is well above the five-year average, according to a BLE report. Around weeks 17 and 18, a decline can be seen here, but it is followed by a price recovery. In the case of German tomatoes, the prices, after coming slightly closer to the five-year average in May, actually rose again in June.

Average price per kilo for truss tomatoes in Germany. BLE market report graph.

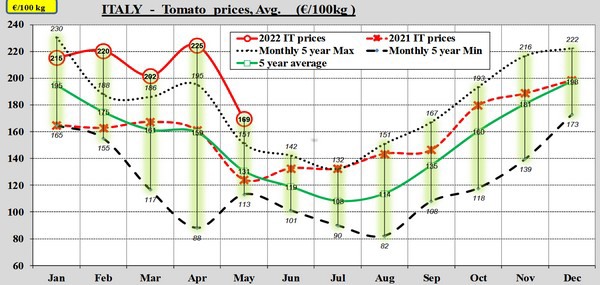

Vine tomatoes from the Netherlands and Belgium barely differ in price from each other in the wholesale markets. German product is considerably better paid but had a market share of only 5.1% in week 24, compared to 41.6% in Belgium and 52.6% in the Netherlands. For cherry tomatoes, prices in week 24 were also higher than the five-year average. With 53.6%, the Netherlands had by far the largest market share in week 24, followed by Belgium with 20.5% and Italy in third place with 14.3%.

Market shares vine tomatoes German wholesale market week 24. Diagram BLE market report.

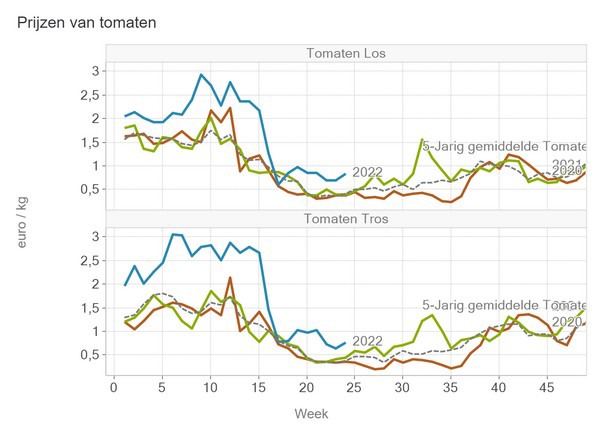

Tomato prices, although still at high levels, did drop in May. Detailed European figures from a market report dated 16 June show that this is the case for cherry tomatoes in all the countries mentioned. With a price decrease of 57% compared to April, the decrease in the Netherlands is the strongest. The decrease is more than twice as high as the 25% for the European Union as a whole. A kilogram of Dutch cherry tomatoes fetched an average of 1.26 euros.

The price of vine tomatoes fell by an average of 39% throughout the European Union. The Netherlands recorded 59%. The average price per kilo of 1.85 euro was reduced by more than 1 euro, bringing the average price per kilo to 76 euro cents. With 71 euro cents, the price is only lower in Spain. In percentage terms, prices fell by 53%, while in Belgium, they fell by 54%. Here a kilo yields 94 Eurocent.

The average price decrease of loose round tomatoes in Holland is even more significant with 61%. Here too, the Netherlands stood out, compared with the average fall of 30% in the European Union, but also compared with, for example, Belgium (-49%).

Summer remains a waiting game

The fact that the tomato market quickly found a new equilibrium after a price dip in early May does not alter the fact that it could still be a difficult summer. An accumulation of tomato production, as also described in a recent WUR report, is still possible. Especially since tomatoes from countries with less high-tech greenhouses also come onto the market during the summer. Moreover, the weather also plays a role in consumption. And then there is inflation, which hits consumers in their pockets. That, too, can have an impact.