Despite the hurdles and challenges created by the COVID-19 pandemic, Australian exporters are still getting recognition, and continued value growth, for the fruit and vegetables that they supply to the world, according to a leading food market research company.

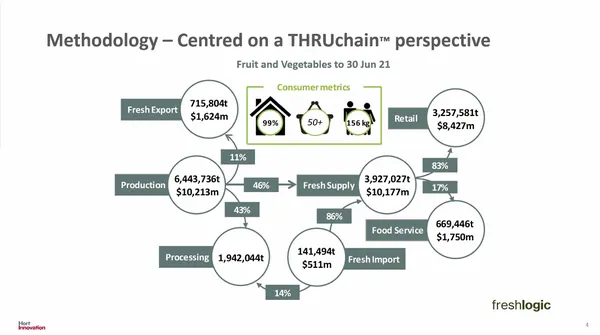

Speaking at the Australian Horticulture Statistics Handbook 2020/21 Launch Event, Freshlogic Managing Director Martin Kneebone says Australia is a serious exporter and has built up a reputation for having a better-quality product, which is reflected by the figures.

"Even where we have serious volume in the fruit category, where there is more volatile pricing, we still get acknowledged for having a better product," he said. "That's the long-term position that we need. But the success of exports has typically been preceded by a need to invest in production, and then manage that production. Maybe elements of domestic market pressure before export volumes came through. We have seen that with two or three categories, and that is testimony to really sound export development work. I think that has been managed well in citrus, grapes and stone fruit (industries) and they have created a wonderful halo for other categories that are looking to go in those markets. But overall, a flush of production typically precedes the export market growth, but we have managed it well."

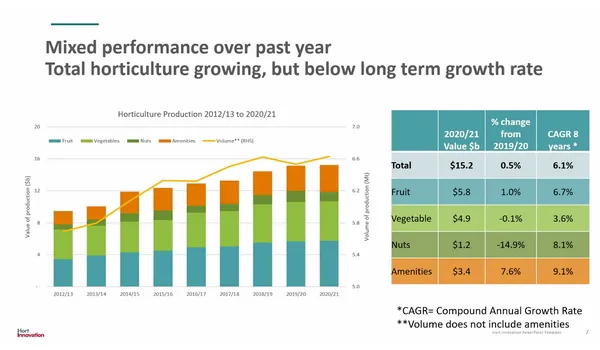

Last week, Hort Innovation released the statistics handbook for the previous financial year, which it compiled with the help of Freshlogic. The horticulture sector overall increased from $15.1 billion in production value in 2019/20 to $15.2 billion despite the challenging growing and market conditions. Production volume was also slightly up by one per cent due to 6.63 million tonnes. Hort Innovation's Head of Data & Insights Adam Briggs explained that while there was an understandable drop off in export value and volume for the 2020-21 financial year, it is expected to rebound quickly and it has not impacted the long-term trend.

"The trend is clear, and the trend is of growth," Mr Briggs said. "The total growth rate is over 11 per cent annually, which if you ask anyone in agriculture, to be trending double-digit growth in terms of compound rate is phenomenal, and reflects the trajectory that is being enjoyed by the sector. Value was a little softer over the past twelve months, and it goes without saying the significant headwinds that the sector has been up against, with challenges such as accessing freight, market pricing and even political pressures as well. It all has an impact on one's ability to get product to market. In saying that, those fundamentals still remain strong for Australian horticulture in our export markets. We have a product that a lot of people want, and it's encouraging to see that realised in our long-term growth figures."

As an example, he highlighted the growth of blueberries over the past nine years, have gone from $1million to $8.4million and while it is still small in terms of volumes, it is illustrative of the trend across most fruit and vegetable commodities.

"Some of the players do drive a lot of the value of export, for example, table grapes account for 38 per cent of fruit exports, and citrus accounts for 36 per cent," Mr Briggs said. "So, those two categories make up over 70 per cent of all fruit export value. Similarly, the vegetable category where carrots make up nearly 40 per cent of the value. There is a degree of concentration from the more mature export-focused industries, but growth is being experienced by those smaller industries, who are involved in their own ways."

In terms of overall production, Mr Briggs also noted there's a concentration in value, with six produce lines making up around 75 per cent of the total value in the fruit category; citrus, grapes, apples, berries, avocados and bananas. He says that over the reporting period, there have also been some constraints in many of the fruit categories in terms of volume growth, but that has not had a significant impact on value.

"The value, for the most part, has continued to rise," he said. "This indicates that the market is willing to receive more of that product, and take a higher price for it. Some interesting drivers for the overall changes in value can be witnessed through considering, for example, movement in table grapes, which experienced a decline in the amount of production volume, with close to $200million in reduced production, and value dropping lower than volume change. For table grapes, the drop in value was driven by weaker export market performance, and given that table grapes export well over the majority of their crops into those markets, that certainly had an impact on their ability to maintain value. It's just another story of how in the fruit sector, it doesn't take much for a few of the heavyweights in the category to sway the overall result. Having said that, growth of $58million for fruit is a fantastic result, all things considered."

The Horticulture Statistics Handbook also found that there were more vegetables produced in the 2020/21 financial year than ever before. Mr Briggs says the main driver was potatoes, which not only had a strong year in terms of volume (5 per cent increase), but value growth was around 12 per cent.

"Other standouts from a value change perspective included carrots, which continued to get stronger, and that links back to their exports," he said. "Leafy salads and mushrooms achieved some recovery in terms of their market. But there have been some challenges with values dropping for some lines, with weaker performances in broccoli, beans, onions and lettuce. But it is important to note that we are coming off the back of a record year, in the previous year. Some of these categories are taking a bit of a breath, with some of the obvious challenges also contributing as well. But there is more diversity in vegetables than with fruit."

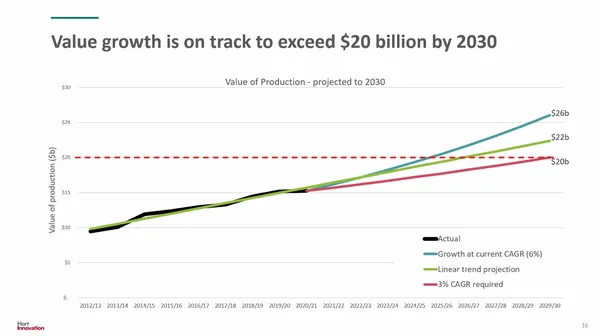

The horticulture sector is also on track in its goal to reach $20billion in value by 2030, with current growth rates projecting that it could get there as early as 2025-26. The National Farmers Federation is driving a whole agriculture sector goal of $100billion by 2030, and horticulture has been one of the fastest-growing sectors.

For more information

For more information

Adam Briggs

Hort Innovation

Phone: +61 2 8295 2300

info@horticulture.com.au

www.horticulture.com.au