Weekly consumer demand for fresh fruits and vegetables continues to be robust compared with the 2019 pre-pandemic baseline. According to the May IRI primary shopper survey series, shoppers point to a low rate of infection (45 percent) and broad vaccination (39 percent) as the top two indicators of what makes them feel comfortable to return to their normal habits without COVID-related precautions.

Trips and basket size

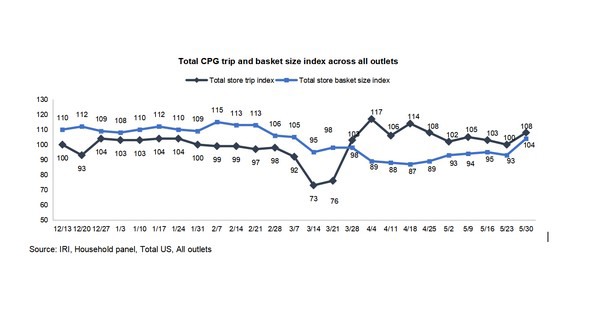

In May 2020, consumers took significantly fewer trips while spending 10-15 percent more each visit. A year later, that pattern translates into an increase in total food store visits as shopping patterns are normalizing, while the average spend per trip is below 2020 levels.

“The return to on-premise dining is likely to affect the high levels of home-centric spending seen in the past 15 months,” said Joe Watson, VP of membership and engagement for the Produce Marketing Association (PMA). “Stronger restaurant sales on top of the continued elevated retail sales are causing some tightness and increased prices in the fresh produce supply chain.” Fresh share

Fresh share

Fresh fruit and vegetable sales were very strong in May 2021, as consumers were in store more often and celebrated Memorial Day with bigger gatherings. Fresh produce sales reached 84.5 percent of total sales, with frozen fruit and vegetable sales in particular losing significant share versus prior periods.

Fresh produce dollars versus volume

Early in the pandemic, fresh produce experienced deflation with volume outpacing dollar growth, though both experienced record highs. Deflation switched to inflation starting in the third quarter of 2020 and dollar gains have tracked above volume gains ever since.

Fresh fruit

“In fruit, the impact of Memorial Day sales and back yard barbecues are evident,” said Watson. “While berries remain number one, melon sales increased both versus 2019 and 2020. Additionally, cherries moved right into the top 10 biggest sellers in fruit.”

Only five out of the top 10 selling fruits lost ground versus the tremendous sales spikes of 2020, being bananas, grapes, avocados, cherries and oranges. Berries are a notable exception: in addition to being the biggest seller still managed robust sales increases both in the comparison to the 2019 pre-pandemic normal (+28.6 percent) and the year-on-year view (+9.3 percent). Fresh vegetables

Fresh vegetables

“Vegetable sales have to compete against the enormous spikes of 2020,” said Watson. “Yet, we see a few areas, including packaged salads and cucumbers, still track ahead of those 2020 peaks.” Watson refers to the 13.8 percent increase in packaged salads year-over-year, in addition to the 28.2 percent increase versus the 2019 pre-pandemic levels. In comparison with 2019, all vegetables still saw robust demand in May 2021.

The next report, covering June, will be released in mid-July. Please contact Joe Watson at jwatson@pma.com with questions or concerns.

For the full report, click here.

For more information:

For more information:

Anne-Marie Roerink

210 Analytics LLC

Tel: +1 (210) 651-2719

aroerink@210analytics.com

www.210analytics.com