Greenyard released the financial results for the full year, along with their increased ambition for a healthy lifestyle among consumers. Hein Deprez, co-CEO of Greenyard, said: “Health is on everyone’s agenda, even more so today. For Greenyard, this is logical: fruit and vegetables play a vital role in moving towards healthier lifestyles. Therefore, we consider it our responsibility to ensure that these products remain available for our consumers, regardless of the challenges and complexities the pandemic created. Together with our partners, we did so successfully, and we now look beyond that point. The intimate and integrated relationship we build with our customers, ensuring a short supply chain, and the products we develop together with them, contribute to our goal to improve life, as they cater for more diversity, choice, convenience and quality in the fruit and vegetable assortment.”

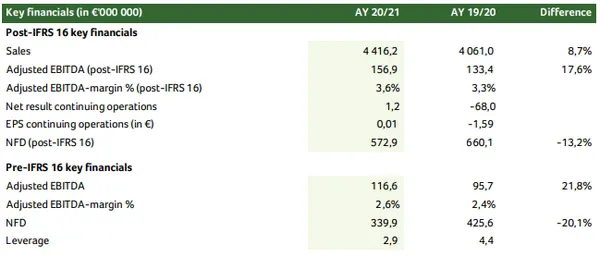

Solid topline growth, sustained profitability and deleverage below 3,0x net financial debt/LTM adjusted EBITDA

Sales. Overall net sales amounted to € 4 416,2m, indicating an increase of 8,7% YoY.

- Fresh sales amounted to € 3 592,7m, showing double-digit growth (+10,1%) versus € 3 263,4m last year (€ 329,3m), whereby sales with integrated customers increased by 22,3% including the ramp-up of some of the latter relationships. In most geographies, parallel to an increasing awareness of consumers for healthy lifestyles, retailer volume was stimulated by COVID-19 induced measures of different local authorities.

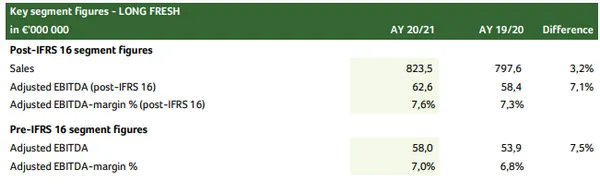

- Long Fresh sales increased to € 823,5m, up € 25,9m from € 797,6m (+3,2%), driven by an important volume increase in retail, new sales contracts and better product mix, partially offset by a temporary loss of volumes in food service (from 20% share of Long Fresh sales in AY 19/20 to 13% in AY 20/21), induced by the quarantine measures related to COVID-19, resulting in a shift from out-of-home consumption to at-home consumption.

Sales increased by 8,7% to € 4 416,2m in AY 20/21. The growth in sales is coming from both the Fresh and Long Fresh segments. The increasing volumes linked to the intensification and ramp-up of the integrated customer models are the main driver of this growth. At the same time, thanks to increased consumer awareness to maintain a healthier lifestyle, and a shift to at-home cooking, due to lockdowns consequent to COVID-19, the retail volumes increased. This was however at the expense of the food service sector which significantly slowed down.

Organic growth amounted to 9,9%, slightly counterbalanced by foreign exchange headwinds (-0,8%) and the effect of the recent divestitures and divestments (-0,4%).

Also adjusted EBITDA (post-IFRS 16) shows a strong increase by 17,6% to € 156,9m, (for reference, pre-IFRS 16 increased by 21,8% to € 116,6m) directly linked to the growing volumes under the integrated customer models, positive price and mix variances as well as the full year impact of transformation initiatives initiated last year and new continuous improvement actions being implemented mainly in the domains of sourcing, transport and procurement. Greenyard did not record any EBITDA adjustments in relation to COVID-19, as margins from extra volumes were more or less compensated by extra costs incurred to secure sourcing and operations.

Net result from continued operations shows the return to profit of € 1,2m versus a loss of € -68,0m last year. This improvement is mainly driven by the operational and commercial transformation, moreover, last year was highly impacted by impairments/losses on sale of subsidiaries and non-recurring transformation costs.

Without leasing debt, net financial debt decreased further by € 85,7m to € 339,9m at 31 March 2021. This translates into a leverage of 2,9x, down from 4,4x last year. The decrease is driven by an increase in operating profit and an active Group-wide working capital management, whilst continuing to invest into the operations and long-term commercial relationships. As to indebtedness and leverage, Greenyard succeeded in securing a stable financing for the coming years by refinancing its bank debt in March 2021, including a capital increase of € 50,0m and a reserved tranche of € 125,0m for the repayment of its outstanding convertible bond, maturing in December 2021.

Post-IFRS 16, at 31 March 2021, net financial debt amounted to € 572,9m of which € 232,9m lease liabilities.

Fresh sales increased by +10,1% YoY, whereby sales within the integrated customer model increased by 22,3%, including the ramp-up of some of these more recent long-term relationships. Retail sales growth was in most geographies stimulated by COVID-19 induced measures of different local authorities, resulting in a shift to at-home cooking, in parallel to increased consumer awareness to maintain healthy lifestyles.

The segment showed an organic growth of +11,2%, with slight foreign exchange headwinds of -0,6%, and M&A and divestitures impact of -0,5%.

In its Long Fresh segment, Greenyard was able to generate an important volume increase in retail, while at the same time suffering from the temporary loss of volumes in food service (from 20% share of sales in AY 19/20 to 13% in AY 20/21). As of the last weeks of the previous financial year, the COVID-19 induced quarantine measures resulted in a shift from out-of-home consumption to at-home consumption.

At the same time, new sales contracts and an increasing share of sales in higher priced products a.o. convenience and fruit, resulted into a total 3,2% growth, proving a continued strengthening of the business. The segment showed an organic growth of +4,9%, slightly countered by -1,4% foreign exchange and -0,3% M&A and divestitures impact.

For the full financial results, please click here.