The Chinese grape season has begun. This year the domestic grape volume expanded by 30%-50%. Rainfall was limited in many production areas, which means the sweetness, flavor, and appearance of the grapes are all better on average than last year. Mr. Liao, CEO of Guangdong HolyFresh Fruit Co., Ltd., recently talked about current conditions and predictions in the Chinese grape market.

Guangdong HolyFresh Fruit primarily exports to Southeast Asia, the Middle East, and South Asia. Their main export varieties include Red Globe, Sunshine Rose, Summer Black, Crimson, seedless white, and Freisa. M

Mr. Liao first explained the initial conditions when the new grape harvest entered the market: "The pandemic has had a huge impact on Chinese grape export. Chinese grape exports to India have come to a standstill, while in other Asian countries the economic impact of the pandemic has weakened consumer buying power. That is why importers gradually reduce their import volumes. The export volume is estimated to decline by 20%-40% this year."

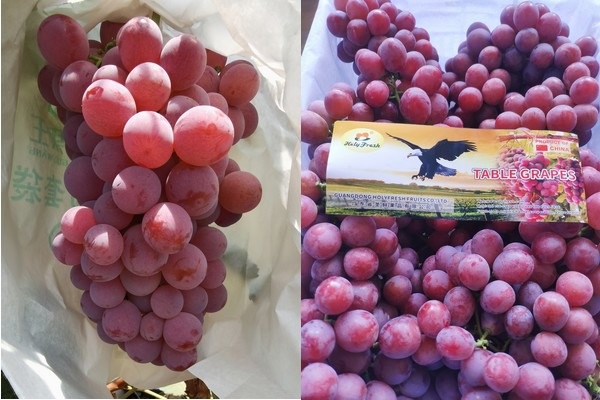

Red Globe grapes

Under the regular circumstances, the export volume of HolyFresh Fruit grows by 20% every year, but during the pandemic the export volume has remained largely the same around 900 shipping containers. "Consumer power is not strong enough to stimulate market growth. This is where the strength of our brand serves us well. We are able to maintain our export volume primarily because our brand has been around for a long time. Clients in many markets are familiar with our brand and are brand loyal. Importers first reduce their import volume from smaller, less well-known suppliers, and some of that trade is handed to us instead. The brand cancels out the impact of competition in a shrinking market."

Sunshine Rose grapes

The price of grapes is expected to decline by 20% in comparison with last year because the production volume expanded and the general market conditions are poor. "Take the Sunshine Rose grape as an example, the current purchase price is 40-80 yuan [6.27-12.55 USD] per kg. Planters and buyers are in an uncertain situation where people have to gamble. Although planters know that the market conditions are not great, they are unwilling for now to drop the price. Yet, they know that the price will fall this season and probably more quickly than last year," said Mr. Liao.

"Looking at the overall conditions, neither domestic nor overseas markets are doing well. Planters, importers, exporters, and retailers are all pessimistic about the market prospects this year. Their profit margins are shrinking. The main reason for this development is the pandemic and its impact on economies around the globe. Although China is one of the markets that recovered from the pandemic relatively quickly, the first half of the year was still marked by the damage done during the pandemic. Only in the second half of this year will we likely see some results from economic recovery."

Summer Black grapes

Mr. Liao has years of experience in the grape industry and developed a clear understanding of trends in the grape market. "Red Globe (grapes with seeds) are the most common grape variety in the Southeast Asian market and in the Middle East, but I think seedless grapes will be the future of the grape market. Market demand for Sunshine Rose, Summer Black, and white seedless grapes is growing every year. The market benefits top-quality grape varieties that survive storage and transport well, and taste great. Sunshine Rose grapes have gained much popularity in the seedless grape market, and this trend still continues.

"Look at our company, last year the export volume of Sunshine Rose grapes increased by 50% compared to the year before last. The price-quality ratio is great and the flavor is excellent, but in addition, the name is widely recognized and that is why the demand for this grape variety grows stronger every year. However, the Sunshine Rose grape is a top-quality grape variety and the retail pricec is rather high.

"Most consumers are middle- and upper class residents of first- and second-tier cities. There is only a limited market, at the moment, but there is a clear trend in third-, fourth-, and fifth-tier cities where economic development is followed by a growing demand for top-quality fruit such as the Sunshine Rose grape. That shows the great potential of this grape variety," said Mr. Liao. "But this is only my view on the market. There is a risk in exploring new markets, and people in the industry have to be careful when they do so."

Guangxi Fresh Agricultural Science and Technology Co., Ltd.

Guangdong HolyFresh Fruit exports around 900 shipping containers per year to markets in Southeast Asia and the Middle East. Export accounts for more than 95% of their retail volume. The company has long-term cooperation agreements with vineyards throughout China. Their main brands include SpriFresh and HolyFresh. These brands are already well established in overseas markets.

"There are not that many Chinese companies who export grapes to Europe and North America, because these markets have strict standards for the amount of chemical residue left on the grapes. However, we are working very hard and we hope to open up new markets in the near future," said Mr. Liao.

For more information:

Mr. Liao Qiang - CEO

Guangdong HolyFresh Fruit Co., Ltd.

Tel.: +86 13631608309

WeChat: David984745

E-mail: David@aliyun.com

Website: www.sprifresh.com