Shoppers are increasingly choosing to grocery shop inside the store as COVID-19 concerns abate. “While online grocery shopping remains elevated from the pre-pandemic levels, we saw an increase in in-store shopping along with more time spent shopping in April,” said Jonna Parker, team lead, Fresh for IRI.

Trips and basket size

As shelter-in-place mandates ensued in April 2020, in-store visits fell far below normal while people bought significantly more when making a trip. One year later, trips sit well above year ago while the average basket size dropped well below that of April 2020.

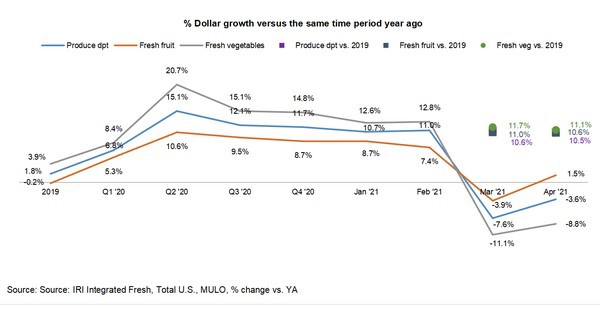

April produce department sales for the four weeks ending 4/25/2021 decreased 3.6 percent year on year. However, in comparison to the 2019 pre-pandemic normal, fresh produce sales at retail were up 10.3 percent.

Fresh share

In 2019, fresh produce sales represented 80.8 percent of total fruits and vegetables sales across the store. That share fell as low as 76.9 percent during the first quarter of 2020, pulled down by the March panic buying weeks when many dollars were diverted to frozen and canned. While frozen fruit and vegetables remain elevated, the fresh share reached its highest point since the third quarter of 2020, at 81.2 percent of dollars.

Early on in the pandemic, fresh produce experienced deflation with volume outpacing dollar growth, though both experienced record highs. In going up against those patterns in April 2021, both dollars and volume sales were down year-on-year, however, dollars decreased only 3.6 percent versus 10.8 percent for volume. Further widening that gap is the inflation in April 2021 versus deflation in April 2020.

Fresh fruit and vegetables

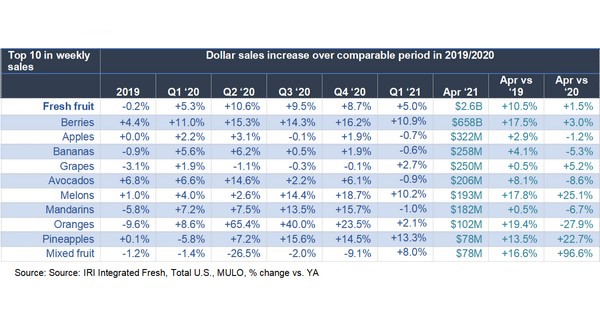

“In fruit, we are seeing some interesting changes as people are moving around more,” said Parker. Only five out of the top 10 selling fruits lost ground versus the tremendous sales spikes of 2020, being apples, bananas, avocados, mandarins and oranges. Berries are a notable exception: in addition to being the biggest seller, they still managed robust sales increases both compared to the 2019 pre-pandemic normal (+10.5 percent) and the year-on-year view (+1.5 percent). While oranges were not able to hold on to the very strong April 2020 results, they are certainly still doing very well against normal levels, up 19.4 percent.

Only five out of the top 10 selling fruits lost ground versus the tremendous sales spikes of 2020, being apples, bananas, avocados, mandarins and oranges. Berries are a notable exception: in addition to being the biggest seller, they still managed robust sales increases both compared to the 2019 pre-pandemic normal (+10.5 percent) and the year-on-year view (+1.5 percent). While oranges were not able to hold on to the very strong April 2020 results, they are certainly still doing very well against normal levels, up 19.4 percent.

“Vegetables’ enormous strength in 2020 means a much tougher road now,” said Joe Watson, VP of membership and engagement for the Produce Marketing Association (PMA). “Yet, we see packaged salads’ dollar sales still ahead of those 2020 peaks, at +20.7 percent along with cucumbers that also managed a gain, at +2.1 percent.”

For the full report, click here.

The next report covering May, will be released in mid-June. Contact Joe Watson, PMA’s vice-president of membership and engagement at jwatson@pma.com with questions or concerns.

For more information:

For more information:

Anne-Marie Roerink

210 Analytics LLC

Tel: +1 (210) 651-2719

aroerink@210analytics.com

www.210analytics.com