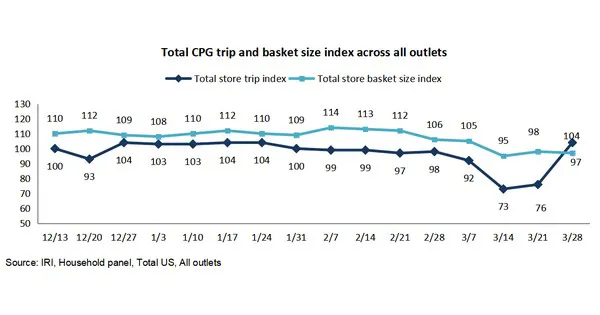

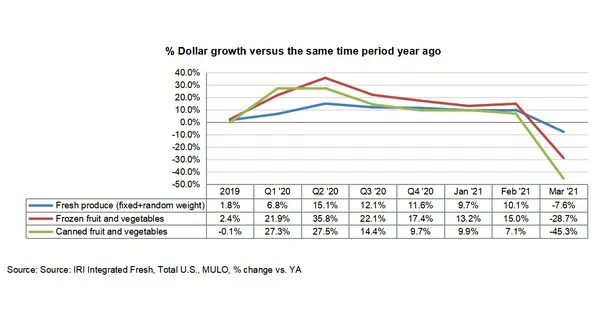

March 2020 experienced the biggest spikes in the history of grocery retailing said Anne-Marie Roerink, president, 210 Analytics. After an initial flurry of trips in mid-March, the number of store visits fell far below year-ago levels whereas the average basket ring came in well ahead of the pre-pandemic normal. While fresh produce sales spiked to record highs in 2020, both canned and frozen fruit and vegetables took share in the early months as people were focused on shelf life. In March 2021, sales started lapping the enormous spikes of 2020 and the comparison to year-ago levels turned negative for most areas. March produce department sales for the four weeks ending 3/28/2021 decreased 7.6 percent year on year. In comparison to the 2019 pre-pandemic normal, fresh produce sales at retail were up 11 percent.

March produce department sales for the four weeks ending 3/28/2021 decreased 7.6 percent year on year. In comparison to the 2019 pre-pandemic normal, fresh produce sales at retail were up 11 percent.

“We knew the year-over-year picture would radically change come March in going up against the early pandemic spikes of 2020,” said Joe Watson, VP of membership and engagement for the Produce Marketing Association (PMA). “But it is just as important to understand current demand relative to the pre-pandemic normal as the country opens up more each day.”

Fresh produce generated $5.3 billion in sales during the four March weeks, unchanged from February 2021. This is down $435 million from March 2020, but up $524 million from the 2019 pre-pandemic normal. In 2019, fresh produce sales represented 80.8 percent of total fruits and vegetables sales. That share fell as low as 76.9 percent during the first quarter of 2020, pulled down by the March panic buying weeks when many dollars were diverted to frozen and canned. While frozen fruit and vegetables remain elevated, the fresh share reached its highest point since the third quarter of 2020, at 80.5 percent of dollars.

In 2019, fresh produce sales represented 80.8 percent of total fruits and vegetables sales. That share fell as low as 76.9 percent during the first quarter of 2020, pulled down by the March panic buying weeks when many dollars were diverted to frozen and canned. While frozen fruit and vegetables remain elevated, the fresh share reached its highest point since the third quarter of 2020, at 80.5 percent of dollars.

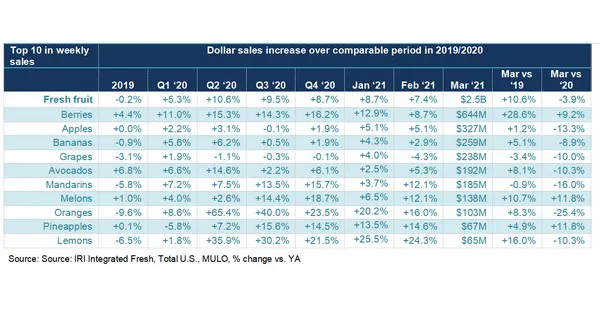

“In fruit, the top 10 measured in dollar sales is fairly typical,” said Watson. “Berries are the untouchable number one, nearly doubling the sales of number two, apples. That is followed by bananas, grapes and avocados. Citrus fruit continues to do very well with mandarins, oranges and lemons all in the top 10 in dollar sales.”

“Vegetables’ enormous strength in 2020 means that we’re seeing many down versus year-ago levels,” said Watson. “Yet, we see packaged salads’ dollar sales still ahead of those 2020 peaks, at +8.4 percent along with cucumbers that also managed a small gain, at +1.9 percent.” While fresh fruit and vegetables dollar sales at retail only decreased 7.6 percent, both frozen and shelf-stable saw much greater declines against the triple-digit increases in March 2020.

While fresh fruit and vegetables dollar sales at retail only decreased 7.6 percent, both frozen and shelf-stable saw much greater declines against the triple-digit increases in March 2020.

Click here for the report. The next report, covering April, will be released in mid-May. Contact Joe Watson, PMA’s vice-president of membership and engagement at jwatson@pma.com with questions or concerns.

For more information:

For more information:

Anne-Marie Roerink

210 Analytics LLC

Tel: +1 (210) 651-2719

aroerink@210analytics.com

www.210analytics.com