European physical markets

Price summary €/t (source: NEPG):

Belgium

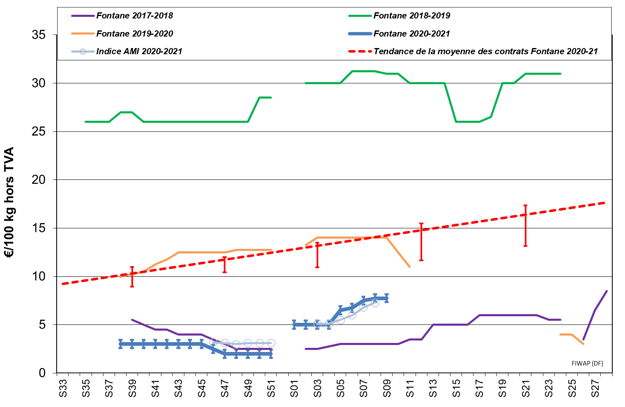

Fiwap/PCA market message:

Potatoes for processing: the market is sustained with limited offer and low demand.

Bintje, Fontane, Challenger: 7.50 - 8.00 €/q, with the most practiced price at 7.50 €. Sustained markets. For Bintje, prices up to 10,00 €/q for immediate delivery to peelers and french fry manufacturers.

Innovator: 8.00 €/q (in general, excess tons of contracts)

For delayed delivery in April-May, some transactions or firm offers between 9 and 14.00 €/q, mostly for Fontane.

Bintje plant: little trade, but prices are firm. Small calibers are difficult to find (almost no offer). Dutch/French/Belgian plants, class A, returned March 2021, by 10 tons, in big-bags excl.VAT; offer completed with Danish plant.

Caliber 28 - 35 mm: between 100 and 105 €/q. Very disparate prices due to the very low availability.

Caliber 35 - 45 mm: 60.00 - 60.00 €/q, firm prices.

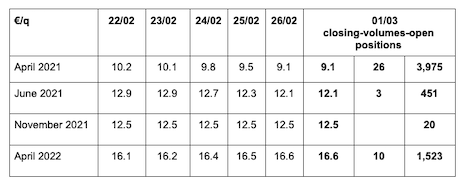

Forward market

EEX in Leipzig (€/q) Bintje, Agria and related var. for transformer, 40 mm+, min 60 % 50 mm +:

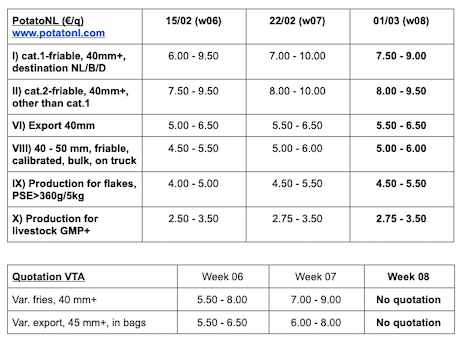

Netherlands

For the industry, the higher prices and firm markets tend to level off: the spring weather at times and the higher temperatures are pushing buyers to wait. Nevertheless, the quotations have progressed, but with reduced activity and fewer transactions. The buyers who were trying to complete the contracts now seem to be covered. The domestic fresh markets remain unchanged with firm prices between 9.00 and 14.00 €/q for soft flesh varieties and between 12.00 and 18.00 €/q for firm flesh varieties. Some first acres were planted this week here and there in the southwest of the country, while the first Egyptian potatoes are arriving on the shelves. Export remains very laborious, with bottom prices trimmed a little further between 8.50 and 11.00 €/q in bags on pallets, for departure to southern Europe, Africa and the Caribbean.

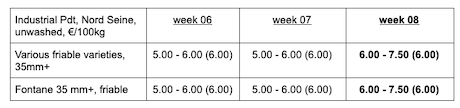

France

The domestic market remains stable overall, with a contraction in sales due to the end of the month and the school holidays. Supermarket sales are still closely tied to the constraints from the 6pm curfew, with a preference for local stores and drive-throughs during the week. The higher temperatures also seem unfavorable for potato consumption. Wholesalers see their activity picking up significantly with the revival of take-out sales from restaurants. More generally, however, wholesalers remain largely penalized by the low level of activity which may decrease even more with the stricter sanitary measures to come in some regions. Export activity is struggling to clear more volumes. The flow to the usual destinations remains on the same schedule, while the intermediate qualities are more often without significant outlets to the more sceptical eastern destinations. Prices are still highly disputed for this segment. Processing activity remains marked by the concern to cover the contracts with purchases on the free market to replace volumes or shortage of some varieties. Purchases are however limited without any real need. The trend will likely get more firm with purchases observed at 7.50 €/q, active intermediate trade and firmer positions for delayed removals.

Industrial production, bulk, departure, excl.VAT, Nord-Seine, €/qt, min - max (moy)(RNM):

Germany

Potato consumption (supermarket sales) increases (+22% in January compared to January 2020), but producer prices do not evolve...

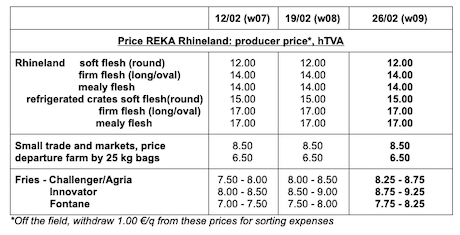

Fresh market (early and semi-early): unchanged prices for firm flesh: 10.83 €/q (10.83 €/q, before last quotation) and also unchanged for soft/mealy flesh: 10.25 €/q (10.25 €/q, before last quotation). But the merchandise from refrigerated crates-pallets is 3€ higher (see REKA prices in table below). Depending on the Länder, the market is supplied by merchandise in bulk, crates or refrigerated crates. In the first (and sometimes second) case, many defects are found.

Processing market: firm market and prices are up again: 8.75 - 9.25 €/q for Innovator (8.50 - 9.00 € last week), 8.25 - 8.75 €/q for Challenger/Agria (8.00 - 8.50 €/q last week), and 7.75 - 8.25 €/q for Fontane (7.50 - 8.00 €/q last week). Higher prices for the crisps varieties as well: 9.00 to 13.00 €/q.

Organic potatoes: unchanged producer prices around 40.00 €/q (all varieties and markets combined), returned trade.

In the fields: the nice weather has encouraged some producers to start planting their early potatoes but progress has been slow: either because the soil was still too cold and humid, or because of the lack of tarp to cover the crops. Here also, we depend on China and prices are increasing with the supply being lower than the demand. Overall, on March 1st, less was planted than last year on the same date, whether in the Palatinate, Rhineland or Lower Saxony (Burgdorf region).

Great Britain

Average price of the free markets for the week ending on February 20th: 13.34 £/q (0.37 £/q more, +2.8%). This price increase is due to the higher number of top quality varieties (category 1) and more expensive varieties in the transaction basket, rather than a real market increase.

The roadmap announced by the government has put key dates in the potato market calendar. The first step will be the reopening of schools in England on March 8th. We hope that this will help ease the current pressure on the markets. Consumers already have the national holidays in mind, and more reservations are being made for the end of the year.

Last week, the markets were calm. Most of the trade was made of common orders, most of the current demand being met by the contracts. In supermarkets, the volumes were lower in February, but prices remained sustained for the firm flesh varieties and for Maris Piper, at least for the superior quality. The wholesale market was “flat” with unchanged prices (approximately 11.00 £/q for Maris Piper). For the industry, the market is not very animated (approximately 9.00 £/q (+/- 10.00 €/q) for Maris Piper).

In the field, the warmer weather in the coming days will help dry the soil, so work will be able to resume in the field to prepare the planting season. The surface areas for potatoes are expected to be lower.

For more information:

FIWAP

www.fiwap.be