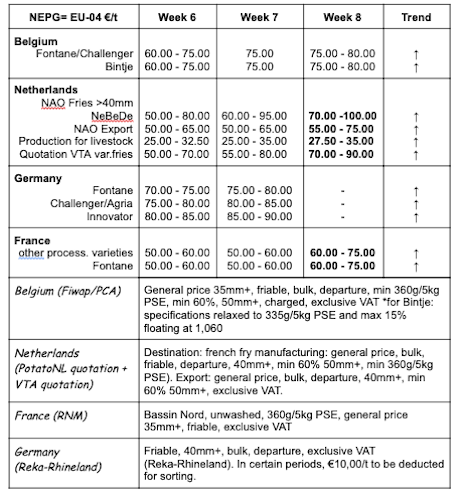

European physical markets

Price summary €/t (source: NEPG):

Belgium

Fiwap/PCA market message:

Potatoes for processing: most of the factories are buying again, but the demand is also still boosted by the purchases to complete the contracts, between producers as well as via intermediate trade. The offer is still (very) low, so markets remain on the rise.

Bintje, Fontane, Challenger: 7.50 - 8.00 €/q. Firm markets.

Some transactions or firm offers at higher prices are still reported occasionally for the best batches of Bintje and Fontane, for delivery in March (9.00 - 10.00 €/q minimum) but also delayed (up to 13.00 - 14.00 €/q for June).

Bintje plant: little trade, but prices are firm. The small calibers are difficult to find (almost no offer). Dutch/French/Belgian plant, class A, returned March 2021, by 10 tons, in big-bags excl.VAT; offer completed with Danish plant.

Caliber 28 - 35 mm: momentarily no quotation; very heterogeneous prices due to very low availability.

Caliber 35 - 45 mm: 55.00 - 60.00 €/q, firm prices.

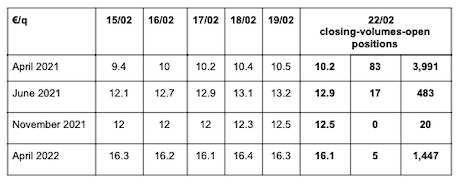

Forward market

EEX in Leipzig (€/q) Bintje, Agria and related var. for transformer, 40 mm+, min 60 % 50 mm +:

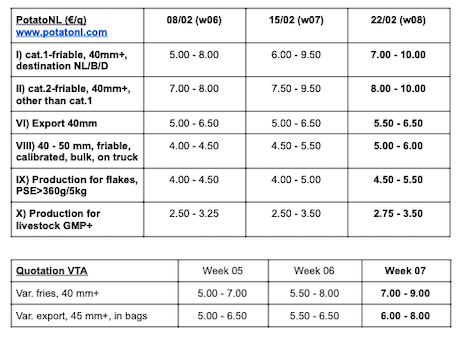

Netherlands

For the industry, prices are still on the rise with an extra 0.50 to 1.00 €/q depending on the category. The transactions observed vary between 7.00 and 8.00 €/q for basic varieties (Fontane, Challenger), and up to 10.00 €/q for Innovator. Transactions are also reported between 9.00 and 13.00 €/q for delivery in April to June. Export is very limited (some shipments to Spain, Portugal, Eastern countries and Ukraine) on a basis of 9.00 to 11.00 €/q in bags on pallets. Buying is made more difficult with the higher prices of processing potatoes. Growing interest from overseas destinations. Domestic fresh markets unchanged, around 15.00 to 18.00 €/q at the producer for firm flesh varieties, and 8.00 to 15.00 €/q for soft flesh varieties.

The 2021/2022 contracts are signed with difficulty. Many producers hesitate because the proposals are down, both in prices and volumes. The decrease in prices is the greatest at the exit from the fields and at the beginning of the period (autumn). Many producers estimate that these prices do not reflect the reality of the production costs, for which the increase is significant on many points: phyto products, irrigation, antigerminatives, machinery...The contracted volumes and surface areas are therefore expected to decrease,

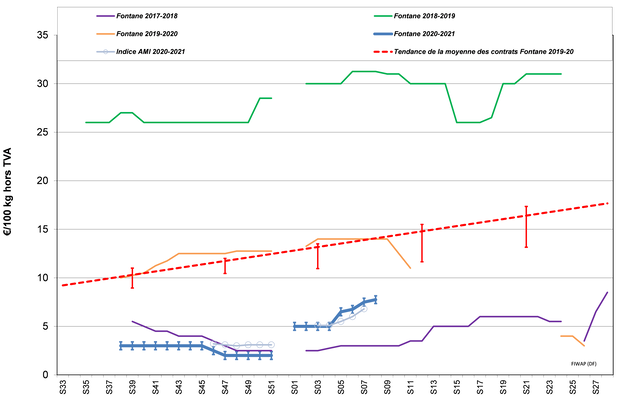

France

Processing market: purchases mainly driven by the replacement of missing volumes under contract, and by intermediate trade rather than factories. No major delays observed in the removal of contracts. Last week, the transactions observed were between 6.00 and 7.50 €/q for immediate delivery, and up to 10.00 €/q by intermediate trade for delayed delivery. The fresh markets remain very (too) calm, but prices are stable. Export is slow (Spain, Italy, Portugal, Eastern countries), and the closure of restaurants continues to weigh on the unwashed/non-washable varieties.

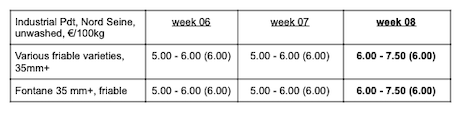

Industrial production, bulk, departure, excl.VAT, Nord-Seine, €/qt, min - max (moy)(RNM):

Germany

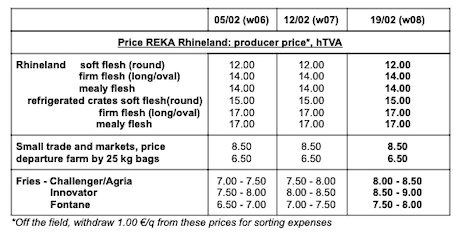

Fresh market (early and semi-early): unchanged prices for firm flesh: 10.83 €/q (10.83 €/q, before last quotation) and also unchanged for soft/mealy flesh: 10.25 €/q (10.25 €/q, before last quotation). But the merchandise from refrigerated crates-pallets is 3€ higher (see REKA prices in table below). Depending on the Länder, the market is supplied by merchandise in bulk, crates or refrigerated crates. In the first (and sometimes second) case, many defects are found.

Processing market: firm market and prices are up again: 8.50 - 9.00 €/q for Innovator (7.50 - 8.00 € last week), 8.00 - 8.50 €/q for Challenger/Agria (7.50 - 8.00 €/q last week), and 7.50 - 8.00 €/q for Fontane (7.00 - 7.50 €/q last week). No quotation for the crisps varieties (8.00 to 11.00 €/q last week).

Organic potatoes: producer prices unchanged/slightly down around 40.00 €/q (all varieties and markets combined), returned trade. In December, organic potato consumption increased by 20% (compared to 12 months earlier). In 2020, the sales of organic potatoes increased by 7%. Discount stores (Lidl, Aldi) see the rate of organic sales increase. 1 out of 20 potatoes (5%) sold at Lidl, and 1 out of 10 sold at Aldi, are organic. In general, 6.5% of the potatoes bought in German supermarkets are organic.

Great Britain

Average price of the free markets for the week ending on February 13th: 12.96 €/q, which is 1.77 €/q lower (-12%). The demand during the week is described as sluggish, most of the activity revolving around contracts. The industry is waiting for the roadmap from the government about lifting the blocking restrictions expected on February 22nd, which is necessary to predict the future demand. Some wonder, however, if lifting the lockdown will stimulate enough demand.

Peelers are buying Maris Piper at 7.50 - 9.00 €/q departure. The fresh markets show a continuing demand for the superior quality, almost exclusively under contract. The quality problems are starting to be felt and for some, the current pressure on prices is becoming incompatible with this year’s higher storage costs. Export to the Canary Islands is anecdotal, but some shipments are reported to Belgian factories on a basis of 8.50 - 9.00 €/q departure.

For more information:

FIWAP

www.fiwap.be