Total Produce is one of the world’s largest fresh produce producers and providers. Operating out of 26 countries (30 inclusive of Dole) while serving many more, Total Produce’s reach extends across the globe incorporating over 160 facilities (over 250 facilities inclusive of Dole) including farms, manufacturing and ripening facilities and cold storage warehousing, packhouses and distribution hubs. Growing, sourcing, importing, packaging, marketing and distributing over 300 lines of fresh produce, Total Produce’s range extends from the more familiar to the truly exotic and includes extensive organic and value-added fresh cut ranges. Serving the retail, wholesale and foodservice sectors.

Today Total Produce and Dole Food Company announced that they have entered into a binding transaction agreement to combine under a newly created, U.S. listed company Dole plc.

According to analysts at Davy, Total’s transaction consideration for the 55pc interest in Dole equates to $250m.

Total bought a 45pc stake in Dole for $300m (€247m) in July 2018.

The Transaction will simplify the existing structure between the two companies by unifying Dole and Total Produce under common ownership, with the objective of enabling full operational integration, realisation of synergies and value creation across the enlarged business. Under the terms of the Agreement, Total Produce shareholders will receive 82.5% of Dole plc shares and the C&C shareholders will receive 17.5% of Dole plc shares, in each case based on the fully diluted outstanding shares immediately prior to the completion of the Transaction.

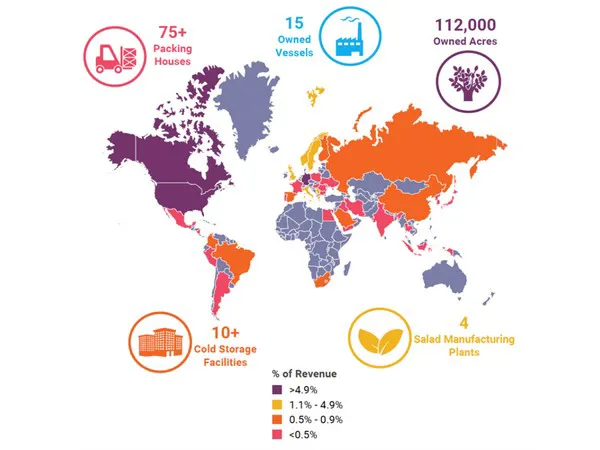

Dole's global sales footprint

Dole plc will be the global #1 in fresh produce with estimated combined 2020 revenue of approximately US$9.7 billion, Adjusted EBITDA of approximately US$379 million and total assets of approximately US$4.5 billion.

Dole plc will be well positioned to deliver attractive long-term growth and utilise its increased size and network to drive market penetration and cross-selling. Dole plc will benefit from the strength of the Dole brand to further expand its product offering and pursue synergistic M&A in a fragmented and structurally growing industry. .

Dole plc’s completion of an initial public offering and a listing on a major U.S. stock exchange is a condition for completion of the transaction In connection with the transaction, Dole plc intends to target raising US$500 to US$700 million in primary equity capital to strengthen and de-lever the combined balance sheet. Upon completion of the U.S. listing of Dole plc, Total Produce will cease to be listed on Euronext Dublin and the London Stock Exchange.

Dole plc, operating under the Dole brand, will be incorporated in Ireland, with its Global Headquarters in Dublin, Ireland. Its headquarters for the Americas will be in Charlotte, North Carolina.The highly regarded management teams of Total Produce and Dole, with combined experience of over 150 years in the fresh produce sector, will continue to operate the combined business.