European physical markets

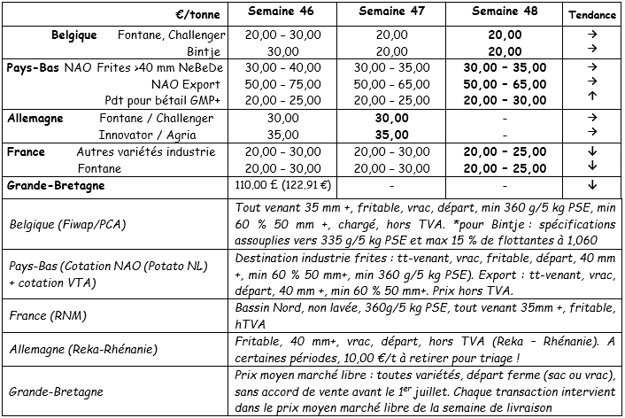

Summary of € / t prices (source: NEPG):

Belgium

Message from the Fiwap / PCA markets:

Industrial potatoes: the industrial demand is almost non-existent on the free market (factories remain supplied through contracts). There are reports of demand for export (also via Dutch exporters) to Africa. Alternative markets (livestock, starch, etc.) remain active with similar prices to what the industry or traders can offer. The supply from the field is ending, and the one from storage is very limited by the low price levels.

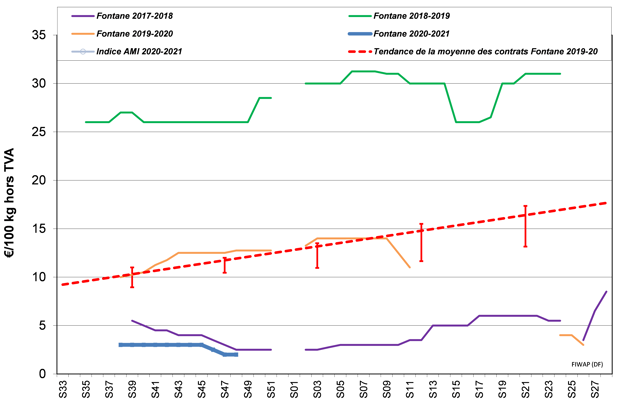

Fontane, Challenger, Bintje: between 2.00 and 2.50 €/q, the most common price is 2.00 €/q.

Futures Market

EEX in Leipzig (€/q) Bintje, Agria and related varieties for processing, 40 mm+, min 60 % 50 mm+:

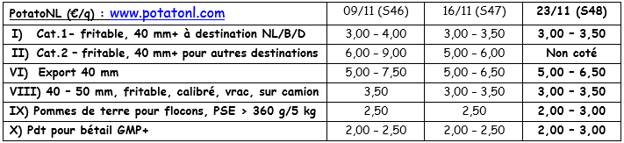

The Netherlands

The markets remain affected by the low prices and great uncertainty of the coming weeks. With the second lockdown, industrial activity has been reduced and purchase prices have fallen. Most of the supply to processors is carried out under contract. The additional volumes purchased are almost nil, but the supply is also very low now that the harvests are virtually finished. At the current price level, producers are not prone to sell. The difference in the price paid for the "surplus tons" by processing factories and alternative markets is very small. Exporters had managed to work nicely until last week. The low prices favor trade to Africa, the Caribbean, and Asia. European destinations remain difficult, but Ukraine's demand (via Poland) is currently great. Producer prices range between 5 and 16 €/q. The domestic fresh markets remain buoyant, with the demand boosted by promotional actions in supermarkets. Producer prices stand at 10.00 - 15.00 €/q for soft-fleshed potatoes and 15.00 - 22.00 €/q for the firm-fleshed ones. In the field, there are still some plots to be harvested in the South-West.

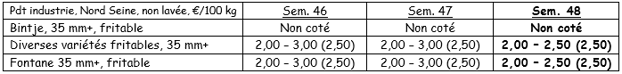

France

Industry: prices at 2.00 - 3.00 €/q, depending on variety, for very small volumes delivered as complement to the contracts. The delivery of the contracted volumes is up to date or late depending on the varieties concerned. The fresh markets have returned to a rather "normal" level of activity, after the pre-lockdown frenzy. They remain sustained by the good demand of potatoes for home cooking. There are active exports to Spain, Portugal and Italy, and there is also demand from Eastern European countries. The starch industry is buying potatoes for consumption.

Industrial potatoes, bulk, for export, excl. VAT, Nord Seine, €/qt, min - max (avg) (RNM):

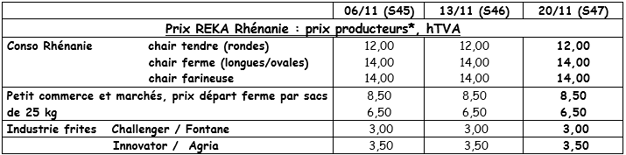

Germany

The prices are stable both for fresh and industrial potatoes. The delivery of lots (which germinate, for example) for livestock feed, biogas and the starch industry continues at a quick pace. Some producers must make choices now: thermo-nebulize and store, or ship before mid-January. Fresh market (early and mid-early): price of firm-fleshed potatoes unchanged: 10.83 € / q (10.83 € / q last week). Also unchanged for the soft / floury fleshed ones: 10.17 € / q (10.17 € / q last week). The demand is good.

Processing market (industrial and storage varieties): Stable and unchanged market: € 3.50 / q for Innovator / Agria (€ 3.50 / q last week), and prices also unchanged for Challenger / Fontane: 3.00 € / q (3.00 € / q the week before).

During the period of shipment from the fields, € 1.00 / q must be withdrawn from these prices for sorting costs

Organic potatoes: producer prices unchanged, with around € 41.00 / q (all varieties and markets combined) after negotiation.

UK

Free market prices (all varieties combined): for the week ending 11/14: £ 11.00 / q (down from £ 0.47 / q), i.e. € 12.29 / q.

For more information:

FIWAP

www.fiwap.be