The pandemic caused changes in virtually all shopping habits, from when and where people shopped to the types, amounts and brands they purchased. These changes were driven by anxiety over in-store visits that prompted fewer and shorter trips as well as by out-of-stocks, more meals at home and greater interest in food experimentation. Seven months since the onset of COVID-19, many of the pandemic shopping habits are trending back toward normal.

According to IRI’s latest survey wave of primary shoppers in late September, anxiety levels over in-store visits have decreased significantly, with 58% of shoppers feeling relaxed. This is an improvement of 15 percentage points since July. This begs the question whether people have similar increased confidence in restaurant visits, which could result in more of the food dollar going to foodservice. Additionally, two-thirds of shoppers now spend about the same amount of time shopping in the store as they did before the pandemic. Browsing for different items to try is also up a few points. These are all encouraging signs for new product launches and in-store merchandising once more catching the attention of shoppers.

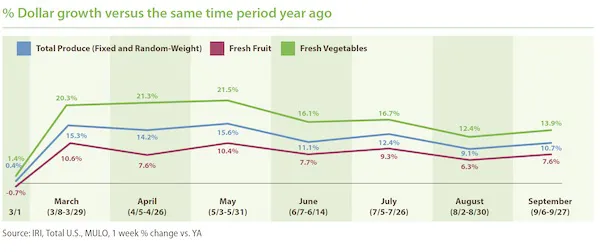

While shopping patterns are normalizing, food spending at retail remains highly elevated across most departments. The month started off with strong Labor Day sales during the week of September 6th. Everyday demand kept produce dollars well above 2019 levels across all temperature zones during the subsequent September weeks. Frozen fruit and vegetable sales are the smallest, but did see above-average gains.

- Fresh produce increased +10.7% over the comparable week in 2019.

- Frozen, +18.5%

- Shelf-stable, +12.6%

Source: IRI, Total US, MULO, 1 week % dollar growth vs. year ago.

Fresh produce generated $5.04 billion in sales during the four September weeks — an additional $489 million in sales versus the same time period in 2019. This encompasses an additional $171 million in additional fruit sales and $313 million in additional vegetable sales. Vegetable sales have outpaced fruit sales throughout the pandemic and have generated 28 weeks of double-digit growth since the onset of the pandemic shopping patterns in mid-March.

Fresh share

Fresh produce commanded an 80.3% share of total fruit and vegetable sales across all three temperature zones during the four September weeks — down a percentage point from its August average of 81.3%. It is also the lowest share since April. “It is important to point out that inflationary levels in frozen and canned goods have been higher than those in fresh produce, which impacts dollar shares,” said Jonna Parker, Team Lead for Fresh at IRI. “However, the pandemic has definitely fueled a consumer desire for items with longer shelf-life, whether that is hardier fresh fruits and vegetables or diverting dollars to canned and frozen.”

Fresh produce dollars versus volume

Labor Day week saw volume sales exceeding dollar sales for the first time in months due to a very strong performance on the fruit side. Volume growth continued to slightly outpace dollar gains the remainder of the month. “Retailers are very cognizant of the new economic reality, which could mean some are investing in price,” said Watson. “Fresh produce promotions have always been an important trip and store driver and even more so during difficult economic times.”

The strong produce volume performance was driven by fruit, that saw a 12.6% increase in September versus the same month year ago — up from +3.7% the month prior. Vegetables had strong volume gains as well, but they tracked four points below dollar gains.

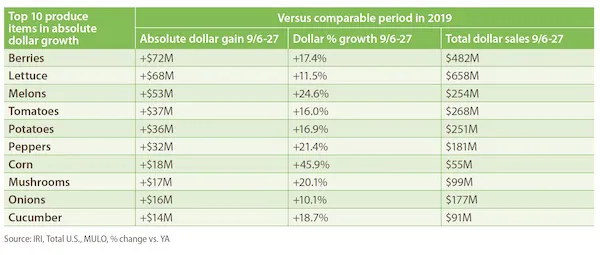

Absolute dollar gains

“The strength of vegetables amid the pandemic is clearly demonstrated by the top 10 in absolute dollar gains,” said Watson. “While berries and melons had very strong September performance as the numbers one and three in absolute dollar gains versus year ago, the remaining eight top 10 contenders were all vegetables.”

To read the full report, click here.

For more information:

For more information:

Anne-Marie Roerink

210 Analytics LLC

Tel: +1 (210) 651-2719

Email: aroerink@210analytics.com

www.210analytics.com