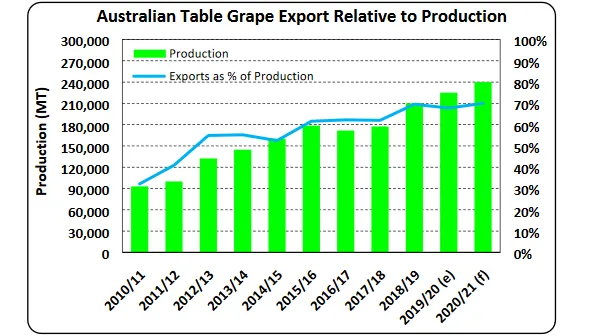

The Australian grape production is expected to continue to expand in the 2020/21 marketing season and is expected to reach a record 240,000 tonnes. That is an increase of 15,000 tonnes compared to the revised estimate for 2019/20. This higher yield is due to the increased plantings of table grapes, and it is expected that almost all of this increased production will be used for export. Exports for 2019/20 hit a record level of 152,500 tonnes as a result of growing exports to China and Southeast Asia, despite some Covid-19-related shipping disruptions. A further increase in production and exports is expected in the coming years as a result of the continued increase in planting and the newer vines coming into production.

Over the past ten years, the yield of Australian grapes has increased by 142%. While the production of 2020/21 is still at a very early stage, it has got off to a promising start with reports from the industry of favourable conditions leading to a major boom in early September 2020, particularly in the main growing areas of Victoria and southern New South Wales. The profuse flowering was followed by excellent leaf formation, which promises high potential yields.

In addition, the high yields resulting from strong export demand in recent years have stimulated the planting of new vines and the conversion of wine grape fields to table grape planting. The table grape sector estimates that annual plantings have increased by about 20% in recent years, but expects the number of new plantings to decline in the coming years. The new plantings are starting to enter full production and will continue to increase the total volume of table grapes in the coming years.

An important positive point for the Australian grape sector is that the expansion of the acreage is aimed at new, own and export-oriented grape varieties. The selected varieties are driven by strong demand from Asian markets such as China. Chinese consumers are increasingly turning away from seeded grapes, such as Red Globe, and prefer seedless varieties. They are also open to new varieties and flavours.

Source: USDA