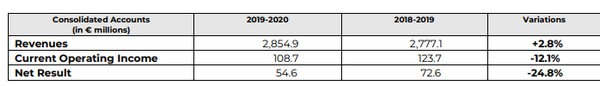

On September 25, 2020, the Supervisory Board, under the chairmanship of Martin Ducroquet, reviewed the statutory and consolidated financial statements for FY 2019 - 2020 as approved by the General Management and certified by the company's statutory Auditors.

The Bonduelle group is once again posting a revenue growth in 2019-2020 despite an unprecedented health crisis that had a contrasting impact on business in the second half of the year, these circumstances adversely affecting the group's profitability. Nevertheless, its performance and financial health remain solid.

This sanitary crisis has highlighted, as a major player of the in the agri-food industry, the commitment of all the group's employees to ensure the continuity of supply to the markets as much as the values

of solidarity that animate them. This performance demonstrates the relevance of a diversified portfolio of activities in terms of technologies, distribution channels, geographies and long-term strategy.

Revenue

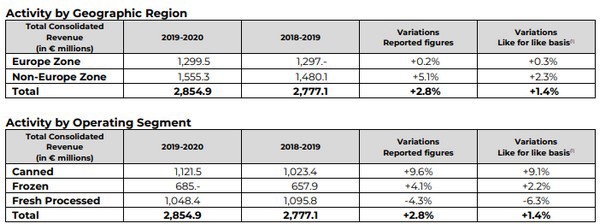

Europe Zone

The Europe Zone, representing 45.5% of the group's revenue over the FY, was stable overall, at +0.2% on reported figures and +0.3% on like-for-like basis.

Non-Europe Zone

The revenue of the non-Europe zone, representing 54.5% of the group's revenue, was up +5.1% on reported figures and +2.3% on like-for-like basis.

For FY 2019-2020, the Bonduelle Group’s current operating income stands at € 108.7 million compared to € 123.7 million the previous financial year, penalized by the Covid-19 global health crisis and whose impact on the group's profitability is estimated between € 7 and €10 million, explanatory factor for the variance with the profitability target announced in October 2019.

This impact mainly includes the additional costs generated by the employee protection measures put in place (social distancing, sanitation, equipment etc...) resulting in lower productivity, losses related to compliance with agricultural commitments, in particular in costs, commitment bonuses paid to factory staff , partially offset by savings (travel expenses, marketing in particular).

Both long-life (canned and frozen) and fresh ready-to-eat (bagged salads, deli salads, salad bowls) activities were impacted by additional costs in varying proportions. The long-life product business segment was able to offset those additional costs thanks to an increase in activity, particularly in Europe due to the share of nationally branded products (Bonduelle, Cassegrain) in the product portfolio compared to the Americas, where private label sales predominate. On the other hand, the fresh ready-to-eat business segment saw a decline in revenues in addition to additional costs, leading to a deterioration in its profitability, particularly in North America due to the relative size of this

segment in this region. Despite this context and the trend observed in its profitability, the Group did not significantly reduce its marketing investments compared to the previous year.

After taking into account non-recurring items (€ 6.8 million), mainly linked to a health warning in the United States in the fresh food segment that impacted the entire market in the first half of the year,

the Bonduelle Group's operating income amounts to € 101.9 million, compared with € 115.8 million last financial year.

Net Result

The net financial expense stands at € 25.9 million against € 22.6 million last financial year. A variation of € 2.5 million explained by the application of IFRS 16 regulating financial leases, and of € 2.4 million

attributable to the negative impact of exchange rates. Income tax expense, corresponding to interests paid on the group's various financing arrangements, is down by € 1.6 million. The group's average cost of financing, already competitive at 2.15%, may be reduced further in the future, thanks to the Neu CP program set up over the summer.

The income tax expense amounts to € 21.3 million against € 20.6 million last financial year and represents an effective tax rate of 28.1%. After taking into account the tax charge and financial income, the Bonduelle Group's net income for FY 2019-2020 amounts to € 54.6 million, compared with € 72.6 million last financial year.

For the full financial results, please click here.