AgroFresh Solutions, Inc. announced its financial results for the second quarter ended June 30, 2020.

AgroFresh Solutions, Inc. announced its financial results for the second quarter ended June 30, 2020.

"I’m pleased with our team’s resolve during the first half of 2020. We provided uninterrupted service to our southern hemisphere customers amid a challenging environment due to the global pandemic, which impacted our flower business as well as caused softness in some key local currencies. The cost optimization initiatives we launched last year helped insulate our business from the pandemic’s broader effects and drove another strong quarter of year-over-year improvement in selling, general and administrative expense, which in turn generated operating leverage and adjusted EBITDA growth during the second quarter of 2020 as compared to the prior year period. For the first half of 2020, adjusted EBITDA margin improved 310 basis points, despite the decline in revenues during our southern hemisphere season due to the aforementioned headwinds," commented Jordi Ferre, Chief Executive Officer.

"We are carefully managing the business through this uncertain environment and with the closing of our comprehensive refinancing on July 27, we have reduced our balance sheet leverage by approximately two turns on a pro-forma basis as of June 30, 2020. This transaction returns our business to a position of strength where we have the available capital and flexibility to pursue our diversification and growth initiatives. We are well positioned for the coming northern hemisphere season during the second half of 2020, with the resources in place to provide the necessary products and service to help our customers navigate this dynamic environment and maximize the value of their crops."

Financial Highlights for the Second Quarter of 2020

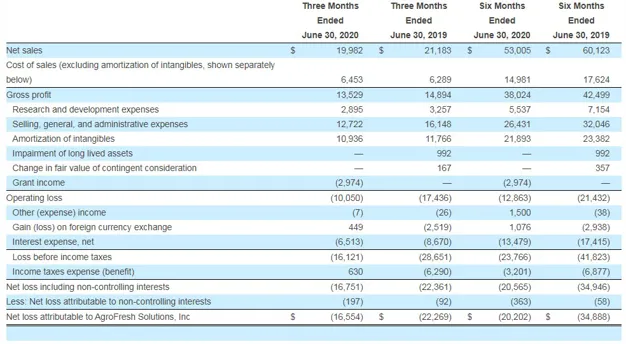

Net sales for the second quarter of 2020 decreased 5.7%, to $20.0 million, compared to $21.2 million in the second quarter of 2019. Excluding foreign currency translation impacts, which reduced revenue by $1.7 million as compared to the second quarter of 2019, revenue increased 2.4%. The net sales increase on a constant currency basis was primarily the result of growth of SmartFresh in the Asia-Pacific region, as well as positive contributions from the Company's SmartFresh diversification strategy.

Gross profit for the second quarter was $13.5 million compared to $14.9 million in the prior year period. Gross profit margin decreased 260 basis points to 67.7% versus 70.3% in the prior year period. The lower gross margin was primarily the result of negative fixed cost leverage on lower reported sales volumes, inventory valuation reserves and revenue mix.

Research and development costs were $2.9 million in the second quarter of 2020, compared to $3.3 million in the prior year period. This decrease was driven primarily by the timing of projects.

Selling, general and administrative expenses decreased 21.2%, to $12.7 million in the second quarter of 2020 as compared to $16.1 million in the prior year period. Included in selling, general and administrative expenses were $0.7 million in the current quarter and $2.0 million in the prior year quarter of costs associated with non-recurring items that included M&A, litigation, refinancing and severance. Excluding these items, selling general and administrative expenses decreased approximately 15.0% in the second quarter versus the prior year period, which reflects the Company's ongoing cost optimization initiatives, as well as a temporary decrease in travel and other miscellaneous expenses related to the COVID pandemic.

Second quarter 2020 net loss was $16.8 million, compared to net loss of $22.4 million in the prior year period.

Adjusted EBITDA(1) was $0.2 million in the second quarter of 2020, compared to ($1.4) million in the prior year period.

As of June 30, 2020, cash and cash equivalents were $35.6 million.

Financial Highlights for the First Half of 2020

Financial results for the first half of 2020 largely reflect the completion and performance of the business for the southern hemisphere season. Net sales for the first half of 2020 were $53.0 million, a decrease of 11.8% versus the prior year period. The impacts of foreign currency translation reduced revenue by $3.8 million for the first half of 2020; excluding this impact, revenue decreased approximately 5.5%. The net sales decrease on a constant currency basis was primarily the result of adverse harvest conditions experienced in key Southern hemisphere markets, such as Brazil, Chile, Argentina and Australia which impacted harvest timing and yields, along with change in demand patterns from customers.

Gross profit margin was 71.7% for the year-to-date period, which compares to 70.7% in the year-ago period, which was in line with the Company’s expectation. The year over year change was a result of the supply chain cost optimizations that were implemented at the end of 2019 and are expected to carry through the balance of 2020.

Research and development expenses decreased $1.6 million to $5.5 million in the first half of 2020 driven primarily by the timing of projects.

For the full financial report, please click here.