A leading international audit and consulting firms, Ernst & Young has found that there is more wastage in Australia's fresh produce primary production, than in the subsequent processing and packaging.

The company undertook research and assessment of relevant literature and case studies as part of Produce Marketing Association Australia-New Zealand's (PMA A-NZ) State of the Industry report, followed by an exploration of future trends that are shaping the supply chain with a focus on consumer behaviours. Six key supply chain performance drivers were uncovered; facilities, inventory management, transport, information and communication, workforce, and supply and demand.

“Poor performance of the supply chain can cause visibility and trust issues, which often makes it difficult to pinpoint the inefficiencies and areas to directly target investment for improvement," PMA A-NZ CEO Darren Keating said. “The PMA A-NZ State of the Industry Report aims to provide the fresh produce with the information to identify opportunities for improvement to ensure greater returns along the whole supply chain”.

Graphic source: PMA A-NZ State of the Industry Report 2020

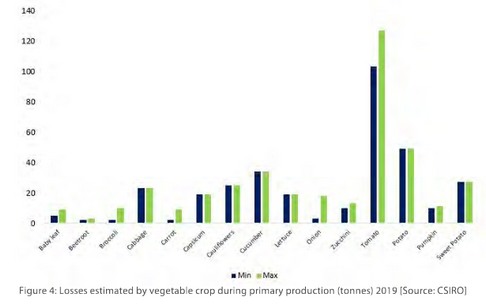

A CSIRO study found that Australia loses at least an estimate of 18-22 per cent, with watermelons suffering the worst losses in the fruit category during the primary production stage and tomatoes in the vegetable category.

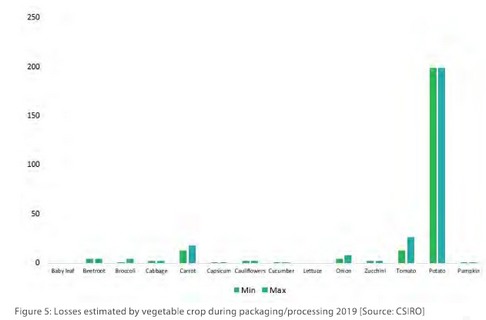

As far as the processing and packaging stage of the supply chain, wine grapes accounted for the highest volumes for fruit and there were significant post-harvest losses for potatoes in vegetables.

Graphic source: PMA A-NZ State of the Industry Report 2020

Mr Keating says due to globalisation, producers need to become more competitive to stay in the market, which means reducing the supply chain costs (55 per cent of total production costs) is important for profitability.

“A consistent theme identified in this report is that supply chains that have high levels of trust and transparency have greater opportunities for success," Mr Keating said. "Data sharing and the challenges that come with it are consistent. From the producer to the consumer there is a desire for more information."

The report also found that the longer a product stays in the supply chain, the more inputs are required for the final output. This decreases the productivity potential of the sector. It also identified that better planning is required by growers:

"Demand signals give an indication for supply required for harvest," the State of the Industry Report said. "An over-supply causes wastage whilst an under-supply can cause lost potential revenue. Due to costs involved, it may not be profitable for a crop to be harvested if the market value for the product if it is lower than expected. Grocery stores have buying power overproduce. Firms seek higher margins because of higher rates of spoilage, wastage and shrinkage, greater labour costs in preparation for sale and higher maintenance up to the sale of produce. These margins mean that producers see less profit."

It also identified other factors that impact supply chain efficiency, including processing, distribution, export regulation delays and slow processes, as well as consumer behaviour.

Fresh produce spends up to 50 per cent of its shelf-life in transit and the report identifies that quality is rated as number one for customer satisfaction with fruit and vegetables. Within that, appearance, taste and size and shape are the top three elements of quality.

“Consumers want access to high-quality locally-grown produce to experience the joy of fresh. The opportunities to make improvements along the supply chain will ensure consistent quality for consumers to enjoy,” Mr Keating said.

The report went onto detail six key trends that are continuing to shape the supply chain response. The first three focus on the personal consumer habits; especially consumption on the go, driven by the rise of snacking vegetables, home delivery services and meal preparation kits for time-poor consumers. Another is higher expectations from sophisticated consumers; increasingly, consumers are thinking about food – from how it is produced, what is in it, to where and when they eat it. Consumers are also becoming more health literate and personalising diets, e.g. genotype-based nutrition and DNA-based supplements.

The report went onto detail six key trends that are continuing to shape the supply chain response. The first three focus on the personal consumer habits; especially consumption on the go, driven by the rise of snacking vegetables, home delivery services and meal preparation kits for time-poor consumers. Another is higher expectations from sophisticated consumers; increasingly, consumers are thinking about food – from how it is produced, what is in it, to where and when they eat it. Consumers are also becoming more health literate and personalising diets, e.g. genotype-based nutrition and DNA-based supplements.

The remaining factors relate to modernisation and social attitudes. Technology including robotics, blockchain and software create leaner supply chains that not only impact individual stages in the value chain but also help integrate them by tracking the progress from production to consumption. Consumers are demanding produce that is ethically sourced and sustainable, and effective waste management is becoming critical. While online grocery shopping will increase over the next decade, requiring innovative solutions to make sure that the logistical process is cost-effective.

For more information on the State of the Industry Report 2020: click here