European physical markets

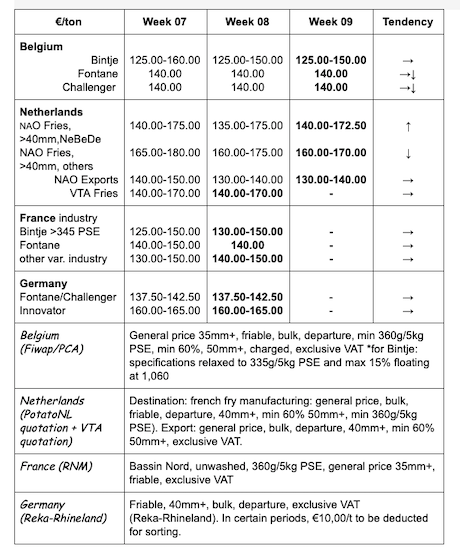

Price summary (source: NEPG):

Belgium

Fiwap/PCA market message:

Industrial potatoes:

Little activity on the industrial markets. The demand is still waiting as the supply is more present. Some export towards Southeastern Europe and Africa.

Price for all comers, 35 mm+, min 60% 50 mm+, min 360g/5kg PSE, bulk, friable, departure, excl.VAT, direct delivery:

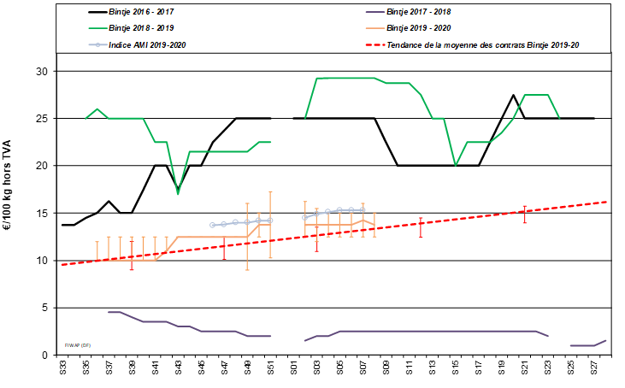

Bintje: 12.50-15.00 €/q, depending on wholesaler, quality and destination. Calm market, with less activity “at the top of the range”.

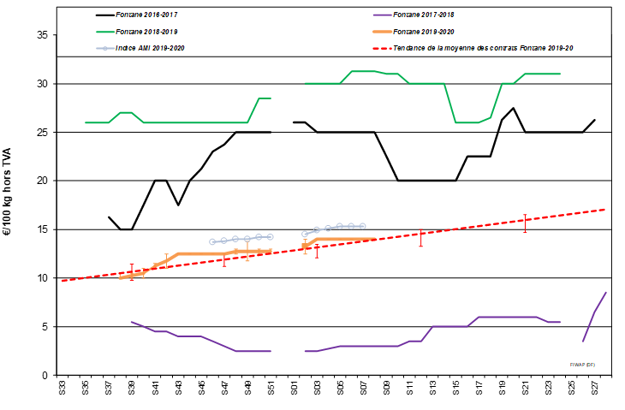

Fontane: around 14.00 €/q, very calm;

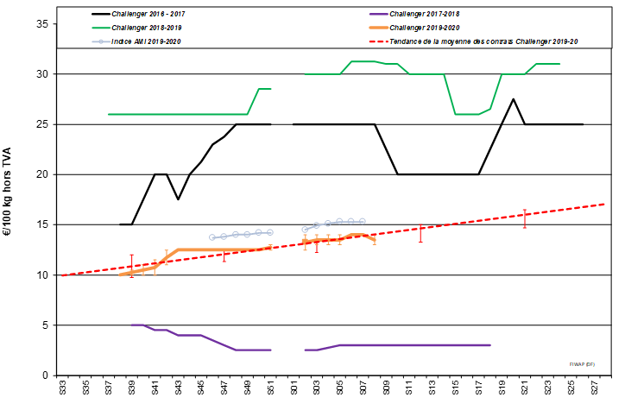

Challenger: around 14.00 €/q, very calm;

For the last 2 varieties, a Belgian processing firm is proposing lower prices.

Innovator: around 15.00 €/q, calm.

Bintje plant: Prices are down (but no quotation due to insufficient transactions), little trade. Dutch plant, class A, returned March 2020, by 10 tons, in big-bags excl.VAT:

Caliber 28-35 mm: / €/q

Caliber 35–45 mm: / €/q

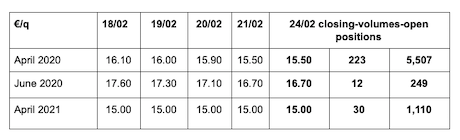

Forward market

EEX in Leipzig (€/q) Bintje, Agria and related var. for conversion, 40 mm+, min 60% 50 mm+:

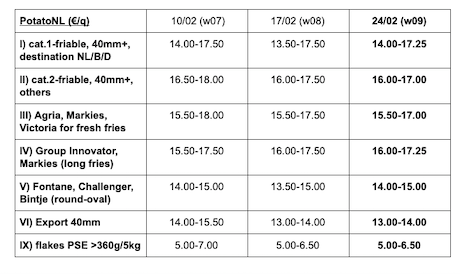

Netherlands

Industrial quotations are slightly down for the first time in several weeks. The lack of dynamic export is noticeable and leaves the industry alone to control the market. The demand from the factories remains limited, while the publication of the stocks in Germany, France and Belgium is not likely to strengthen prices. The industry is now running at full speed, based on (excess of) contracts. In export, the preparers must make some concessions in terms of prices, with prices calibrated departure big-bag at +/- 16.00 €/q (4.00 €/q less than in early January), which already seems to boost the volumes a little. Hope remains high, March being a traditionally active month for export.

Quotation PotatoNL: also available on www.potatonl.com

Processing industry: in December 2019, the Dutch factories worked 317,000 tons of potatoes, which is 41,700 tons more than in December 2018 (+15%!). The entire 2019 harvest therefore reached 1.84 million tons, an increase of 80,000 tons. Over the last 12 months on record, the total is 3.863 million tons, which is still down by 149,000 tons.

Dutch export in January went well, with 75,000 tons shipped, which brings the total for the season to 482,200 tons, the highest figure in 5 years. Included in this total, shipments to Germany doubled at 60,300 t, and exports to Eastern Europe reached 28,000 t.

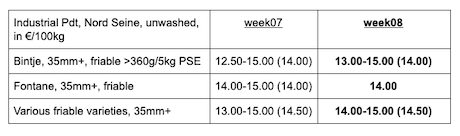

France

Industrial pdt, bulk, departure, excl.VAT, Nord Seine, €/qt, min–max (moy)(RNM):

For the industry, prices are stable but the demand is (too) weak. Quotations are maintained despite the very few transactions observed.

Export is still heavy, with some prices slightly down towards 17.00 to 21.00 €/q for the basic quality (caliber big-bag departure). The top quality Agata is between 25.00 and 29.00 €/q.

Stocks at the end of December were estimated at 3.02 million tons, compared to 2.75 million tons for the average of the last 3 years. A little over half of the stock was intended for the processing industry, including 89% of contracts. For the fresh market, the contracting rate of stocks was only 22%.

Good export figures: at the end of December, France had exported a total of 693,000 tons since the beginning of the season, a slight increase (+2.0%). The destinations with the highest increase are Spain (+9%), Italy (+33%) and Eastern countries (+103%).

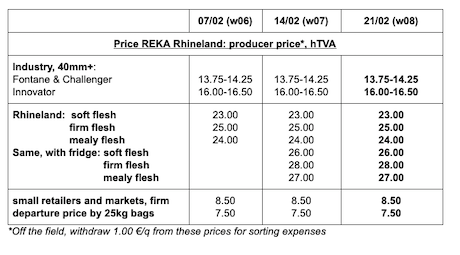

Germany

Markets are firm, both for crates-pallets-fridges and for the friable varieties. Fresh market, prices are still stable but firm for firm flesh at 24.00 €/q (compared to 24.00 €/q), as well as for soft and mealy flesh at 22.42 €/q (compared to 22.25 €/q). For the “crates-pallets-fridges”, prices are higher! Processing market: unchanged quotations for Fontane/Challenger at 13.75-14.25 €/q (13.75–14.25 €/q) and for Innovator at 16.00–16.50 €/q (16.00–16.50 €/q) which is particularly sought after.

Organic potato: producer prices returned trade: between 63 and 65 €/qt. The mild temperatures in January and February did not stimulate the demand, and did not really influence the conservation qualities negatively. The organic (and conventional) sector has indeed invested in fridges and refrigeration in recent years. The sector estimates there will be enough supply of organic potatoes until the end of May. After a very strong increase in the consumption of organic potatoes during the first 9 months of 2019 (+16% more in 2019 than in 2018). Consumer purchases were down 12% in October and December 2019 compared to the same months in 2018. It is too early to see which influences organic imports from Egypt will have (10,000 t in 2019), and later, the imports from Spain (10,000 t also) on the German market (and by extension those of the Benelux and Scandinavia).

Great Britain

Few changes on the markets, which are considered to be calm. The price level remains higher than the prices observed on the continent, with Maris Piper between 19 and 23 €/q for peeling, and the superior quality varieties (Agria, Markies, Ramos) between 24 and 35 €/q calibrated. On several markets, the superior quality maintains its prices, while a more pressing offer of less quality creates a slight downward pressure.

The heavy rainfalls of the past few days/weeks continue to slow down early plantings, both in Cornwall and elsewhere (Channel Islands, Pembrokeshire).

For more information:

FIWAP

www.fiwap.be