European physical markets

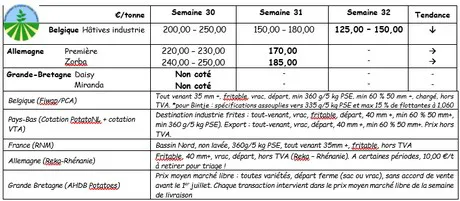

Summary of prices (source: NEPG) :

Belgium :

message from the Fiwap / PCA markets :

Industry: calm market with few transactions observed. Lower prices tend to limit supply, which is not excessive. On the other hand, industrial demand is delaying because contracts are taking over. On the export side, growing demand for Eastern Europe is expected in the coming weeks/months.

Price for all coming, 35 mm+, min 60% 50 mm+, min 360 g/5kg EPS, bulk, sinterable, ex works, excluding VAT, direct delivery: between 12.50 and 15.00 €/q, with the most common price at 12.50 €/q.

Prices in the auction at Roeselare (source: REO via PCA): 05 August: Weighted price (red and white) for hand-picked potatoes: 0.27 €/kg excluding VAT. Appro: 24 t.

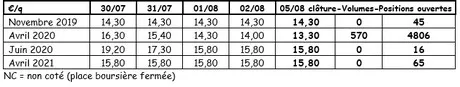

Futures market

EEX in Leipzig (€/q) Bintje, Agria and related transformer var., 40 mm+, min 60% 50 mm + :

Netherlands :

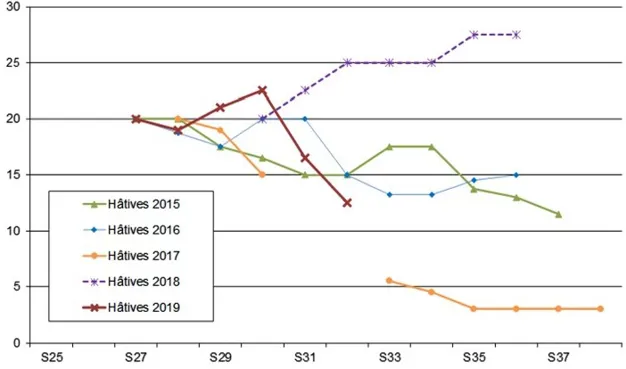

The trend was completely reversed last week following the return of more favourable weather for crops. The plants are currently covered by contract and prices on the free market fell below €20/q last week. Fresh markets are also under pressure, but with less price cuts. Indurated lots are traded between 30 and 35 €/q at the producer. Frieslander is between 25 and 30 €/q. Few export activities observed, with some transactions to Africa based on 30 to 35 €/qm (calibrated in departure bags).

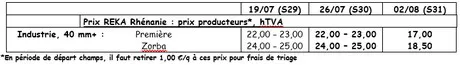

Germany :

Supply increased last week after rains returned to the early regions in central and southern parts of the country. Prices are down, to 17.00 to 18.00 € in industrial varieties in the Rhineland, to 42 to 48 €/q in early firm flesh varieties, and to 38 to 43 €/q in other firm flesh varieties. Despite the variable weather conditions, the north of the country remains very dry, especially in Lower Saxony where it has hardly rained in the last 3 weeks.

Strong increase in surface areas in Germany (source: Statistiekbureau Bundesamt):

The new estimate made by the Statistiekbureau Bundesamt shows an increase from 24,000 ha to 276,000 ha, an increase of almost 10% compared to last year! The largest increase is in Lower Saxony (+9,600 ha to 123,500 ha), followed by North Rhine-Westphalia (+7,800 ha to 41,000 ha) where most of the additional hectares are used for industrial processing. South Bavaria increases from 3,000 ha to 41,600 ha.

Great Britain :

Average price AHDB: not quoted due to lack of volumes.

The harvest continues easily, with rain having only locally slowed down activities last week. Domestic demand for new crop remains stable. Export to the continent has slowed down but the interest of various buyers remains very real.