The current South African grapefruit season is just past the halfway mark, but from here on out it’s expected that the estimated 16% drop in export volumes will make itself felt. If the season is stretched out with steady and constant supply, the CGA grapefruit focus group says it could expect a good market and good returns until at least week 31.

The original export estimate has been revised downwards a number of times, now resting at 13.8 million 17kg equivalent cartons. A reduction in volumes to last year (as well as a slightly larger average size) has concentrated the mind on marketable counts and has had the consequence, exporters note, of keeping marginal counts out of the market.

“Most regions are now done with selective picking and the general size distribution could move towards an increased volume of count 45s and 50s once more of the smaller ‘outside’ fruit is also packed,” the grapefruit focus group said in a recent memo. “Although not yet at alarming levels, especially given the expectation of a decrease in overall volume, growers have to remain conservative with the packing of small calibre fruit.”

The Citrus Growers’ Association had cautioned growers to be circumspect about class 2 exports of Star Ruby which are, in fact, 25% lower than last year this time, “a feather in the cap of growers”, notes the memo.

Last year saw a record export total of 16.5 million cartons, but supply didn’t always meet with a receptive market.

Good early returns in Europe and Russia

This year the European grapefruit market has thus far yielded good returns on the fruit. The current campaign consists of a larger percentage of counts 35/40 than last year and a lower proportion of counts 50 and smaller.

However, the good run could be dampened by the upcoming Northern summer holiday and much reduced market activity, and export volumes could be constrained during the coming four weeks.

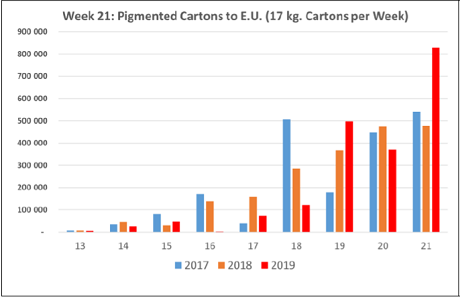

Week 21 saw 800,000 cartons sent to Europe, which might signal the start of a stock buildup, the grapefruit focus group points out, and it reiterates the imperative to only deliver on a programme basis, especially in Europe and Russia.

The Russian market has equally done well, although the market will start filling up with the 400,000 cartons sent since week 19.

More grapefruit (mostly smaller fruit) has been exported to the Middle East thus far than during the past two years. In week 21, 60,000 cartons were sent and could, the focus group warns, precipitate an oversupply.

Far East

The first shipment of grapefruit on a conventional vessel to Japan was delayed by a week by technical matters, but it and a second conventional vessel will deliver close to 10,000 pallets or approximately 550,000 cartons of grapefruit, arriving this week and next.

Exports to South Korea are currently picking up steam.

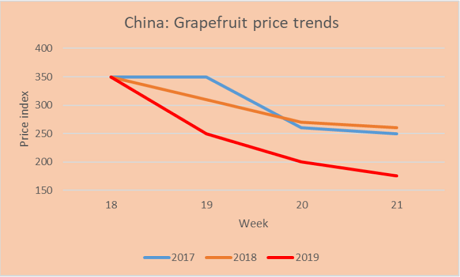

In China, the trend of price decreases was even more marked than last year, dipping from RMB350 to about RMB175 from weeks 18 to 21, although the supply versus demand situation has now stabilised.

The memo quotes a Chinese receiver: “The market has held for prime counts and China-quality fruit in the last 2 weeks, but my biggest concern (history tells us) is this really slow sales rate. If we have a big arrival week, stocks will start to build and sellers will start cutting prices.”