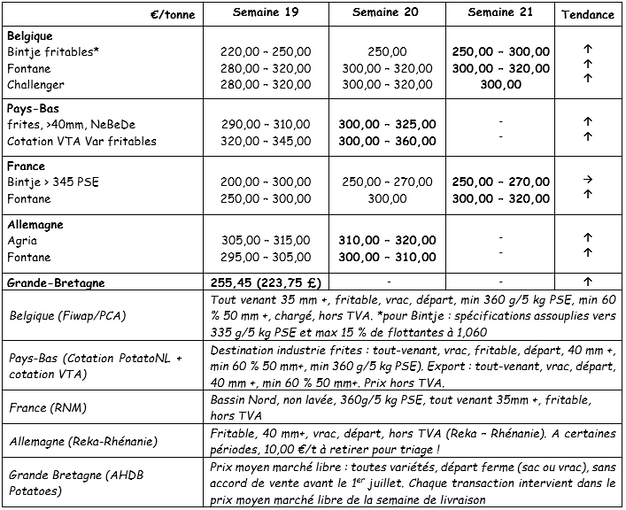

European physical markets

Summary of prices (source: NEPG) :

Belgium

Message from the Fiwap / PCA markets :

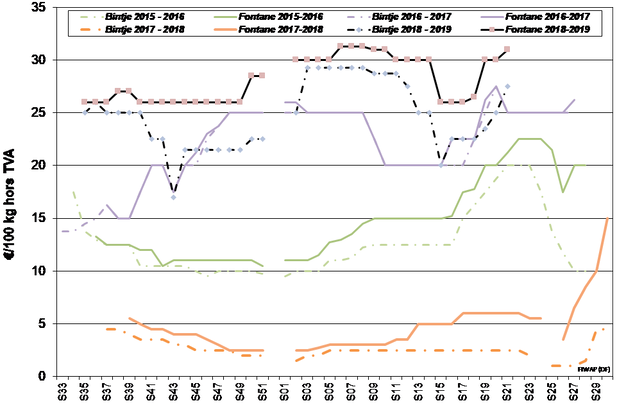

Most manufacturers remain or have returned to purchasing, mainly in Fontane, to a lesser extent in Challenger, and a few in Bintje. Peeling is always looking for the best batches, whether in Bintje or Fontane, while factories are only interested in Bintje as a second or third choice.

Fontane: 30.00 to 32.00 €/q, firm market;

Challenger: mainly 30.00 €/q, firm market;

Bintje : "sinterable quality": max 15% floating at 1060 g/l and PSE min of 335 g/5 kg, sufficient size and good cooking colour: 25.00 to 30.00 €/q, firm market. The higher price is applied for batches suitable for peeling, which are becoming more and more difficult to find.

Prices in auction / veiling of Roeselare (source: REO via PCA): May 20 :

Weighted price (red and white) for hand-picked potatoes: 0.90 €/kg (90.00 €/q) excluding VAT. Supply: 12 tons.

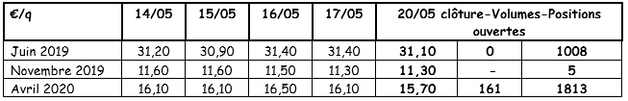

Futures market: EEX in Leipzig (€/q) Bintje, Agria and related var. for transformers, 40 mm+, min 60% 50 mm +:

Netherlands

Prices are on the rise, with this week's real transactions in sinterable quality between 30 and 34 €/q in industrial varieties (Fontane, Agria, Markies), and between 37 and 40 €/q for the domestic fresh market. For industry, last week's quotations reflect the lack of supply and continued demand, with most quotations exceeding €30/qm. The volumes traded are low given the scarcity of stocks. Factory schedules generally predict the availability of early birds in week 28 (2nd week of July), but nothing is less certain given the poor spring weather observed so far. The export continued last week to Poland and other Eastern European countries, with a persistent interest from North Africa and the Caribbean, on the basis of 30 to 36 €/q (calibrated, bags or big-bags departure). The large sinterable size (Agria for example) for Spain is 40 - 47 €/q.

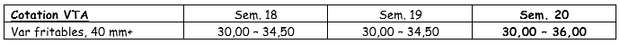

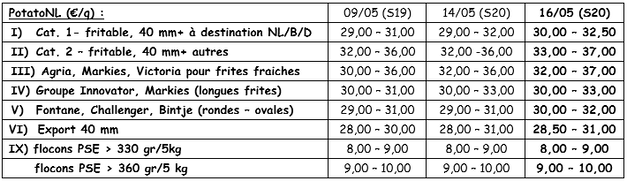

PotatoNL quotation: see also on www.potatonl.com

Industrial activity in decline (source: NAO via VTA): last April, Dutch factories processed 329,800 tonnes of potatoes, 10% less than in April 2018. This is the 6th consecutive month of reduced activity. Over the last 12 months, the total used decreased by 2.8% to 3.91 million tonnes.

Active export in April (source: NAO via VTA): the Netherlands exported 76,855 tonnes last April, mainly to Belgium (41,700 tonnes) and Germany (12,200 tonnes). April showed a recovery in trade to Spain, Romania and Poland. The total exported since the beginning of the season reached 650,000 tons, compared to 710,000 tons last year.

France

For the industry, prices have returned to high levels, in a calm market, with moderate but present demand and in a context of very limited supply on the open market. Actual transactions regularly exceed €30.00/q in specific varieties. The weather has a positive impact on the physical market. Exports are also strengthening, but with very limited volumes due to low inventories. The sinterable quality is defended between 32 and 40 €/q depending on the quality and size (big-bags start).

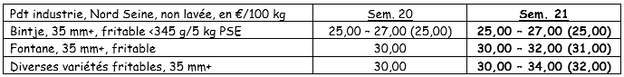

Unwashed industrial potato, bulk, departure, VAT excluded, Nord Seine, €/qt, min - max (average) (RNM) :

Germany

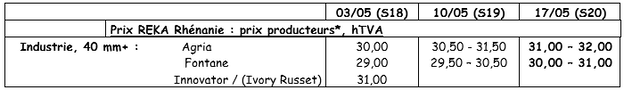

On the fresh market (Rhineland), the quotation of old potatoes ends. The market is tight, with Egyptian/Israeli women almost finished, and Spanish women rising in power. The trade has no stock, what happens is prepared and then distributed immediately. The first indigenous early harvest in the Palatinate was quoted at 92 €/q for tender meat and 90 €/q for firm meat. In potatoes for industry (French fries), prices vary greatly depending on quality! Rising prices again for sinterable products: Agria between 31.00 and 32.00 €/q, Fontane between 30.00 and 31.00 €/q. The "Spitzenpartien" (lots of very good quality for peeling) leave at 35,00 €/q. The cold weather has somewhat delayed harvests.

*During the field start period, you must withdraw 1.00 €/q at these prices for sorting costs

Great Britain

Average producer price (all markets combined) week 19: 25.55 €/q (compared to 24.29 €/q in week 18).

For more information:

FIWAP

www.fiwap.be