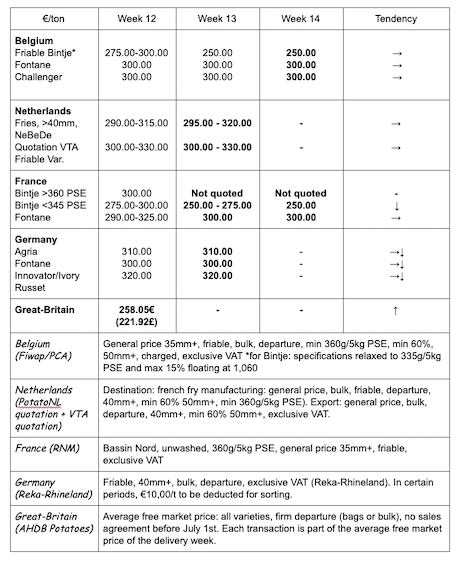

Belgium

Fiwap/PCA market message:

Industrial varieties: very few transactions on a market considered calm. In Fontane and Challenger, most manufacturers are waiting and are not buying for immediate delivery. There is some demand for delayed delivery (May). The offer is not pressing but sufficient. In Bintje, the industry is completely out of the market. Peelers (semi-industrial and smaller) are still buying. The trend is calm (offer higher or equal to demand).

Fontane: mainly 30.00 €/q, calm;

Challenger: mainly 30.00 €/q, calm;

Bintje: “friable quality”: max 15% floating at 1,060 g/l and PSE min 335g/5kg: mainly 25.00 €/q. Higher prices for the top quality (caliber and cooking) destined for peelers.

Planting of the early potatoes started last week and during the weekend in various sub-regions of Flanders. The proportion already planted is now estimated at maximum a few dozens of percent. Unless it rains heavily, the work will continue this week and the next. The ground remains cold, however.

European physical markets

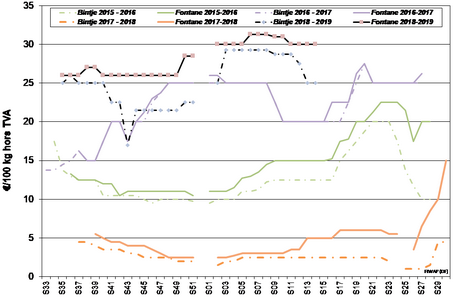

Price summary (source: NEPG):

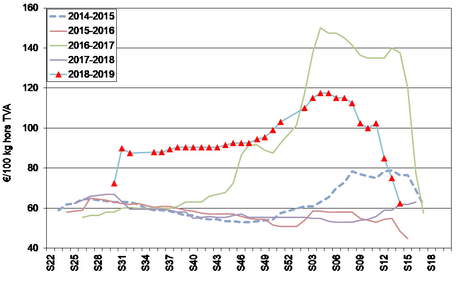

Bintje plant: Dutch plant, class A, returned April 2019, by 5 tons, in bags, hTVA: very little trade, prices still going down.

Caliber 28-35 mm: 60.00-65.00 €/q

Caliber 35–45 mm: 40.00-45.00 €/q

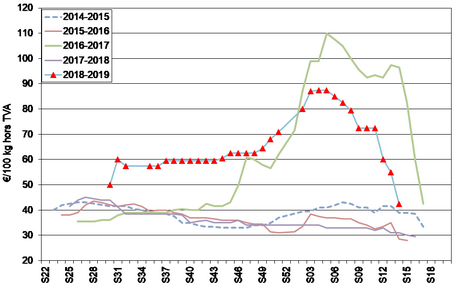

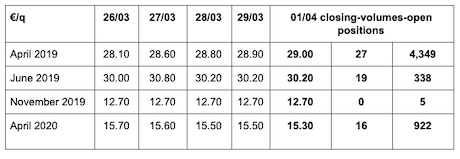

Forward market

EEX in Leipzig (€/q) Bintje, Agria and var. related for conversion, 40 mm+, min 60% 50mm +:

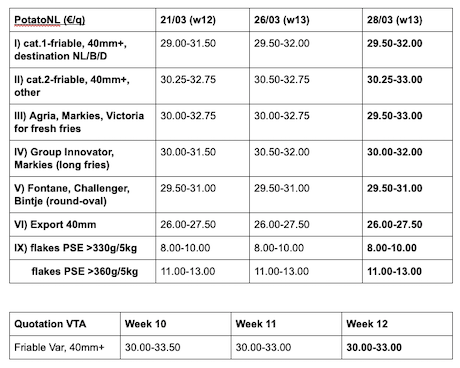

Netherlands

The physical markets remain extremely stable. Hesitations on the market last week did not bring any increase in the offer for the most popular industrial varieties. Real transactions vary between 29.50 and 33.00 €/q for immediate delivery. On the fresh markets, prices are sustained by the low stocks and by the high prices of the early Mediterranean potatoes. Depending on the varieties, producer prices vary from 27 to 38 €/q, higher prices being attributed to the firm flesh varieties in fridge/pallox. Little export activity, except for some small volumes to Africa, and despite an interest from Eastern countries. Departure prices between 29 and 32 €/q (calibrated in big-bag).

Quotation PotatoNL: also available on www.potatonl.com

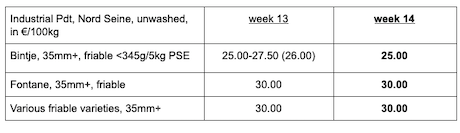

France

There was almost no demand from industry for immediate delivery, which brought prices slightly down last week. There is some demand for delayed delivery, on a basis of 30.00 €/q. As for export, shipments continue to Eastern countries, more than towards the south. Stocks are very limited in some regions and transportation is sometimes difficult to find.

Unwashed industrial potato, bulk, departure, hTVA, Nord Seine, €/qt, min–max (moy)(RNM):

Stocks at the end of February (source: UNPT/CNIPT): stocks at the French producers were estimated at 1,254,000 tons at the end of February, compared to 1,939,000 tons at the end of February 2018, and 1,580,000 tons at the end of February 2017. About 70% of this stock is destined for the processing industry.

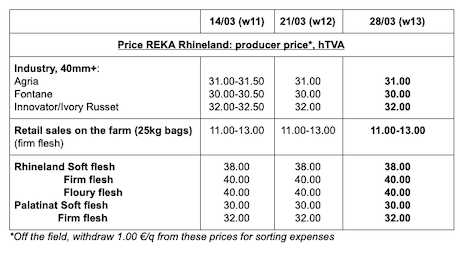

Germany

Most early potatoes were planted in February, and despite some damage to the tarps from the storm (see previous editions), the earliest have 10cm! Antifreeze irrigation took place last week because temperatures went down to -4°C in some areas. The lack of water and the very dry soils in some sub-regions could become problematic.

On the fresh market (Rhineland), on March 22nd, prices were stable for firm flesh at 40 €/q for the storage output refrigerated crates, and at 38 €/q for soft flesh. For firm flesh on sale at the farm (Rhineland), firm prices between 11 and 13 € per 25 kg bag (slight increase). Great-Britain

Great-Britain

Average producer price (all markets) week 12: 25.80 €/q (24.91 €/q in week 11).

For more information:

FIWAP

www.fiwap.be