Potato growers across the NEPG zone are entering a period of market pressure as free-buy prices fall and processors prepare to reduce both contract prices and contracted volumes for the 2026-2027 season. Current free-buy prices range between 0,50 and 4,00 €/100 kg depending on country, variety, and conditions, with limited buyer interest.

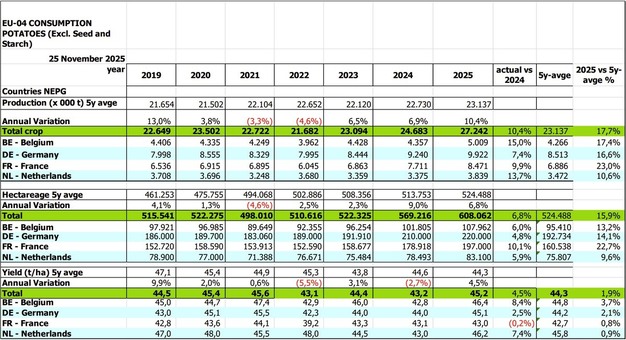

NEPG expects total production across the zone to reach around 27,2 million tons, approximately 10 per cent higher than in 2024. The organisation notes that these figures are provisional and may be adjusted in the coming weeks.

According to NEPG, growers now face a decision on whether to maintain existing planted area or consider reductions due to economic risk. The organisation states that current market conditions require careful assessment of production costs and potential losses.

NEPG attributes the current situation to a combination of early plantings in good conditions, a 7 per cent increase in planted area, and a 5 per cent rise in yields. Adequate rainfall across much of the region contributed to higher output. Meanwhile, the southern region experienced lower rainfall and the northern region higher rainfall, but overall volumes increased by an estimated 10 per cent.

On the demand side, NEPG reports a contraction in the global frozen fries market. Factors include recently imposed US import tariffs, a strong euro compared with the US dollar, and growing sales of processed potato products from emerging exporters, including China, India, Egypt, and Turkey.

In the frozen chip trade, NEPG notes that China and India have increased exports to neighbouring markets over the past two seasons, with volumes now above 500.000 tons. At the same time, EU-27 exports have declined for a second season.

Given current conditions, NEPG states that growers must evaluate whether maintaining current production scale remains viable, particularly in areas with high annual land rental costs. The organisation notes that there is no indication that competitiveness challenges in the European frozen fries market will be resolved in the short term.

For more information:

NEPG

Tel: +32 81 610 656

Email: [email protected]

www.nepg.info