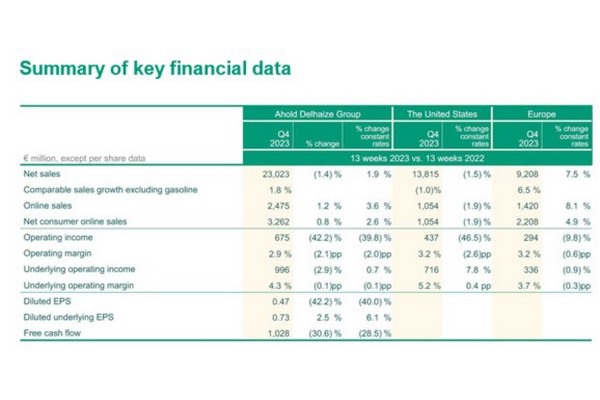

Ahold Delhaize, a large food retail group in both supermarkets and e-commerce in Europe, the US and Indonesia, reported fourth quarter results (Q4) Group net sales were €23.0 billion, up 1.9% at constant exchange rates and down 1.4% at actual exchange rates. Q4 comparable sales excluding gas increased by 1.8% for the Group, with a decline of 1.0% in the U.S. and an increase of 6.5% in Europe. Comments from Frans Muller, President and CEO of Ahold Delhaize: “I am pleased to report a solid end to the year for Ahold Delhaize. The local brands in our strong international portfolio have been steadfast in creating value for customers by enhancing their highly personalized loyalty programs, increasing access to omnichannel offerings, and expanding their innovative own-brand assortments. In an increasingly complex world, our brands are able to deliver consistency to customers, associates and suppliers, quarter after quarter.

Comments from Frans Muller, President and CEO of Ahold Delhaize: “I am pleased to report a solid end to the year for Ahold Delhaize. The local brands in our strong international portfolio have been steadfast in creating value for customers by enhancing their highly personalized loyalty programs, increasing access to omnichannel offerings, and expanding their innovative own-brand assortments. In an increasingly complex world, our brands are able to deliver consistency to customers, associates and suppliers, quarter after quarter.

"Disciplined cost management is more important than ever to mitigate cost increases for customers, especially as global conflicts create potential volatility in supply chains. In 2023, we left no stone unturned and significantly exceeded our original Save for Our Customers goals, generating over €1.25 billion in cost savings, which is 29% more than we generated in the prior year.

Net consumer online sales increased by 2.6% in Q4 at constant exchange rates. Double-digit growth at Food Lion and Hannaford and accelerating growth at Albert Heijn was partially offset by FreshDirect."

"Throughout 2023, we have been steadfast in creating value for customers. Our brands expanded their high-quality own brand assortments, optimized loyalty programs and provided a seamless shopping experience both in-store and online. In addition, our teams pulled together to deliver a record of more than €1.25 billion in cost savings to invest back into our customer value proposition."

Q4 underlying operating margin was 4.3%, a decrease of 0.1 percentage points. One-off adjustments in the U.S. partially offset declines in European margin and in insurance benefits at the Global Support Office. Q4 IFRS operating income was €675 million and IFRS diluted EPS was €0.47. IFRS results were mainly impacted by a €250 million loss on the divestment of FreshDirect. Q4 diluted underlying EPS was €0.73, an increase of 2.5% compared to the prior year at actual rates.

2023 full year Group net sales were €88.6 billion; underlying operating margin was 4.1% and diluted underlying EPS was €2.54, in line with initial expectations for the year.

2023 full year IFRS operating income was €2,846 million and IFRS diluted EPS was €1.94.

The 2024 outlook

Underlying operating margin of ≥4.0%; underlying EPS at around 2023 levels; free cash flow of around €2.3 billion; and net capital expenditures of around €2.2 billion. The divestment of FreshDirect will reduce the amount of 2024 reported net sales and online sales for the U.S. segment by $600 million.

For more information:

For more information:

Ahold Delhaize

Tel: +31 88 659 9211

Email: [email protected]