By bombing nuclear facilities in Fordo, Natanz, and Isfahan last weekend, the United States intervened in the conflict between Israel and Iran. Tehran has stated that Washington crossed a "red line" and is threatening retaliation. The uncertainty surrounding the extent of this response is a critical factor for internationally operating companies in the region, according to Evofenedex.

© evofenedex

© evofenedex

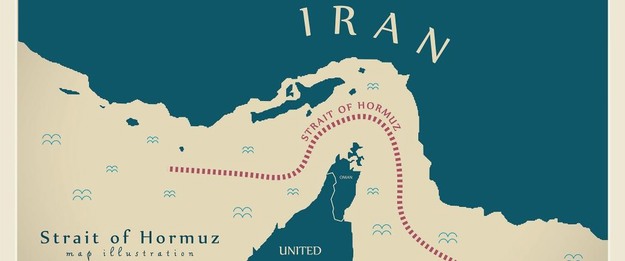

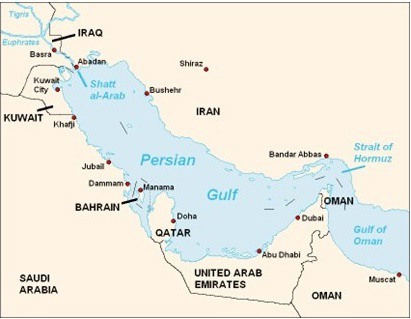

Iran has several options for retaliation against the U.S. strikes. These include attacks on U.S. bases in the region or (partially) closing or rendering the Strait of Hormuz inaccessible. This could involve deploying naval mines or ballistic missiles—potentially through Iran-affiliated Houthi rebels in Yemen, to deter commercial shipping.

Significant risks for Iran, too

Iran's parliament has approved the closure of the Strait of Hormuz, according to Iranian state television. However, the country's National Security Council and Supreme Leader have yet to endorse the decision. Closing the Strait would also entail considerable risks for Iran itself. The country relies on the passage for its own oil exports, and such a move would likely further strain its relations with neighbouring states in the Persian Gulf.

If Iran were to close the Strait of Hormuz, it could disrupt global trade and logistics. The Persian Gulf is a rapidly growing export market for many Dutch companies, so this could also have consequences for the Netherlands. In an article last week, we outlined the economic stakes for Dutch entrepreneurs, with key concerns being energy supplies, container logistics, and supply security.

Significantly higher oil prices © evofenedexIn terms of oil flows, 84 percent of exports from the Persian Gulf go to Asia, particularly China, India, South Korea, and Japan. Saudi Arabia and the United Arab Emirates have limited options to divert oil via pipelines to ports outside the Gulf, such as Djedda and Fujairah. In Europe, the immediate impact would likely be a sharp increase in oil prices, potentially reaching US$100 per barrel for Brent crude. Additionally, cargo flows would face significant pressure, with ports outside the Persian Gulf—especially Sohar, Salalah, Djedda, Karachi, Colombo, and Indian ports—experiencing congestion due to diverted containers.

© evofenedexIn terms of oil flows, 84 percent of exports from the Persian Gulf go to Asia, particularly China, India, South Korea, and Japan. Saudi Arabia and the United Arab Emirates have limited options to divert oil via pipelines to ports outside the Gulf, such as Djedda and Fujairah. In Europe, the immediate impact would likely be a sharp increase in oil prices, potentially reaching US$100 per barrel for Brent crude. Additionally, cargo flows would face significant pressure, with ports outside the Persian Gulf—especially Sohar, Salalah, Djedda, Karachi, Colombo, and Indian ports—experiencing congestion due to diverted containers.

Source: evofenedex