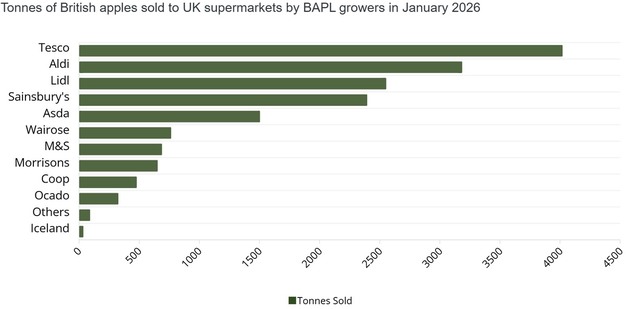

Data for January 2026 show that Tesco accounted for the largest share of British apples sold by BAPL growers, with around 4,000 tons supplied during the month. Aldi followed at approximately 3,200 tons, with Lidl close to 2,600 tons. Sainsbury's recorded about 2,400 tons, while Asda took roughly 1,500 tons. Waitrose, M&S, Morrisons, Coop, Ocado, Others, and Iceland each handled lower volumes, all below 1,000 tons.

© British Apples & Pears

© British Apples & Pears

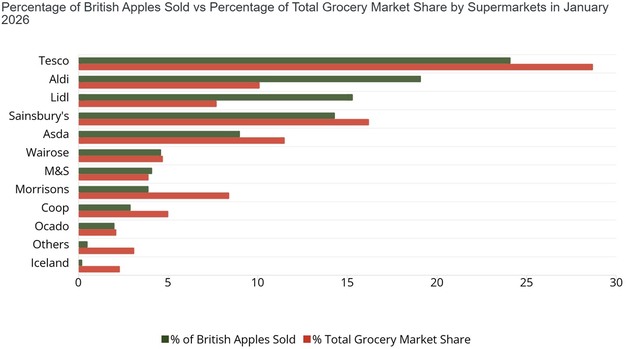

When comparing each retailer's share of British apples sold against its total grocery market share, discounters appear to over-index. Aldi represents around 19 per cent of British apple sales while holding approximately 10 per cent of the total grocery market. Lidl accounts for about 15 per cent of British apples versus roughly 7 per cent grocery share.

Tesco, the largest grocery retailer with close to 28 per cent total market share, accounts for around 24 per cent of British apples sold, indicating a slightly lower share relative to its overall grocery position. Sainsbury's shows the opposite trend, with around 16 per cent of British apple sales compared with approximately 14 per cent grocery share.

© British Apples & Pears

© British Apples & Pears

Asda's British apple share stands near 9 per cent against a grocery market share of around 11 per cent. Morrisons also under-indexes, with roughly 4 per cent of British apple sales compared with about 8 per cent of total grocery sales. Coop, Waitrose, M&S, and Ocado hold smaller but relatively aligned positions, while Iceland shows limited participation in British apple volumes.

Overall, the January data indicate that while Tesco remains the leading outlet in absolute tonnage, discounters Aldi and Lidl are capturing a proportionally larger share of British apple sales compared with their footprint in the total grocery market. This suggests that British-grown apples continue to perform strongly within value-led retail channels, while some traditional multiples are relatively underrepresented in domestic apple sourcing during the period.

© British Apples & PearsFor more information:

© British Apples & PearsFor more information:

British Apples & Pears

Tel: +44 (0) 1507 353778

Email: [email protected]

www.britishapplesandpears.co.uk