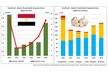

Egypt increased garlic shipments to Brazil in 2025, according to EastFruit. Brazil imported 3,900 tons of Egyptian garlic last year, valued at more than US$6.8 million. This represented a 2.4-fold increase compared with 2024 and exceeded the combined volumes of the previous two years by 20 per cent.

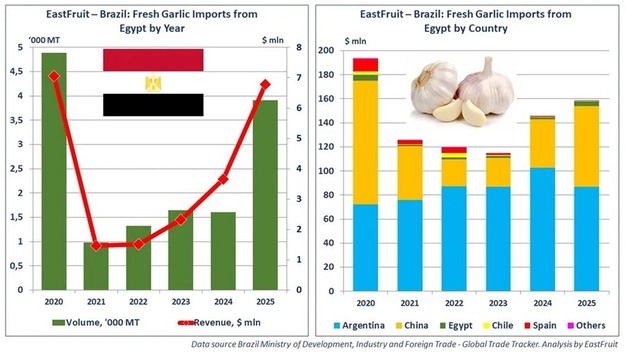

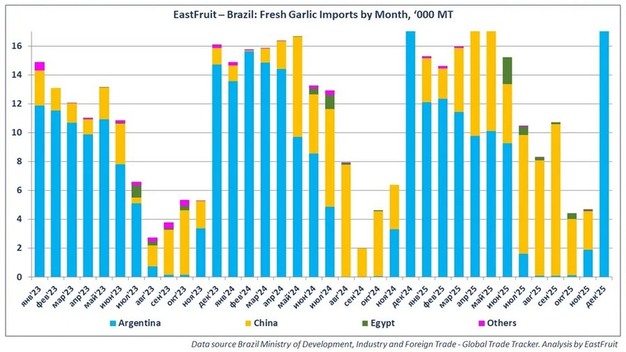

Despite growth in domestic output, Brazil continues to depend on imports to supply the market and remains among the world's top five garlic importers. Historically, Argentina has been the main supplier, accounting for more than 70 per cent of imports, particularly from December through May when local stocks are limited.

© EastFruit

© EastFruit

Market dynamics shifted in 2025 as economic conditions influenced procurement decisions. High inflation and lower consumer purchasing power pushed demand toward lower-priced garlic. Importers reduced purchases of higher-priced domestic and Argentine products in favor of lower-cost alternatives. As a result, Argentina's market share declined to 55 per cent, while China expanded to 42 per cent, supported by competitive pricing and demand from retail and food processing channels.

Egyptian exporters also increased volumes during this period. Shipments were concentrated in June and July, coinciding with reduced Argentine availability and delays to the local harvest. Egypt's share of Brazil's garlic imports exceeded 12 per cent in June and closed the year at 2.5 per cent.

© EastFruit

© EastFruit

Brazil is a relatively recent destination for Egyptian garlic. Initial shipments were recorded in 2016 at 26.5 tons. From 2019 onward, exports became regular, reaching a previous high in 2020 when Brazil imported more than 7,000 tons from Egypt. While volumes in 2025 remained below that earlier peak, shipment levels indicate scope to approach or exceed prior records if current trade patterns continue.

For Brazilian buyers, the diversification of supply sources has increased price options during periods of tight local availability. For Egyptian suppliers, steady access to the Brazilian market reflects continued participation in global garlic trade flows linked to seasonal supply gaps and price-driven demand.

Source: EastFruit