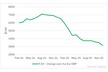

South African citrus growers packed a record 203.7 million cartons for export last season, representing an increase of 22 per cent compared with 2024. While export volumes expanded, industry stakeholders continue to point out that higher output alone does not translate into structural growth without broader market access.

The 2026 South African citrus season, expected to start in April, follows a period of strong volume growth. Export performance going forward is closely linked to progress in trade negotiations and access conditions in key destination markets.

The European Union remains South Africa's main citrus outlet, absorbing about 35 per cent of exports last season. However, EU phytosanitary measures related to false codling moth and citrus black spot continue to affect trade flows. According to industry estimates, these measures cost growers close to R4 billion per year, equivalent to about US$210 million. South Africa initiated dispute proceedings at the World Trade Organisation in 2023, but the issue remains unresolved.

The United States market also remains relevant, particularly following a tariff exemption announced in November for South African oranges. The exemption applies only to oranges, while mandarins remain subject to a 30 per cent reciprocal tariff. Mandarins are a regular product in the U.S. market, and alignment across citrus categories would affect trade volumes under similar supply chain conditions.

South Africa's citrus exports are counter-seasonal to U.S. production, supporting category continuity without overlapping domestic supply. Trade engagement between the two countries continues under more constrained conditions, with citrus remaining part of the discussions.

Beyond the EU and U.S., progress in trade arrangements with BRICS partners has so far delivered limited outcomes for citrus exporters. While discussions on protocols and tariffs are ongoing with some member countries, tangible changes for growers have not materialised.

Citrus production plays a central role in rural economies across South Africa. The sector supports employment at the farm level and sustains demand for services such as packaging, transport, cold storage, and agricultural inputs. More than 140,000 workers are employed directly in citrus farming, with broader linkages across logistics and input supply chains.

South Africa is the world's second-largest citrus exporter, making market access a determining factor for translating production growth into longer-term sector stability. Export outcomes in the 2026 season will depend on developments in trade access across the EU, U.S., India, and China, and on how additional volumes are absorbed by destination markets.

Source: BusinessDay