State-level minimum wage policies continue to evolve across the United States, with growing implications for agricultural employers. While the federal minimum wage has remained at US$7.25 per hour since 2009, 31 states and Puerto Rico have established higher wage floors. However, the extent to which these state requirements apply to farmworkers varies considerably due to multiple exemptions.

© American Farm Bureau Federation

© American Farm Bureau Federation

The recent change in the Adverse Effect Wage Rate (AEWR) methodology for H-2A guestworkers has renewed the relevance of state minimum wages in agricultural employment. Under federal rules, H-2A workers and corresponding domestic employees must be paid the highest applicable rate among the federal minimum wage, state minimum wage, prevailing wage, collective bargaining rate, or the AEWR. In several states, the revised AEWR for Skill Level I workers now falls below state minimum wages, making the state rate the new operative wage floor for many employers.

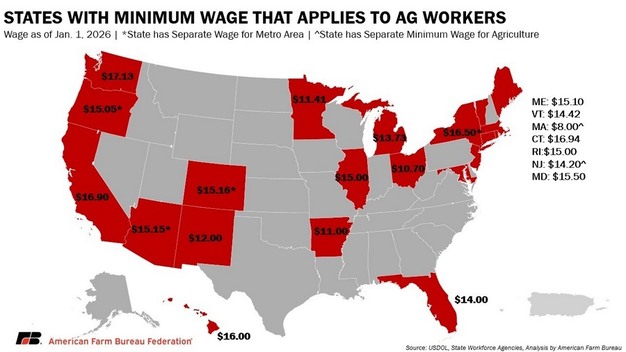

Currently, 21 states have minimum wage laws that apply to agricultural workers. State wage levels range from US$8 to US$17.13 per hour, up to 136% above the federal requirement. These state policies contribute to a patchwork of wage rules that differ not only between states but also within individual states, where separate rates exist for metro areas or specific worker categories.

Despite these variations, national data show that average farm wages exceed minimum requirements. According to Occupational Employment and Wage Statistics, crop farmworkers average US$18.20 per hour, and livestock workers average US$18.55 per hour, both higher than the highest state minimum wage. However, these averages do not eliminate the regulatory complexity faced by growers operating across state lines.

© American Farm Bureau Federation

© American Farm Bureau Federation

Minimum wage exemptions add another layer of variation. At the federal level, small farms with fewer than 500 total "man-days" in a prior quarter are exempt, as are immediate family members, range livestock employees, and certain seasonal hand-harvesters paid by piece-rate. State exemptions differ widely, with some states exempting all agricultural work, others mirroring federal standards, and some applying exemptions only to defined small employers or specific industries.

As wage floors continue to rise in various states, producers face increased administrative requirements and tighter operating margins. Employers working across multiple states must navigate shifting wage thresholds and eligibility rules, while maintaining compliance with H-2A regulations that increasingly reference state minimum wages.

With the AEWR no longer serving as the consistent wage benchmark in many regions, state minimum wage laws are expected to play a larger role in agricultural labor planning. The ongoing variation across states underscores the complexity of labor regulation in agriculture and the challenges for growers operating in a fragmented wage environment.

© American Farm Bureau FederationFor more information:

© American Farm Bureau FederationFor more information:

American Farm Bureau Federation

Tel: +1 202 406 3600

Email: [email protected]

www.fb.org