Hass avocado has dramatically transformed Peruvian agriculture, benefiting tens of thousands of families, encouraging the formalization of agricultural jobs, and establishing the country as a key player in the global Hass avocado market. Arturo Medina, general manager of ProHass (the Association of Hass Avocado Producers and Exporters), emphasizes: "No other export fruit has as much social impact in Peru as Hass avocado."

© FreshPlaza

© FreshPlaza

Aturo Medina, General Manager of ProHass.

From an emerging crop to a world power

The history of Hass avocado in Peru started in 1999. Unlike traditional varieties like Fuerte or Naval that are mainly popular domestically, Hass was introduced with an export focus from the outset. "This wasn't somebody starting a hobby, planting a small tree in their backyard. It was done with a global vision and in an entrepreneurial way," recalls Medina.

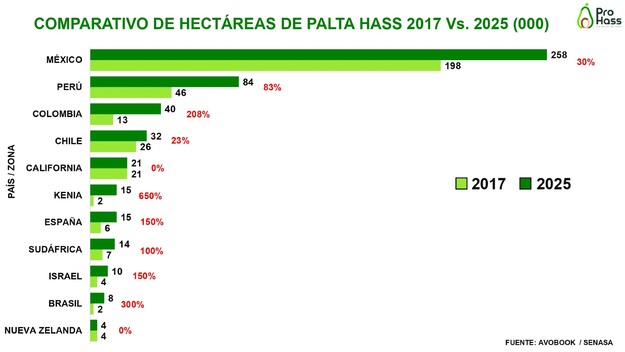

"It all started with medium-sized growers from the central coast who started converting their citrus, asparagus, and other crop fields to focus on Hass avocado cultivation. The real breakthrough, however, came in 2001 when the government passed the Agrarian Promotion Law, which provided legal stability, tax benefits, and labor incentives for agro-exporters. This law, combined with the country's economic stability, led to the emergence of a modern, export-oriented horticulture sector. And the Hass avocado was at the forefront of this development," Medina stated. Today, Peru is the world's second-largest producer and exporter of Hass avocado after Mexico and the primary supplier to almost every country outside the United States.

© ProHass

© ProHass

Peru's direct competitors are Mexico, Colombia, California, Kenya, and South Africa.

Rapid growth

In October 2025, Peru exported 692,000 tons of Hass avocados, a 38% increase from 2024, when yields were low due to El Niño and Cyclone Yaku. "This year, the weather conditions were favorable," says Medina.

The area and production have increased by an average of almost 20% over the past five years. "There are approximately 7,000 to 8,000 hectares that still haven't come into production, which represents additional growth potential. Peru aims to export 1 million tons by 2030."

© ProHass

© ProHass

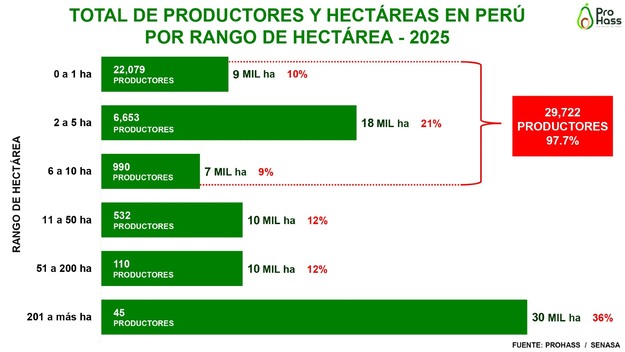

Thousands of small producers

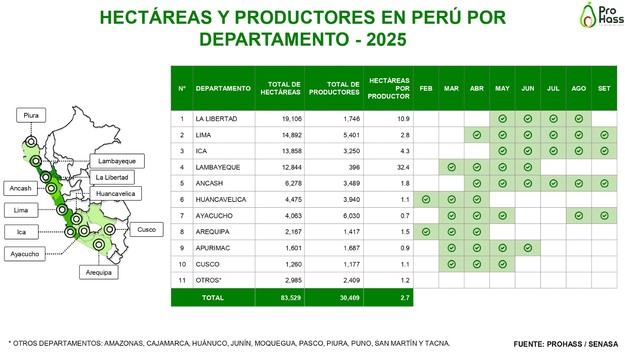

What makes the Hass avocado so unique is that it is grown across the country by a diverse group of farmers. "Of the 30,000 registered producers, 70% own less than one hectare of land, and 97% own less than ten hectares. This makes cultivation an unprecedented driver for rural development."

"Cultivation takes some patience, as the tree only starts to produce fruit in the third or fourth year. Despite this, more small-scale producers are investing in this crop. Avocados give them a better income than traditional crops, allowing them to improve their housing, health, food, and education conditions," Medina stated. Additionally, the industry creates direct and indirect jobs for thousands of families.

More and more export companies, sometimes without their own plantations, are working closely with these producers. "They offer assistance with certifications, irrigation, crop management, and logistics. In some regions, they even build houses, clinics, or churches. Everyone in the chain contributes to development. Social responsibility is a top priority for us," Medina emphasized.

Initially, Hass avocado production was mainly carried out by medium and large producers along the coast. Now, small producers in the Andes are also getting involved. This not only increases production but also extends the season during which Peru can supply avocados. Regions like Huancavelica (4,000 ha), Ayacucho (4,000 ha), Apurímac (1,000 ha), and Cusco (1,200 ha) have significantly expanded their cultivated land in recent years.

© ProHass

© ProHass

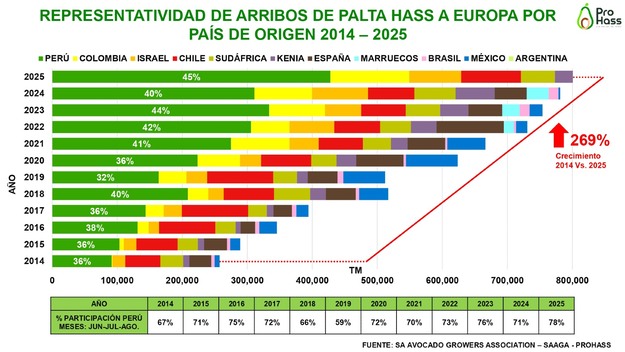

Europe, the main destination

62% of Peruvian avocados are exported to Europe, which remains the main market. "From the beginning, Europe was our first destination," says Medina. Peru supplies 45% of the avocados Europe consumes each year, increasing to 78% during peak months (June-August). "The Netherlands serves as a distribution hub, but countries like Italy are now importing directly from Peru, showing increased consumption and market maturity."

The United States accounts for 15% of exports, but the situation there is more challenging: Mexico dominates this market with a 75% share, followed by California-grown fruit. "We compete directly with California, while Mexico delivers fruit all year round," Medina stated. Nevertheless, Peru increased exports to the U.S. by 54% this year.

Asia accounts for 8% of exports. Growth is strong in countries like China (+59%) and Japan (+75%), though Medina acknowledges that more work is needed to further develop these markets. "There is a great potential for growth in Asia," he said.

He also highlighted Argentina's progress, where exports increased by 125%. "It is a good market, especially because it demands small calibers, similar to Asia. Chile, on the other hand, is Peru's third-largest export destination after Europe and the United States. It has a large domestic consumption (8.6kg per capita), second only to Mexico. Its proximity simplifies logistics, and despite Chile's large production, Peru benefits from being in counter-season," Medina stated.

© ProHass

© ProHass

The challenge of profitability

Despite growth, profitability faces challenges. International prices have declined over the past five years due to oversupply from new players, including Morocco, Colombia, Israel, Kenya, Ecuador, and Brazil. Meanwhile, production costs in Peru, particularly for agricultural inputs, logistics, and formal labor costs, including benefits such as health and holidays, have risen sharply. Prices are falling, but costs are increasing, hitting small farmers the hardest," he said.

In response, ProHass has chosen not to promote new plantings. Instead, they focus on increasing the productivity of existing hectares. "We advise small growers: don't plant more, but produce more on the same hectare. If your current yield is four tonnes, using advanced irrigation, proper nutrition, and pest management, you could potentially double or even more than double your production," states Medina.

© ProHass

© ProHass

Export destinations

Peru currently exports avocados to over 70 countries, but markets such as Taiwan, Vietnam, Australia, New Zealand, and Mexico remain to be explored. ProHass, initially a producers' association, now also includes exporters, totaling 70 members. From November 17 to 19, the association hosted the 7th Latin American Avocado Congress, featuring 60 technical presentations and drawing over 1,200 participants from Mexico, Colombia, Brazil, Argentina, Chile, Guatemala, the Dominican Republic, Spain, the U.S., and Canada.

Medina, who has led the organization for 24 years, states, "We aim to share information, build expert networks, and further professionalize the industry." His enthusiasm is contagious: "In this agricultural country, avocado not only creates jobs but also fosters hope."

For more information:

Arturo Medina - General Manager

ProHass

Tel: +51 999 965 777 (Peru)

Email: [email protected]

www.prohass.com.pe