The importation of fresh oranges from third countries, specifically from Egypt, by European Union member states is one of the issues that is raising the most concerns this season amongst Spanish producers and operators. Both importation and exportation are inherent to trade, and we have to remember that the cause of those concerns is not the fact that trade is diversified, as we all understand that we are in a free market; but rather, that non-EU imports are not expected to meet the same requirements as those of our European partners, as producers across Europe continue to denounce.

Every month, the Ministry of Agriculture, Fisheries and Food of Spain provides a detailed report on citrus imports in Europe with information on the monthly volumes acquired in the EU-27, the main suppliers and how those figures vary compared to previous campaigns; but who is behind the importation of Egyptian oranges in Europe?

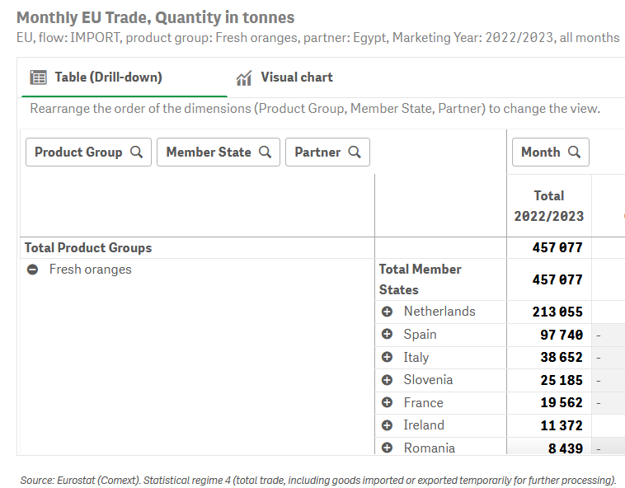

The answer is publicly provided by the European Commission's agricultural trade data tool, AGRIDATA. In the 2022/23 campaign, when Egyptian citrus imports skyrocketed from 206,413 tons in the previous campaign to 457,077 tons (increasing by 121%), the Netherlands was the largest importer, with 213,055 tons, 46.6% of the total.

In second place was Spain, with 97,740 tons, followed at some distance by Italy, with 38,652 tons, and Slovenia with 25,185 tons.

At this point, it is worth noting that Spanish imports were far from making up for the decrease in the national harvest reported in the previous campaign. Still, the data offer the opportunity to reflect on Spain's role as the EU's second largest buyer, as well as the role it wants to play in the future when it comes to the importation of Egyptian oranges, especially given the huge contrast with the 2021/22 campaign when, according to figures provided by the European Commission, it only imported 25 tons from Egypt.

Regarding the import of oranges from South Africa, a country that has been relegated by Egypt to second place in the ranking of Europe's largest suppliers, the Netherlands was again the largest buyer in the 2022/23 campaign, with 280,000 tons out of the 449,702 tons imported in total by the EU (62.4%). Portugal followed in this case, acquiring 78,819 tons.

Italy ranked third with 36,153 tons, and two places back, with about 12,000 tons of fresh oranges imported almost entirely between July and October, was Spain.

What's happening in the 2023/24 campaign?

For now, the European Commission is only offering figures broken down by country for December 2023. According to this data, of the 3,399 tons of fresh oranges imported from Egypt, 1,296 were acquired by Slovenia; 1,050 by the Netherlands and 658 by Spain.

However, the figures given by the Spanish Ministry in its latest enhanced monitoring report of citrus imports in the EU revealed that imports from Egypt had increased by 104.7% in January 2024 compared to the same month last year, and that the 45,281 tons that arrived in Europe accounted for 87.6% of the oranges imported on the continent that month.

It is not yet possible to be sure of how things will develop, but in previous campaigns, Egyptian imports have been concentrated mostly in the first half of the year, coinciding with the Spanish campaign, and have increased significantly in February.

Only official data will confirm if this trend is to continue, however, the price difference that exists in the EU between Spanish oranges, Mediterranean ones in general, and the Egyptian ones, which according to some operators are up to 40-50% cheaper, lead us to suspect that nothing will change this year.