All below charts in Italian:

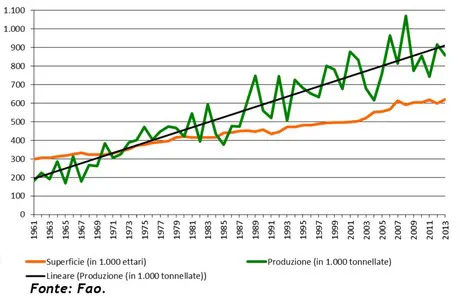

Cultivated area and global production trends (1961-2013)

In Turkey, the average growth rate was 13.4% against the 4.3% of Italy. The difference is mainly due to the increase of yields - 12.2% in Turkey and 3.5% in Italy. In 2013, Italy owned 11% of the 620 thousand hazelnut-producing hectares worldwide. In terms of production, Italy represented 13% of the 859 thousand tons produced globally.

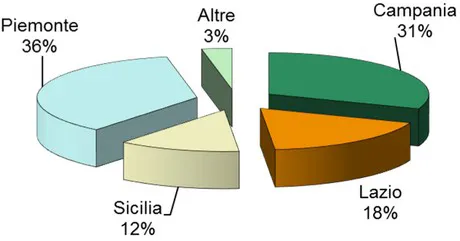

In 2014, the production areas in Italy were mainly Piedmont (36%), Campania (31%), Lazio (18%) and Sicily (12%). Over 75,000 tons were produced, 113 thousand less than 2013.

Regional production (2014)

International trade

Italy plays an important role at an international level but also imports a lot.

During the 2014/15 season (September-December), it exported over 8,000 tons of shelled hazelnuts for over €75 million and imported over 16,000 tons for over €135 million.

Click here to enlarge

During the 2014/15 season (September-December), hazelnut in shell export reached merely 727 tons for a total value of €3.3 million, whereas imports reached 2,500 tons for almost €8.7 million.

Click here to enlarge

An unstable market

The Italian hazelnut market is unstable due to the changes in global production, unpredictability of prices, effect of Turkish trade policies, Dollar and Euro fluctuations against the Turkish lira and a production chain characterised by many producers and very few big confectionery companies.

FreshPlaza processing of Ismea data