In North America, Canada has become a complementary destination to the United States for imported blueberries. Canadian demand is concentrated in the off-season, when domestic production declines. Retailers favor fruit with good firmness and post-harvest shelf life that can handle longer logistics chains and repeated handling at the store level. As shipments from Peru and other Southern Hemisphere origins have increased, exporters increasingly manage integrated North America programs, covering both the United States and Canada, while applying differentiated assortment and pricing strategies.

For exporters, Canada provides an option to diversify risk within the same region. Part of the volume can be allocated to U.S. retail chains with strict specifications, while another share is directed to Canadian buyers that balance price levels with consistent quality. In both cases, performance depends on consistent fruit condition and well-planned arrivals. Avoiding volume concentration in a narrow time window or a single market remains a priority.

© Blueberries Consulting

© Blueberries Consulting

At the other end of the spectrum, Taiwan is developing as a test market for premium blueberries in Asia. The market is supported by a modern retail structure and consumers willing to pay for fruit that meets defined standards for flavor, presentation, and traceability. While demand volumes are smaller than in China, the level of specification requires careful fruit selection and controlled supply execution.

For exporters, Taiwan offers a platform to test varieties, sizes, packaging formats, and branded programs under commercial conditions. Campaign structures and positioning strategies are often trialed in Taiwan before being adjusted and applied to larger Asian markets. This approach allows exporters to refine logistics, quality parameters, and communication with importers at manageable volumes.

Despite clear differences in consumption patterns and distribution channels, Canada and Taiwan share a focus on consistency. Buyers in both markets prioritize planned supply programs, adherence to agreed calendars, and clear specifications for size, firmness, and eating quality. Logistics performance, including transit time and temperature management, is closely monitored.

Varietal choice plays a central role in meeting these requirements. Not all blueberry varieties perform equally under extended transport and handling. Varieties that combine field productivity with firmness, crispness, and cold stability are better suited for these markets. More sensitive varieties tend to remain focused on closer destinations or narrower commercial windows.

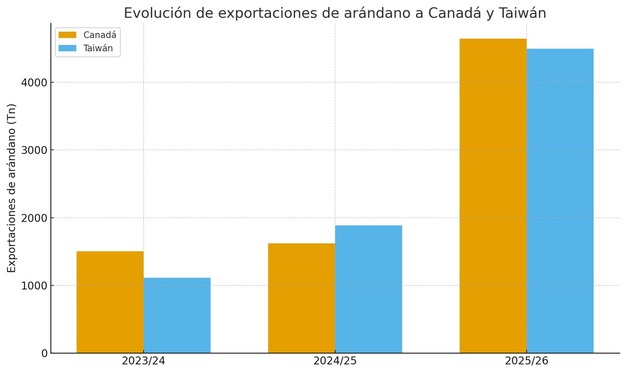

Together, Canada and Taiwan function as reference markets for exporters managing long-distance blueberry programs. Canada supports off-season placement in North America, while Taiwan provides insight into premium positioning in Asia. Feedback from these markets is increasingly used to adjust field planning, portfolio composition, and export scheduling in a fragmented global blueberry trade.

Source: Blueberries Consulting