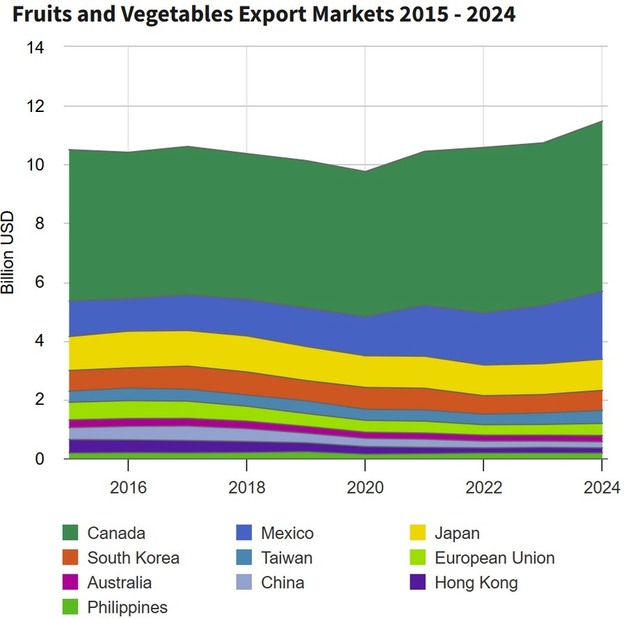

U.S. fruit and vegetable export markets have shown consistent long-term resilience between 2015 and 2024, with gradual recovery after a dip in 2020 and renewed growth through 2024. Canada remained the dominant destination throughout the period, while markets such as Mexico, Japan, South Korea, and Taiwan continued to strengthen their positions in the U.S. export portfolio.

© USDA

© USDA

From 2015 to 2018, total export value across all major markets remained above 10 billion USD, led overwhelmingly by Canada. In 2015, Canadian imports of U.S. fruits and vegetables were valued at about 5.65 billion USD, accounting for roughly half of all U.S. exports in the category. Mexico followed as the second-largest market, reaching 2.31 billion USD. Japan consistently held third place, importing 1.06 billion USD in the latest reporting period.

Export values began to soften in 2019 and reached a low point in 2020, reflecting global logistics disruptions and demand imbalance during the early pandemic period. Several markets contracted during this year, including Japan, South Korea, Taiwan, and the European Union. Total U.S. fruit and vegetable exports dipped below the 10-billion-USD range for the only time in the decade.

By 2021, markets began to stabilise again. Mexico surpassed 5 billion USD in combined fruits and vegetables for the first time since 2017, driven by steady retail demand and integrated regional supply chains. Japan, while smaller in volume, remained a consistent high-value destination, with annual purchases holding above 1 billion USD through 2024.

South Korea and Taiwan also recovered after the 2020 downturn. South Korea's purchases reached 680.9 million USD in the latest period, while Taiwan imported 440.48 million USD. The European Union maintained imports valued at 414.36 million USD.

© USDA

© USDA

Australia, China, the Philippines, and Hong Kong formed the next tier of markets, each receiving between 176.46 million USD and 217.98 million USD in U.S. fruits and vegetables in the most recent dataset. Although smaller, these markets contributed stable and diversified export outlets over the ten-year span.

By 2024, total export value across all major markets rose again, surpassing the 11-billion-USD level. Canada remained the anchor market. Mexico and Japan confirmed their roles as key partners, while Asia as a region continued to absorb a growing share of U.S. produce.

Overall, the 2015–2024 period shows a U.S. fruit and vegetable export sector that withstood cyclical challenges and maintained strong market positions across North America and Asia. The decade closes with a higher overall export value than the starting year and expanded opportunities across multiple markets.

To view the full report, click here.

For more information:

For more information:

USDA

Tel: +1 (202) 720-2791

Email: [email protected]

www.fas.usda.gov