The International Nut and Dried Fruit Council has released updated 2025/26 hazelnut production estimates, showing lower expected volumes in Turkey and Italy and higher output in Chile and the United States.

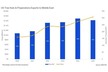

Turkey, the world's largest hazelnut producer, is projected to harvest 500,000 metric tons in 2025/26. This reflects a 36 per cent year-on-year decrease and is lower than the 609,000 tons estimated in May. Reports attribute the decline to spring frosts and summer droughts, placing the crop at one of its lowest levels in recent seasons.

Production is forecast to increase in Chile and the United States. Chile's output is projected at 120,700 tons, up 106 per cent, while the United States is expected to reach 106,000 tons, up 19 per cent.

Italy's production is forecast at 65,000 tons, a 25 per cent year-on-year decline. The International Nut and Dried Fruit Council cites adverse weather conditions and pest pressure, particularly from the brown marmorated stink bug.

Market sources report that Ferrero, the largest global buyer of hazelnuts, has offered Turkish growers TRY 300 to 310 per kilogram, depending on quality. Ferrero is speculated to have purchased around 35,000 tons of hazelnuts so far. TRY 300 to 310 per kilogram equates to roughly US$9.00 to US$9.30 per kilogram using prevailing exchange rates.

Benchmark export prices have eased. The Expana Benchmark Prices for Turkish 11/13 Levant quality hazelnuts FOB Turkey declined 11 per cent over the four weeks to 20 November, falling to US$1,490 per ton after earlier movements toward US$1,800 per ton. Industry commentary attributes the lower price level to weaker demand following the previous rally.

The updated figures reflect ongoing adjustments in global hazelnut supply and the influence of seasonal conditions across producing regions.

Source: Mintec/Expana